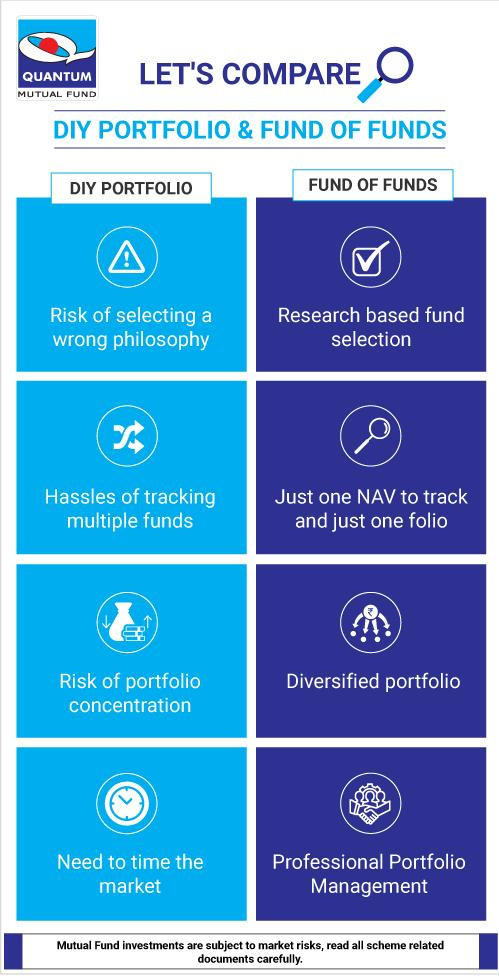

With the myriad options in mutual fund schemes in the market, choosing a scheme has become a cumbersome task. For DIY (do it yourself) investors, there are several risks when it comes to equity mutual fund portfolio construction, namely, the risk of choosing a wrong philosophy. Additionally, there is the risk of portfolio concentration. Considering a basket of 7-8 mutual funds, it could be a hassle tracking the performance of multiple funds. In contrast, a Fund of Funds scheme helps simplify the equity mutual fund selection, portfolio construction and tracking. You effectively track just one NAV and one fund. Your portfolio is managed by a professional fund manager, who will periodically balance the portfolio depending on the market conditions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

www.Quantumamc.com