Data center is a building or property that houses storage servers, networking devices, and other important useful connectivity hardware. These buildings are hired as means to replicate what an on-premise computer system can do, which reduces the operational cost of consumers. With the growing demand for data processing along with the increase in usage of smart devices and internet applications, the demand for data centers has also increased. This directly affects the operation intensity and standard operating procedures being followed by these giant data center buildings. One of the core operational factors of efficiency for these data centers is the PUE or power usage effectiveness, which is a measure of efficiency in any data center. The PUE gets impacted by any change in load on servers or in power consumption.

Read Report Overview: Data Center Liquid Cooling Market

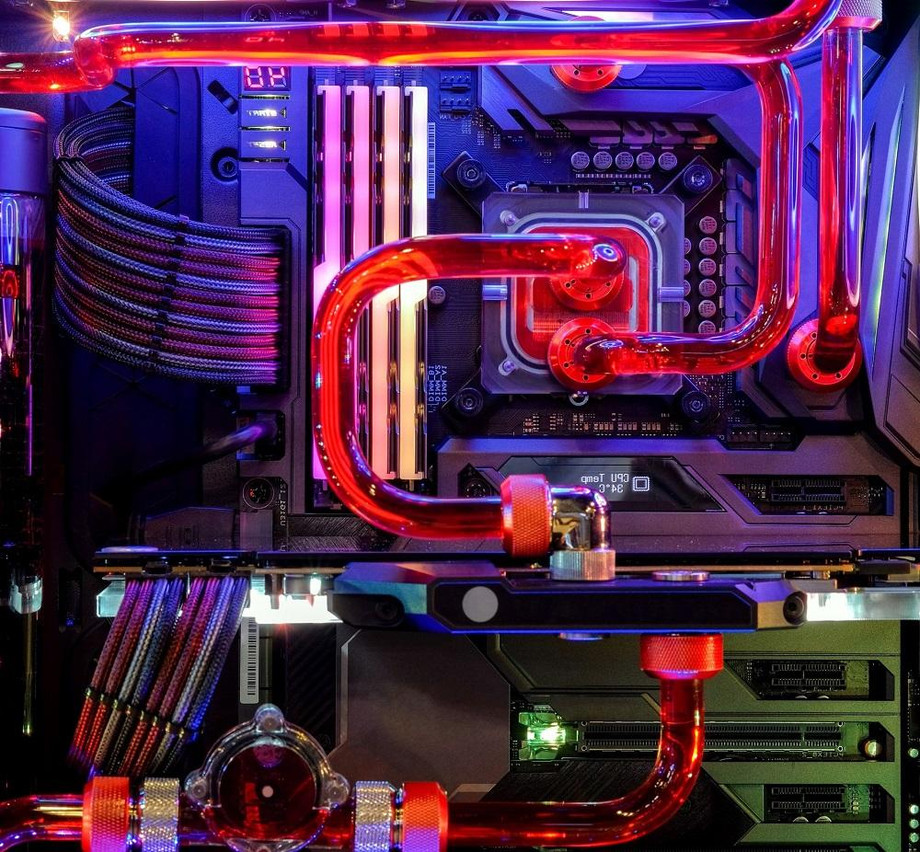

Data centers are designed to run 24/7, which causes the components to heat. Overheating can lead to outages, thereby preventing a data center from running continuously. Apart from this, the servers are designed in such a way that they operate at an optimum temperature, and any change in that temperature may lead to dysfunction. Thus, cooling becomes a crucial component of data center operations.

The global data center liquid cooling market was valued at $2.79 billion in 2021, which is expected to grow with a CAGR of 27.67% and reach $11.84 billion by 2027. The growth in the global data center liquid cooling market is expected to be driven by increased water scarcity and boosting number of edge, colocation, and hyper data centers.

IT and Telecom Industry Segment to Dominate the Data Center Liquid Cooling Market

The IT and telecom industry is the largest contributor to the demand for the entire data center industry, let alone the market for data center liquid cooling. The industry is driven by data transmission and data processing, with the IT industry producing the largest amount of data from data-intensive applications. The IT and telecom industries are considered to be the backbone for all other industries as communication is a key factor in the growth of a modern economy. Similarly, the banking, financial services, and insurance (BFSI) industry also plays a huge role in the economy, and due to the ongoing efforts of dematerialization, the BFSI industry is expected to further push the demand for data centers.

Both these industries play a significant role in driving the demand for data centers, thereby boosting the demand for data center liquid cooling technologies.

Hyperscale Data Centers to Generate the Highest Demand in Data Center Liquid Cooling Market

Hyperscale data centers are responsible for cloud services and cloud computing applications. Due to the ongoing trend and increased migration from physical computing to cloud computing, hyperscale data centers have been producing more demand as compared to other data center types. Some of the leading hyperscale operators such as Alibaba, Microsoft, and Google have already enacted these technologies and are expected to further drive the market.

The data centers have begun updating their premises by introducing liquid cooling systems to significantly reduce electricity usage involving innovations for data center cooling. Reduction in operating costs further drives the global data center liquid cooling market. Sustainable development initiatives and corporate social responsibility (CSR) activities are also driving the global data center liquid cooling market with the support of different government initiatives and environmental guidelines, particularly that support reduction of carbon emissions. For instance, due to the influence of a few government initiatives, such as the Paris Agreement, data centers and other industries will adopt liquid cooling technologies to decrease the heat that is dissipated, thereby contributing to reducing global warming.

Request for a Sample: https://bisresearch.com/requestsample?id=1427&type=download

Competitive Landscape

The competitive landscape of the data center liquid cooling market consists of different strategies undertaken by major players across the industry to gain market presence. Some of the strategies adopted by the companies are new product launches, business expansions, and partnerships and collaborations.

Recent Developments in Global Data Center Liquid Cooling Market

- In January 2022, Green Revolution Cooling collaborated with Intel to reduce the environmental impact of digital infrastructure. This would result in the customers developing and implementing advanced data center liquid cooling techniques in future data centers.

- In March 2021, Submer and SYNNEX Corporation joined forces. According to the agreement, Submer’s range of liquid cooling and edge-ready solutions will be manufactured in the U.S. and distributed by SYNNEX.

- In November 2021, Schneider Electric and Chilldyne formed an alliance partnership to increase the sustainability and effectiveness of data centers. This collaboration enhances the entire line of Uniflair cooling and chiller solutions offered by Schneider Electric.

- In March 2021, LiquidStack, launched from stealth mode with new deployments across vital sectors such as high-performance computing (HPC), cloud services, artificial intelligence (AI), and edge and telecommunications, and funded by Strategic Partner Wiwynn in a Series A funding round.