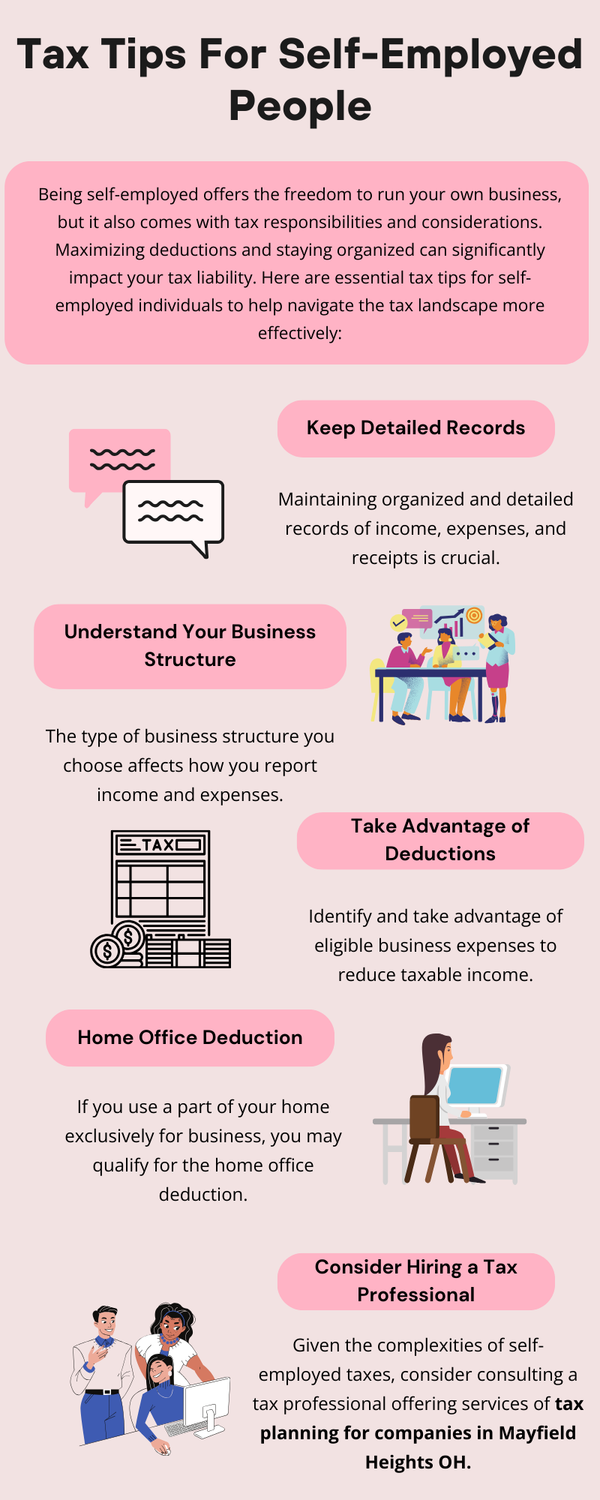

For self-employed individuals, prioritize meticulous record-keeping to maximize deductions. Deduct eligible business expenses, including home office costs and equipment. Leverage retirement savings plans for tax advantages. Consider quarterly estimated tax payments to avoid penalties. Stay informed about tax code changes and seek professional advice for personalized strategies to optimize tax liability and financial well-being. To know more visit here https://www.mayfieldheightscpa.com/tax-planning-mayfield-heights-oh