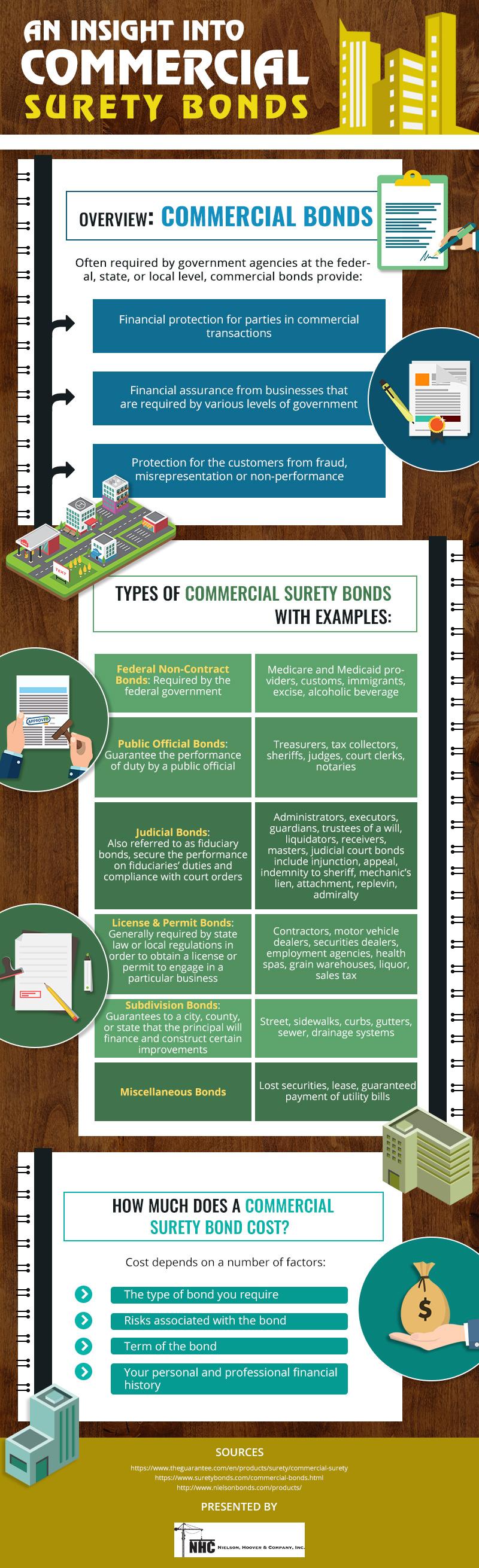

Types of Commercial Surety Bonds to Know

One of the things that you need to make sure that you are aware of when it comes to commercial surety bonds are the types that are available and who might need them. Knowing this can make the entire process easier, and you would know which ones are going to be required for your project. Here are the most common types and who would need them.

Federal non-contract – This type is required by Medicaid and medicare, alcoholic beverage, excise, immigrants, and customs providers by the federal government.

Public official – For the public official that is holding an office, then this is required for their performance, and it is often purchased by notaries, court clerks, judges, sheriffs, tax collectors, and treasurers.

Judicial – This one is also known as fiduciary, and it is there to ensure the performance and compliance with the court orders and fiduciaries’ duties. Normally administrators, guardians, executors, will trustees, liquidators, master, and receivers are required to get the commercial surety bonds.

License and permit – This one is often required by the local or state government when a license is being applied for, and those who need it include sales tax, liquor, grain warehouses, health spas, employment agencies, securities dealers, vehicle dealers, and contractors.

Subdivision – This is a guarantee to the state, county or city that the holder will both finance as well as build specific improvements and is held by those dealing with drainage systems, sewers, gutters, curbs, sidewalks, and streets.

There are also some miscellaneous options that you can look at and see if you need, including those for lost securities, guarantee for payment of the utility bills and leases.

This is everything that one would need to know about the various types of commercial surety bonds and who would need them. Make sure that if you need one that you have it and that you know the level of coverage required. These people often are necessary to get them from any level of government starting from the local until federal.