Payroll is not exactly a fascinating business function; nonetheless, it is critical for your growth, compliance and employee satisfaction. From working with different kinds of employees to getting free online pay stub generator, there are several areas to cover in payroll processing. Unfortunately, a number of myths abound in this area, rendering payroll management complex and fraught with mistakes.

Common Payroll Management Myths

Let us discuss some of the common myths that business should steer clear of to ensure future growth.

- If you have a small business, it is easier to do payroll in-house

While it is easy to see how this myth originated, it remains just that: a myth. No matter how small your business, the bureaucratic struggles, paperwork, challenges of employee classification, etc., remain the same. Deciding to deal with all this in-house is a challenge whether your team comprises ten people or 10,000.

- Payroll management tools and vendors don’t take on small businesses

This is absolutely untrue. Plenty of modern payroll providers and free check stub maker take on small businesses with tiny teams. They offer scalable solutions that can fit in with groups of different sizes without a hassle.

- You don’t need to document payment for contractors and freelancers

Plenty of businesses work with contractors, seasonal hires, freelancers, etc. A common myth is that payments to this section of the workforce can be made casually, without proper documentation. However, this is not the case. You are required to make regular payments to all your workers and share a Form 1099 with them. In fact, misclassifying employees and not recording such hires while filing taxes for your company can incur hefty penalties.

- Digital paystubs are not suitable for your business

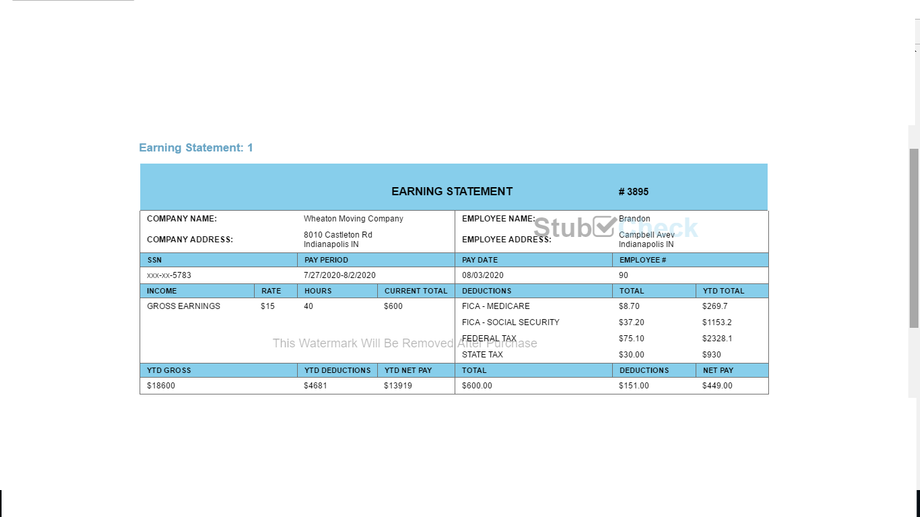

Many organisations have now taken to building stubs online. It simplifies things considerably, brings you cost savings, and also contributes toward reducing your carbon footprint. However, some firms believe that digital stubs are either not legal or not suitable for their establishment. As long as you use a trustworthy check stub creator and comply with the laws in your state, digital payslips are completely acceptable. StubCheck.com, for instance, assures you of an updated algorithm for calculating deductions, exemptions, etc., freeing you of the anxiety of committing a compliance mistake.

- You needn’t bother with tax compliance issues if you hire from a trusted talent pool

This is simply false. You might delude yourself that a trusted talent pool will free you of tax compliance issues. But even the calmest employee might choose to fallout if payroll violations and delays continue to be the norm.

- Outsourcing payroll will trap you with a vendor

Some firms believe that payroll solutions providers have a long lock-in period that requires you to continue the association even if you are dissatisfied. However, many present-day providers allow a lot of flexibility, complete or partial refunds, and plenty of wriggle space.

Continuing to believe in age-old myths in modern times can be detrimental to the health of your business. Bust these common—but completely baseless—myths regarding payroll management to witness quicker growth and savings in costs, time and effort.