Trading chart patterns are a valuable part of trading. While you need to technical analysis for understanding the market reaction. Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern.

However, there is more than one kind of triangle to find, and there are a couple of ways to trade them. Here are some of the more basic methods to both finding and trading these patterns.

In this article, I will discuss triangle chart patterns and it’s variants. So, without further ado, let begin the show —

First I will address Ascending Triangle —

What is an ascending triangle?

The ascending triangles form when the price follows a rising trendline. However, the trend consolidates, failing to make new highs.

Ascending triangles are considered to be continuation patterns. Therefore, a break of the resistance prompts a rally.

The pattern is negated if the price breaks below the upward sloping trendline.

Also Read: Step-by-step Solution on Forex Brokers Problems

The example below of the EUR/USD (Euro/U.S. Dollar) illustrates an ascending triangle pattern on a 30-minute chart. After a prolonged uptrend marked by an ascending trendline between A and B, the EUR/USD temporarily consolidated, unable to form a new high or fall below the support. The pair reverted to test resistance on three distinct occurrences between B and C, but it was incapable of breaking it.

The ascending triangle pattern formed once a horizontal resistance and ascending support lines acted as buffers for the price action. Finally, EUR/USD breached resistance at E, signaling a potential bullish breakout.

EUR/USD

Now, it’s time for descending triangle —

What is a descending triangle?

Not surprisingly, the descending triangle is the opposite of the ascending triangle. It forms when the price follows a downward trendline and then consolidates, failing to make new lows or break a downward trendline.

Descending triangles are considered continuation patterns. Therefore, a break in the support prompts the price to fall.

The pattern is negated if the price breaks the downward sloping trendline.

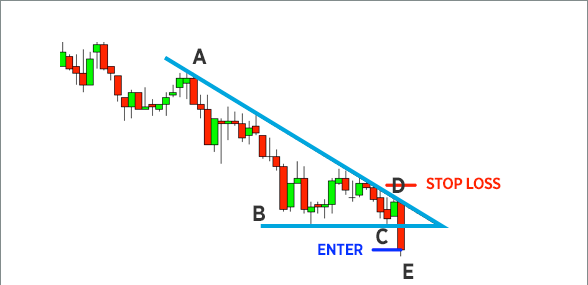

NZD/USD

The example above of the NZD/USD (New Zealand Dollar/U.S. Dollar) illustrates a descending triangle pattern on a five-minute chart. After a downtrend that followed a descending trendline between A and B, the pair temporarily consolidated between B and C, unable to make a new low. The pair reverted to test resistance on two distinct occurrences, but it was incapable of breaking out to the upside at D. The pattern formed horizontal support while descending resistance lines acted as buffers for the price action. Finally, the NZD/USD breached the resistance at E, signaling a potential bearish breakdown.

Finally, now I will add a Symmetrical triangle —

What is a symmetrical triangle?

The pattern is identified by two discrete trendlines. The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs.

Symmetrical triangles generally form during consolidation and the volatility tends to decline as the pattern progresses.

Symmetrical triangles tend to be neutral and can signal either a bullish or a bearish situation. Therefore, a breakout from the pattern in either direction signals a new trend.

NZD/USD

The example above of the NZD/USD illustrates a symmetrical triangle formation on a 15-minute chart. After a rapid uptrend, the pair consolidated between A and B, unable to find a distinct trend. During the consolidating state, the pair continued to form a series of lower peaks and higher troughs. Volatility dropped off considerably if compared to the beginning of the formation. Ultimately, the pattern ended when both of the trendlines came together at C.

The Bottom Line

So, above I showed how these triangle patterns work. Next day, I will add more about how you can use them while trading. Also, if you need more capital for trading, then I think it’s time for grabbing forex no deposit bonus. It will add some extra trading money to your account.

Best of luck!