Convertible Debenture Purchase Agreement is long-term debts that are issued by companies to convert to stocks for certain tenure. This agreement does not support them and those are unsecured bonds.

The Agreement holder earns interest on this long-term bond and being able to convert it into stock, It is a unique and flexible feature of convertible debentures. The feature turns in security as it reserves off certain risks.

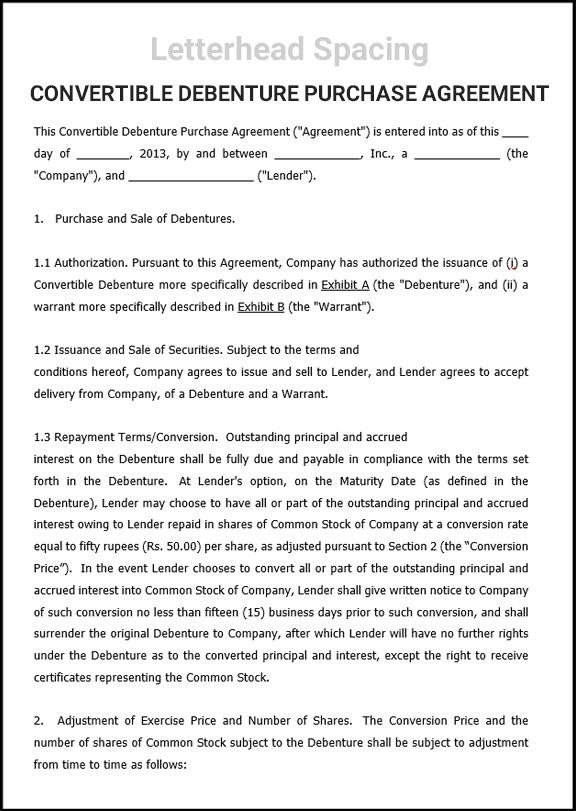

Long-term debt securities pay interest returns agreement holders like any other agreement. It is a hybrid financial product and has some features of both debt and equity investments. Organizations issue convertible debentures as fixed-rate loans, paying the agreement holder fixed interest payments on a regular schedule.

Benefits of Convertible Debenture

As the fixed income tool, Where it is an agreement or debt loan it describes needs to be repaid. Too much debt on the organization's balance sheet can be lead to high debt costs. and it includes interest payment.

Why Use Convertible Debenture Purchase Agreement?

Coupon rate or interest is registered that could be fixed and the paid by organization to the debenture holder.

The rating of the organization debenture is determined to offer interest on the debenture.

For non-convertible debentures, a maturity date is assigned as a part of the agreement.