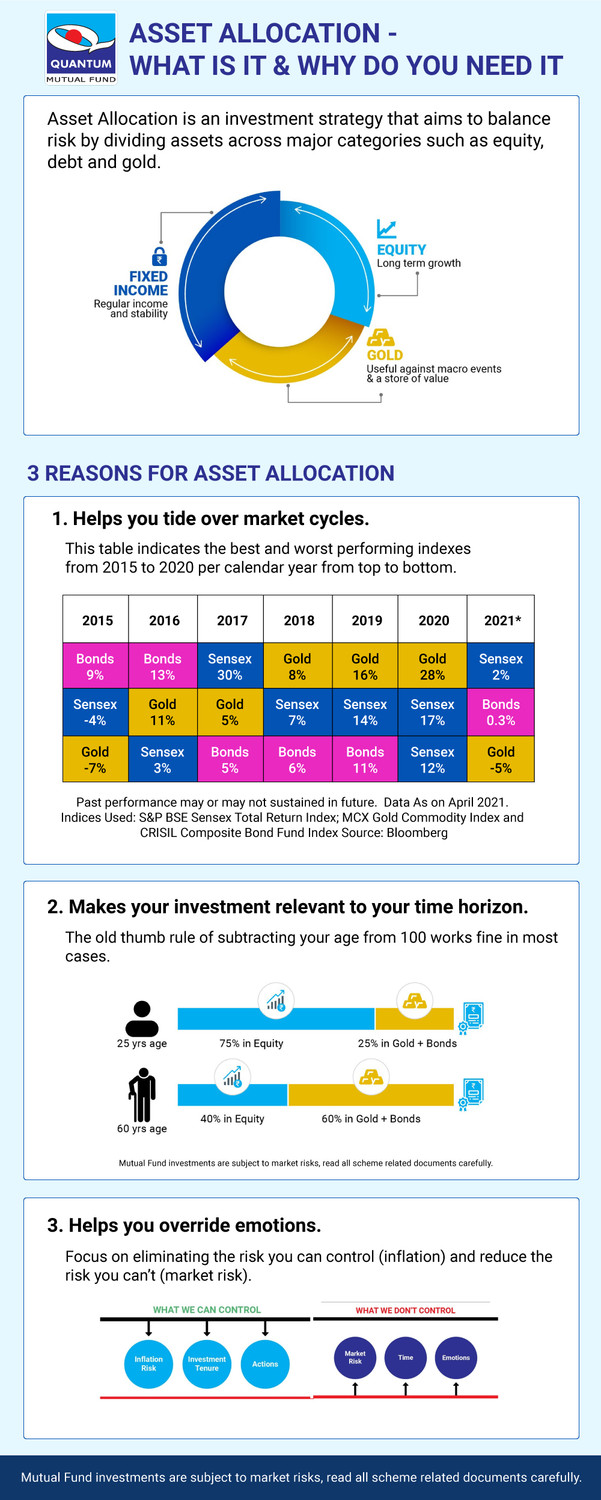

Asset Allocation is an investing strategy that aims to balance risk by dividing assets across major categories such as equity, debt and gold.

The three reasons for asset allocation are:

- it helps you tide over the market cycle: Assets are cyclical. This means it is difficult to predict which asset is likely to perform better in the future. Investing in just one asset class could hamper your financial goals. Thus, it is recommended to diversify your investments in the three asset classes to minimize downside risks.

- Makes your investments relevant to your time horizon

Your asset allocation needs to be relevant to your investment duration and your age. The old thumb rule of subtracting your age from 100 works fine in most cases. As you near your financial goals, it is advised to allocate more to debt mutual funds and lesser to volatile assets such as equities.

- Helps you override emotions: It is important to make decisions rationally and not let emotions get in the way of our mutual Fund investments. Generally, we focus on things beyond our control (Market Risk, Time, and Emotions) while we rarely focus on factors that we can control. (Inflation, Investment Tenure, and Actions).