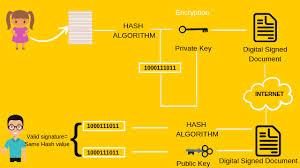

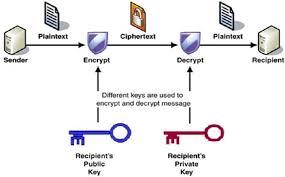

A Electronic Signature could be the equal of the Actual physical signature in Digital structure, mainly because it establishes the identification in the sender of the Digital doc in the Internet. Digital Signatures are Utilized in India for http://edition.cnn.com/search/?text=Digital Signature on line transactions such as Cash flow Tax E-Filing, Company or LLP Incorporation, Filing Once-a-year Return, E-Tenders, and many others., You will discover 3 forms of Electronic Signatures, Class I, Class II and Course III Digital Signature. Class digital signature renewal I type of Electronic Signatures digital signature agency are only employed for securing e-mail communication. Course II style of Digital Signatures are utilized for Business or LLP Incorporation, IT Return E-Filing, Getting DIN or DPIN, and submitting other forms Together with the https://en.search.wordpress.com/?src=organic&q=Digital Signature Ministry of Company Affairs and Cash flow Tax Office. Course III type Digital Signatures are employed generally for E-Tendering and for taking part in E-Auctions. Digital Signatures come in the shape of a USB E-Token, wherein the Electronic Signature Certificate is saved within a USB Generate digital signature and might be accessed through a pc to sign files electronically.

With E-Return submitting getting obligatory for Cash flow Tax Assesses having an money of around Rs.5 lakhs per annum, the need and prevalence of Digital Signatures has enhanced manifold. IndiaFilings will help you obtain your Digital Signature stress-absolutely free online. TAX Trace INDIA is a Registered Companion of SIFY and E-Mudhra.

Explanations to acquire Digital Signature

Course II Electronic Signature

Class II Digital Signatures are utilized for Cash flow Tax E-Filing, Enterprise or LLP Incorporation, Yearly Return Filing, etc., Class II Electronic Signatures are needed to file files electronically While using the Ministry of Corporate http://www.thefreedictionary.com/Digital Signature Affairs and Money Tax Division.

E-Token

Digital Signature Certificate are stored on a safe USB flash drive referred to as a E-Token . The Electronic Signature Certificate saved during the USB flash generate have to be connected to a pc to electronically sign a doc.

Class III Digital Signature

Course III Electronic Signatures give the highest volume of assurance and are used for E-Auctions and E-Tendering. Authorities entities such as the Indian Railways, Banking companies, and so on., have to have Course III Digital Signatures to be involved in their E-Tenders.

Registering Authority

TAXHINT INdiais a Accredited Registering Authority of Sify and E-Mudhra. For that reason, TAX HINT INDIA will let you obtain Sify or E-Mudhra Digital Signatures stress-absolutely free and swiftly.

Validity

Digital Signatures commonly have class 2 digital signature a validity of a couple of yrs. The validity of your Electronic Signature is usually renewed when the time period digital siganture for tender from the preceding Electronic Signature expires.