Best PMS Service in India | Best PMS Service Provider 2019 | Top PMS in India

When it comes to choosing an asset class or an investment category which can do best in the long term, it is “Equity”. Within equity, Portfolio Management Schemes are the perfect choice for sophisticated investors to make long-term lump-sum allocations as it brings professional management with largely “buy and hold” strategy.

Wealth creation is a Marathon and not a Sprint. Holding on with conviction to stay invested in good investments creates wealth over a long period of time.

Here is the list of Top 5 Wealth Creators in the Portfolio Management Service industry which have delivered more than 2.5x return in the last 5 years –

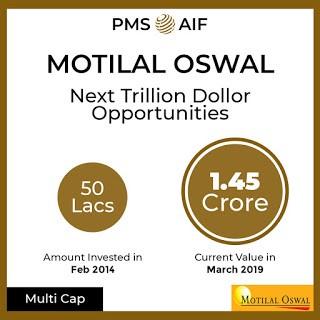

1) Motilal Oswal Next Trillion-Dollar Opportunities (NTDOP)

Below are some of the facts about this strategy:

Portfolio Type — “Multi-Cap Portfolio of Best Companies from Sectors that stand to contribute most to the Next Trillion GDP Growth”

Fund Manager Name — Mr. Manish Sonthalia

Investment Strategy — The investment philosophy is centred on BUY RIGHT: SIT TIGHT principle.

Buy Right is represented by — (QLGP)

“Q” denotes the quality of the business and management

“G” denotes growth in earnings and sustained RoE

“L” denotes longevity of the competitive advantage or economic moat of the business

“P” denotes our approach of buying a good business for a fair price rather than buying a fair business for a good price

Sit Tight

Buy and Hold: Strictly buy and hold and believe that picking the right business needs skill and holding onto these businesses to enable investors to benefit from the entire growth cycle needs even more skill.

Focus: High conviction portfolios with 25 to 30 stocks being our ideal number. We believe in adequate diversification but over-diversification results in diluting returns and add market risk.

NTDOP Portfolio Management Service of MotilalOswal invests in companies which are likely to earn 20–25 % on its net worth going forward. MotilalOswal PMS invests with a margin of safety and purchases a piece of great business at a fraction of its true value. MotilalNTDOP stands for Next Trillion-Dollar GDP growth. So, the focus is on buying companies that will benefit out of the Next Trillion-Dollar GDP growth. MotilalOswal identifies potential long-term wealth creators by focusing on individual companies and their management. It strongly believes that “Money is made by investing for the long term”. It follows a Focused portfolio strategy and the portfolio consists of up to 25 stocks. In his words of Mr Manish Sonthalia, Head of PMS, at Motilal Oswal Asset Management during the latest Webinar organised by PMS AIF WORLD on 13th Sep 2019, Motilal Next Trillion Dollar Opportunities Portfolio (MotilalNTDOP) is a stable portfolio of unleveraged businesses. Mr Manish Sonthalia, mentioned, “Our philosophy is to play on operating leverage”. The portfolio comprises of good businesses. We have held most companies for many years and have seen ups and downs in the past as well. These companies have delivered in the long term. We continue to hold as there is a conviction. Businesses do not travel in a straight line; one has to take a long-term view. Buying decent businesses and holding on to them for the long term is what we believe in. It’s more about the longevity of growth; the terminal value of the business and not 1 or 2 years of growth. Expected earnings growth of companies in MotilalNTDOPPMS can be seen in the vicinity of 18–20%.

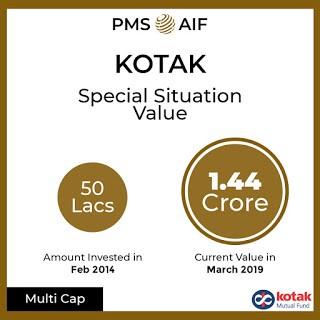

2) Kotak Special Situations Value

Below are some of the facts about this strategy:

Portfolio Type — Portfolio is a Mix of Value Opportunities and Special Situations

Fund Manager Name — AnshulSaigal

Investment Philosophy/Strategy:-

Corporate Special Situations

Investment operations whose results are dependent on happening or not-happening of one or more corporate events rather than market events/moves

1. Price related — Securities bought at a discount to (expected) price guarantees by a buyer in the form of de-listings, buy-backs, open offers, etc.

2. Merger-related — Shares can be created at a discount to current market price

3. Corporate restructurings -Value unlocking due to corporate restructuring, assets sales, demergers, business triggers, etc.

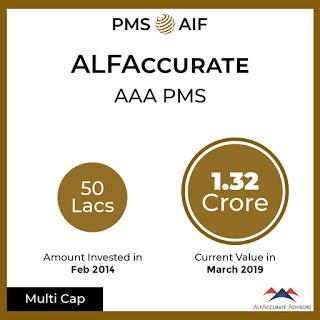

3) ALF Accurate Advisors AAA PMS

Below are some of the facts about this strategy:

Portfolio Type — “Well diversified, relatively low-risk portfolio”

Fund Manager Name — Rajesh Kothari

Investment Philosophy/Strategy

Well Diversified Portfolio

1. Identify emerging trends and opportunities from a universe of 450 companies and filter using a variety of valuation parameters.

2. Focus on earnings, free cash flow, ROE, long term growth and profitability trends for stock identification.

Analysis & decision-making process:

1. Initial screening followed by a corporate meeting and detailed due diligence.

2. Identify a sustainable competitive advantage.

Portfolio construction, monitoring & nurturing:

1. Both Top-Down and Bottom-Up approach with a benchmark agnostic strategy to achieve the long term investment objective.

2. Continuous portfolio monitoring ensures prudent risk management.

3. Regular interaction to provide strategic inputs to strengthen systems, controls, and CG in line with best practices.

Lastly, exiting & realizing value:

1. Constant evaluation of valuation metrics to decide optimum return potential.

2. The intrinsic value V/s Current Market Price to evaluate the Margin of Safety.

3. Change in underlying assumptions of the investment thesis.

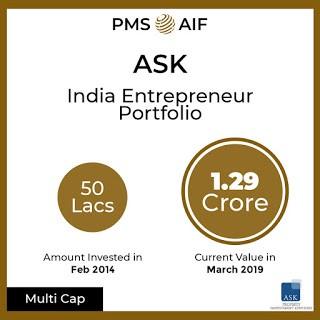

4) ASK India Entrepreneur (IEP)

Below are some of the facts about ASK IEP PMSstrategy:

Portfolio Type — “Portfolio of large and growing companies with promotors’ significant skin in the game”

Fund Manager Name — Sumit Jain

Investment Strategy –

1. Identify large and growing business opportunities with a competitive advantage that are significantly sized (min Rs.100cr of PBT)

2. The quality of the business should be good to be able to fund strong growth through internal cash generation. So, it looks for 20% compounded growth from each business and targets over 25% growth from the portfolio

3. To fund this growth, the business ROCE should be over 25% so that growth can be funded and there are surpluses for the dividend.

4. The management should have the drive and have skin in the game to deliver compounded growth period after period (uncompromised corporate governance is a must). Hence, invest in businesses with an identifiable business house at the helm with a minimum 25% stake.

5. We seek to identify such businesses at a reasonable discount to value and stay invested for a length of time and make money as EPS compounds

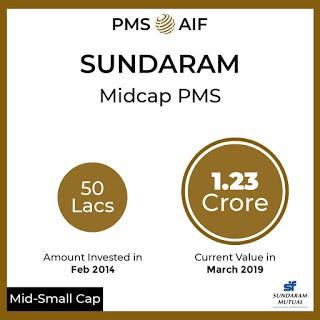

5) Sundaram Midcap

Below are some of the facts about this strategy:

Portfolio Type — “Mid & Small Cap Portfolio of companies expected to see huge market cap rise by 2025”

Fund Manager Name — Madangopal Ramu

Investment Strategy –

EASE Portfolio:

Emerging leaders with clean and high — quality management

Asset light & high ROCE businesses

Scalable companies: Mid-cap to large-cap, small-cap to mid-cap transitioning companies

Excellent cash conversion from operations