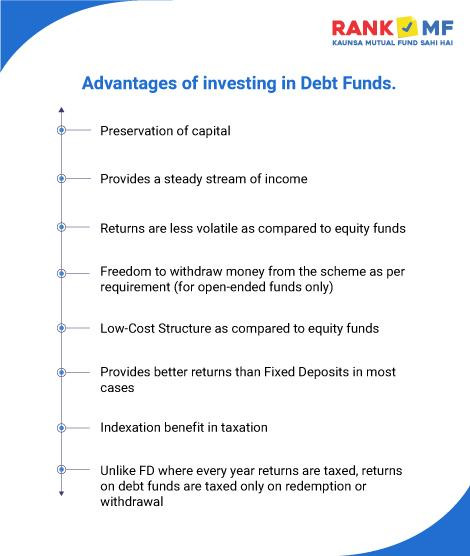

Advantages of investing in Debt Funds.

Debt Funds are a type of mutual fund which invests in fixed income-generating securities. A debt fund may invest in Treasury Bills, Government Securities, short-term or long-term corporate bonds, money market instruments, floating-rate debt and other debt securities of different time horizons. The expense ratio on debt funds is usually lower, on average than equity funds because the overall management costs are lower.In simpler terms, investing in fixed income securities is like giving a loan to receive a fixed, pre-decided interest on the loan. There are various types of debt mutual funds such as Income Funds, Dynamic Bond Funds, Short-term and Ultra Short-term Debt Funds, Liquid Funds, Gilt Funds, Credit Opportunities Funds, and Fixed Maturity Plans. A brief description of different debt funds is given below.

Read More : https://www.rankmf.com/knowledge-center/article/what-are-debt-mutual-funds/