Is online trading a reliable source of income? The short answer is that trading is your greatest bet in today's expanding global economy. The global economy is greatly impacted by forex trading, which has already attracted a sizable market.

With a strong strategy like the Forex swing trading strategy, you can make numerous lucrative trades.

But there are also some dangers involved. This market is becoming more and more erratic. Therefore, being strategic is the only thing you need if you want a profitable experience. There are numerous tactics to use when trading in the forex market.

You only need to choose which path you want to take. Because you cannot successfully apply a strategy if you are not interested in it, additionally, you ought to pick a straightforward strategy.

For your kind information want to tell you that swing trading can occur on both Forex trading Strategies and Gold Trading Strategies. The simple Forex trading strategy, known as the Forex Swing Trading Strategy, is an option if you like taking risks.

Main Points

- To make a solid trade, a straightforward strategy involves identifying one's entry and exit positions.

- The application of this strategy is simple for those with other professions.

- The main elements are to swing high and swing low.

- Swing trading is suitable for those with a set time because this strategy does sensible market analysis.

- By doing simple actions, you may trade in FX trading with a great strategy.

Swing Trading: What Is It?

Wins or losses in forex trading depend on your level of strategic thinking. There are numerous Forex trading strategies. Do you have a clear understanding of swing trading?

Among the finest strategies for this is "swing trading." But I must be clear that swing trading is an approach to trading rather than a particular strategy.

It's a trustworthy method that guarantees gains in a fairly short period of time.

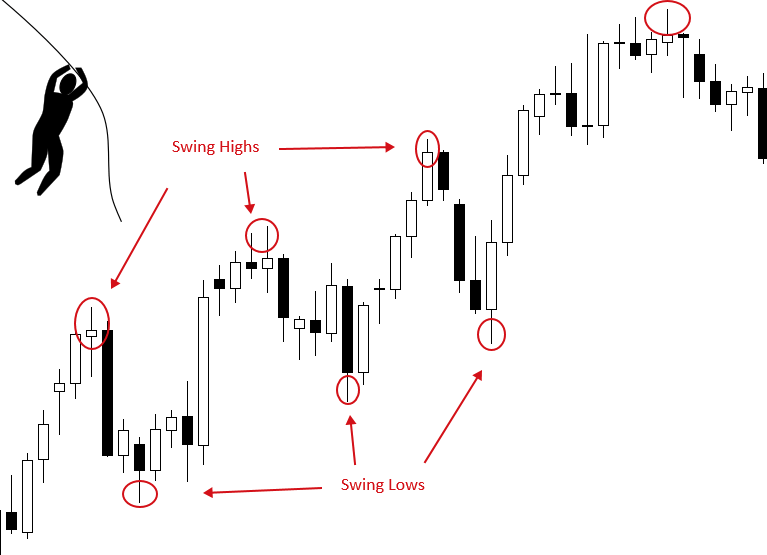

This trading strategy is short/medium term. Here, traders typically keep positions open for a few days or weeks. Finding the "swing highs" or "swing lows" will yield profits.

As they cannot constantly check the charts to trade, full-time workers frequently use this strategy.

They trade free time and invest many hours researching the market before making a trade. To learn more, you can research various forex swing trading strategies online.

Day trading is distinct from swing trading. Here, making money within a day is the main goal. It's not for serious players.

Swing trading is a quick option for people who want to make money right away. Technical analysis is the first tool used by swing traders to determine their trading position.

Charts are used by traders to identify price trends and patterns before opening positions.

Swing traders should understand everything there is to know about swing trading. I'm hoping they will find this information useful.

The Operation of Swing Trading

The greatest alternative for a trader who works a full-time job or is unable to check charts all day but has a certain window of time to study the market and stay current on world economic developments is swing trading.

The price of currency pairs is current in a swing trading strategy thanks to technical analysis.

This trading strategy seeks to spot "swings" in a medium-term trend and enter only when they point a high likelihood of success. In this case, traders purchase a currency when it is on a "swing low" and then sell it when it is on a "swing high."

Trades in swing trading go on for longer than a day. It called for greater stop losses due to weather volatility.

Along with his trading strategies, a Forex trader needs to have good money management. So, is swing trading in forex profitable?

Open doors are limited in swing trading since longer time frames produce better results.

Only five to ten arrangements may be delivered to you each month. The return from everyone, however, can often be much greater than that of day traders. The forex traders can choose from a variety of trading approaches in the forex trading strategy.

Due to the rate of currency pair fluctuations, you can frequently see trades go solely against you throughout the holding time. For a brief period of time, it fluctuates more, but you shouldn't worry too much about it.

The key in this situation is to express your desire quickly. Your overall profits may be impacted if you are unable to do so.

The purpose of swing trading among forex traders

The largest market in the world is dominated by forex trading. Being strategic is far more important in this case. One of them is the swing trading strategy, which is rising in popularity every day. The worth of a particular currency over the long run is unimportant to this system.

Its method of operation is to use a high swing point to find profit. You can choose a specified time frame, however it can operate all day.

Here's an illustration using the NZD/USD index:

Source: FOREX.com

Check out the orange horizontal line first. It stands for what is referred to as a critical support level. We can see that it was tested three times between late May and the middle of June, but held up each time.

The New Zealand dollar, however, dropped past the 0.649 level line and kept falling after a brief recovery period.

The point of a swing trade was now a real possibility. It was already trading almost 9% lower in March when it touched 0.630. It has been four years since the NZD was worth just 63 cents. Finally, you might inquire:

Variations in Swing Trading

How does swing trading work?

Many different trading tactics are often used by swing traders.

Reversal, retracement (or pullback), breakouts, and breakdowns are the four most frequent.

- Trading Reverse reversals

The foundation of reversal trading is a change in price momentum. A change in an asset's price trend is known as a reversal. For instance, the price starts to decline when an upward trend loses momentum. Both positive and negative reversals are possible (or bullish or bearish).

- Retracement trading

Looking for a price to momentarily reverse within a bigger trend is the basis of retracement (or pullback) trading. Prior to continuing in the same direction, the price briefly retraces to a previous price point.

It might be challenging to foresee reversals and tell them apart from temporary pullbacks. A pullback is a shorter-term "mini reversal" within an existing trend, whereas a reversal is a trend change.

Think of a retracement (or pullback) as a "small countertrend within a big trend."

If a price movement is a retracement, it should only be momentary and short-lived.

Always expect pullbacks before reversals. Determining whether this is merely a pullback or a true trend reversal is tough.

- Trading when a breakout occurs

A strategy known as "breakout trading" involves taking a position on the early side of a UPTREND and watching for the price to "breakout." When the price crosses a crucial line of resistance, you enter a position.

- Breakout strategy

A breakdown strategy is the opposite of a breakout strategy. You take a position early in a DOWNTREND, anticipating that the price will "breakdown" (also known as a downside breakout). As soon as the price crosses through a crucial SUPPORT level, you place a trade.

Swing traders: Are they more successful?

Therefore, my response will be: Swing traders anticipate making a lot of small victories that add up to large returns. For instance, while swing traders might earn 5% weekly gains and outperform other traders' long-term returns, other traders would wait five months to receive a 25% benefit.

The Top Forex Swing Trading Techniques

All FX trading techniques frequently use swing trading. Anyone with any interest is welcome to participate in this.

This method of trading strategy is simple to use and takes little time, so one can select a time period of their choosing.

There are various swing trading techniques in Forex that may be used to meet strategy demand.

Despite their differences, the end result is the same. You can select a trader based on your type and begin your quest.

Either your selected strategy can trade against trends or it can follow them.

The Best Forex Swing Trading Techniques Are As Follows:

Trading trends

One of the finest Forex swing trading techniques is trend trading. People are voluntarily going through this, which is greatly hyping the market.

In this kind of trading, a distinct price signal provides a predetermined lineup of prices while going up or down, and this procedure linearly adheres to a step-by-step formula.

This trading strategy also takes advantage of positive trendlines. This strategy identifies the market's turning point, its low point, and its growth zone. From the lowest low to the highest value, it started.

P.S. Because it compensates losses with returns that surpass losses, trend trading is one of the safest swing forex techniques.

Counter-Trend Trading

An essential form of swing trading strategy is counter-trend trading. Because this system requires significantly more attention, this protocol is challenging to utilize.

A signal being missed can be a curse for your failure. To generate a significant profit, you must therefore pay more attention to the ideal entrance and leave times.

The trend trading strategy is the antithesis of this trading method. This approach or system depicts growth rather than breakdown. Furthermore, one of the best forex swing trading tactics is position trading.

Moving Average strategy

The moving average strategy of forex swing trading takes into account the average duration of all market movements.

A trader needs to be skilled in order to use this strategy. The forex market offers a round-the-clock trading service, so if you're using a moving strategy, you'll need to choose a time frame that works with your plans.

The following list includes some of the moving average strategy's periods:

20/21 Period: The moving average strategy's most common protocol is of this kind. Price movement is more precise here than it is elsewhere.

50 Period: This time period is widely accepted as the industry norm among them. The medium for long- or short-term trends is this period frame.

100 Period: For swing traders who prefer holding positions weekly or monthly, this time period is ideal.

200/250 Period: The daily holders should use this time. Here, the results are substantially better.

Bollinger Band Strategy

https://jpcdn.it/img/1a97e3674c77c931fbfdcb465691863f.png

Bollinger band strategy can be used as a standard measurement deviation in fields like analytics. Bollinger's band strategy locates a precise turning point by using three indicators.

This three-point strategy produces an average that resembles a moving average.

This strategy uses the same tricks to buy more at a price and sell them at a price. Finding a good balance between buying and selling is key. All you need to do to make money is to be strategic.

A versatile strategy

This strategy contains all the instruments required for various essential swing trading strategies; therefore, it may be utilized for teaching reasons. The mother of all strategies, if you will.

In essence, it combines all swing trading strategies. The experiment will perform best if a specific strategy is used.

The best swing trading strategies for beginners may be learned to learn more about swing trading strategies.

Trading is a winning or losing experience. For traders to excel in this industry, they must be strategic and focused. Which swing trading strategy is thus the most effective?

The advantages and disadvantages of the swing trading strategy

Swing trading became the preferred strategy when the trading market was active. However, there are still certain problems that make things difficult for the consumers.

The pros and cons of the swing trading strategy are as follows:

Swing trading strategy advantages:

- Day trading takes more time than swing trading.

- It offers the highest potential for short- to medium-term profit.

- Here, getting in and out of the market swing is important for trading.

- More so than any other trading strategy, it involves less analysis.

- Trading procedures can be streamlined with swing trading.

- This strategy makes traders' market risk known.

- When transactions go against you, it can reassure you to remain cool.

- You may start forex swing trading with fewer setups.

- It has a multi-day trade holding capacity.

These are swing trading's benefits. Nothing exists other than a curse. Therefore, swing trading had drawbacks as well.

Swing trading strategy drawbacks

- Trade holdings are vulnerable to weekend and overnight market risk.

- The sudden turnaround of the market could cause a great deal of harm.

- The trends cannot be followed by a trader.

- Overnight risk exists.

- Compared to intraday trading, return is lower.

- To function, it calls for more restraint, composure, and patience.

Swing trading is more profitable and simple to utilize, despite some of its drawbacks. With these benefits, everyone is naturally curious about...

How Much Do Swing Traders in Forex Make?

It might be $1,000 per day for a day trader and $5,000, $12,000, or $60,000 per month for a swing trader. Every trader has a different setting where they feel comfortable.

It might be $1,000 per day for a day trader and $5,000, $12,000, or $60,000 per month for a swing trader. Every trader has a different setting where they feel comfortable.

Saying this doesn't mean that you can't keep increasing your profits, but as your compensation rises, the motivation to do so diminishes.

Is Swing Trading Good for Newcomers? Swing trading is simple to utilize, to put it simply. Its techniques are typically categorized for novice traders with good trading expertise.

Swing trading is simple to utilize, to put it simply. Its techniques are typically categorized for novice traders with good trading expertise.

Swing trading is a trading strategy that not only beginners but those with other employment can benefit from learning.

If you are a swing trader, you can run your side business or semi-enterprise in addition to forex trading. It helps you the most by keeping the market current. You can enter or quit fast after doing some analysis.

But if you spend some time here, you can find everything. Overall, learning this trading strategy is simple. I wish all newcomers success and a fulfilling experience.

How To Begin Swing Trading

Please stop talking now. Directly following are the steps to begin swing trading:

Please stop talking now. Directly following are the steps to begin swing trading:

The trade setup is in step one.

Swing trading should be started first because it closely resembles the trading conditions. It is useful during the period with no trend. If you trade trends, for instance, a trend must exist, and your trading strategy should be defined in your trading plan.

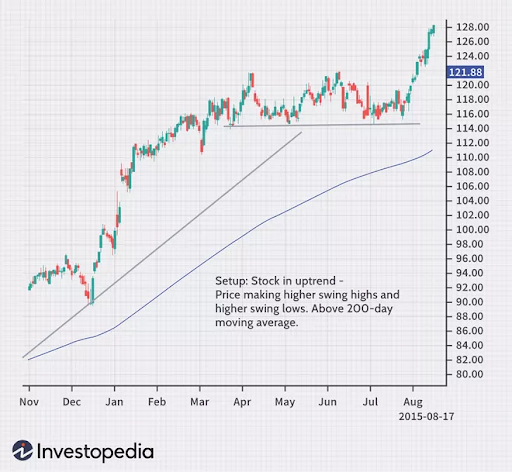

Figure 1: Stock on Uptrend, Offering Potential Trade Setups for Trend Traders

An illustration of this tread configuration can be seen in the image. Prices are swinging high and low in this area, and the price range is similar to the 200-day moving average.

You can plan your trade but keep in a strategy that for it to work, the conditions must be favourable. Your trading plan can be successful if you read trading books. You can each trading book like Best swing trading book, Best day trading book, Trading strategy book etc. Which time window would be ideal for swing trading, then?

He typically works with time frames of 1 minute or 5 minutes. When comfortable holding deals for several days, go on to day trading.

The Trade Trigger, the second step

Even when you are ready to trade, you still need a trigger event to know when to place your trade.

Although it is clear that the market is rising, there will soon be additional chances for winning trading.

Some traders prefer to buy when prices are high, while others prefer it when the market declines. so decided on a winning strategy.

Figure 2: Possible Trade Triggers in an uptrending Stock,

Three potential trade triggers are depicted in this figure. You can make a selection from this list based on your trading strategy.

The Stop Loss in the third step

Not every successful trade is the result of choosing the ideal entry point and trading trigger. The easiest way to control this trading risk would be with a stop-loss order.

For lengthy transactions, a stop loss is typically set for a short career just above a recent swing high and slightly below a recent swing low. It gives you several options for setting up this stop-loss move.

The Average True Range (ATR) stop loss technique is the alternative. In order to do that, a stop-loss order must be placed at a specific distance from the entry price.

Figure 3: shows a long trade example with a stop loss.

You can see in this image where your stop loss will be.

The Price Target in the fourth step

Now that you are aware of the favourable trading conditions, you also know where to enter the trade and when to exit it.

So earning potential for profit is the next step. Position trading in the forex market is a fantastic technique to channel your swing trading emotions when it comes to swing trading strategies.

The profit goal is not determined by some arbitrary subject. Targets based on size patterns are offered by all chart types.

You can see where the price is reversing by looking at the bottom channel, or price goal, of the track.

After evaluating your trading style and strategy, it would assist you determine your profit target.

The Reward-To-Risk Analysis, the fifth step

Wherever the profit margins are greater than 1.5 times the risk, you should take your position. For instance, if the price approaches your stop loss and you lose $100, that means you should gain $150 or more if the goal price is attained.

In Figure 3, the risk is 210 pip, while the possible payoff is 600 pip. With 600/210, the reward-to-risk ratio is 2.86:1.

A trailing stop loss is not without risk. You only need to control the risk associated with your trading position.

If the profit margin is the same or minimal, you should not make the trade. A competent trader will make the wise trade to avoid bad trades.

This five-step process serves as a filter, enabling you to enter deals that are pertinent to your trading strategy. Only those transactions have a good potential for profit in relation to risk. Adapt the additional stages to your trading strategy.

Swing traders might want to refrain from entering positions prior to the release of earnings reports or important economic data, for instance.

In this situation, before making a trade, examine the economic calendar to make sure there aren't any scheduled similar occurrences during the time you're likely to be in business. Swing trading time frames are abstract concepts that can help you see your trading more clearly.

One can immediately begin their adventure into forex swing trading by following these simple steps.

Who is the top swing trader in the end?

Mark Minervini

Mark has accumulated a lifetime of experience already. He has almost 30 years of experience as a great swing trader, and he was included in a Market Wizards book. The evaluated returns for Mark are excellent, and he really exemplifies what is possible with hard effort and focuses.

Are You a Good Fit for Swing Trading?

There is no right or wrong answer to this query. Since I started trading in 2005, swing trading has shown to be quite profitable. You should keep in mind that I have tried every possible trading strategy. Prior to 2010, I tried everything, from rapid scalping tactics to trading Monday gap tactics. However, the fact that swing trading forex has been successful for me does not preclude you from improving.

Contrary to popular belief, personality has more to do with finding an appealing style. Designers frequently struggle to convey their unique sense of style. You can decide if swing trading is right for you with the help of the following considerations.

- If you desire, you might want to become a swing trader.

Most swing deals in forex can be finished in a few days or weeks. This entails working on the weekends or even at night. Fortunately, there are a number of ways to control the hazards connected to prolonged holding times.

Knowing that volatility may occur before governmental elections provides a straightforward substitute for closing positions before Friday. Forex was the reason I started using daily price action at the beginning of 2014 because I desired more financial freedom. Overall, if a person does not have some expertise of swing trading, it will be difficult to trade on the forex market.

- If you are a novice, you might not want to be a swing trader in the forex market.

In swing trading, there is nothing immediate or practicable. The slower and more experienced traders benefit from this. You are making a mistake if your trade's holding duration exceeds two days.

You aren't thinking about working for meager pay for each position. Your average profits from a successful swing trade may surpass 2%. However, the average day trader makes much less money on profitable deals. The earnings per execution are not very high. In the forex market, overnight position holding is challenging. However, for forex traders with different trading philosophies, this category might be helpful.

Conclusion

You might find this blog to be useful. Using this strategy as described could put you in your comfort zone.

All you need to know before setting out on your adventure is how to begin your swing trading strategy. Your trading experience could be altered by this protocol.

As a swing trader, I advise using a swing trading strategy to get started on a fruitful trading path.

This is where I have to stop because the article is already quite long. I sincerely hope that everyone is enjoying their experience with the Forex swing trading strategy.