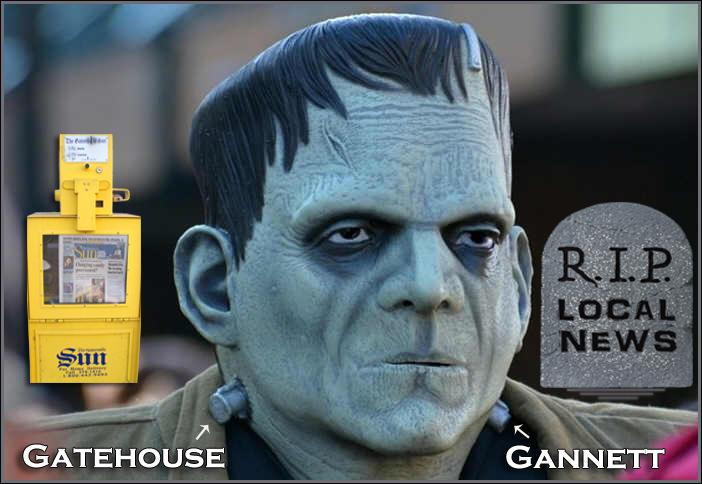

Gatehouse Media Parent to Buy Gannett for $1.4 Billion

(T)he efficiencies wrought by the merger may also result in publications that rely less on local reporters and more on USA Today-type stories produced or edited remotely and published in dozens of the company’s publications. Journalists across the country fretted over whether the deal would mean a wave of layoffs.

WALL STREET JOURNAL

Gatehouse Media Parent to Buy Gannett for $1.4 Billion

Deal combines largest owner of U.S. newspapers by titles and the largest newspaper group by circulation As part of the deal, New Media will pay $6.25 in cash and 0.5427 New Media share for a total of $12.06 for each Gannett share

By Cara Lombardo and Jeffrey A. Trachtenberg Updated Aug. 5, 2019

The country’s two largest newspaper chains agreed to combine their businesses in a roughly $1.4 billion deal, further consolidating an industry reeling from strong economic headwinds.

New Media Investment Group Inc., NEWM -11.68% the parent of GateHouse Media, is buying Gannett Co. GCI -5.98% in a cash-and-stock transaction, the companies said Monday.

The deal combines the largest owner of U.S. newspapers by titles—GateHouse, with 400 papers and a total circulation of 4.29 million—and the largest newspaper group by circulation—Gannett, with a circulation of 4.32 million and 215 titles including USA Today, according to a University of North Carolina study.

The tie-up will test whether a new local-news colossus will be better equipped to deal with the rapid decline in print advertising and increased competition from tech giants as Alphabet Inc. ’s Google and Facebook Inc. for digital advertising dollars. Google and Facebook together are expected to take 51% of all U.S. digital ad spending in 2019, according to research firm eMarketer.

More than 2,100 newspapers have closed since 2004, according to the UNC study. The deal will give a towering role in the local-news industry to a private-equity-backed entity, underscoring the rise in the industry of financial investors who have been relentless about cutting costs.

Michael Reed, chief executive of Pittsford, N.Y.-based New Media Investment Group, will serve as CEO of the combined companies, while the company will retain the Gannett name and its McLean, Va., headquarters. Gannett on Monday also named former XO Group President Paul Bascobert as its new president and CEO, succeeding former CEO Robert Dickey, who retired in May.

GateHouse….is known for rigorous cost-cutting, including layoffs. New Media is operated by private-equity firm Fortress Investment Group LLC, which is owned by Japanese telecommunications-and-investing giant SoftBank Group Corp.

…The companies said they expect to eliminate roughly $275 million to $300 million of expenses annually—a big number considering the size of the deal. In a call with investors Monday, Mr. Reed said that approximately 25% of the combined company’s revenue will be digital….

Bernie Lunzer, president of the NewsGuild-CWA, said in an interview that the union had working relationships with both GateHouse and Gannett, but that he was “concerned about what the merger will mean for journalism,” citing the potential for job cuts. NewsGuild has about 21,000 members, including about 1,500 who work for Gannett and GateHouse, he said.

Leon Black’s Apollo Global Management LLC is helping fund the purchase through a $1.79 billion term loan, the companies said Monday.

The deal is expected to close by the end of 2019, pending regulatory approval and approval from both companies’ shareholders. Gannett shareholders will own roughly 49.5% of the combined company, with New Media shareholders owning the rest.

Gannett reported financial results concurrently with announcing the deal. It said net income surged 64% to $26.7 million in the second quarter from the year-earlier period, boosted in part by $32.8 million of gains on property sales. Revenue fell 9.6% to $660.3 million. New Media’s second-quarter net income fell 76% to $2.8 million from $11.7 million a year earlier. Revenue rose 4% to $404.4 million. The deal was announced on the stock market’s worst day of 2019 so far. Gannett’s shares closed 2.7% higher at $11.04, while New Media’s closed 7.6% lower at $9.89. — Matt Wirz contributed to this article.

Copyright ©2019 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8 Appeared in the August 6, 2019, print edition as 'Largest U.S. Newspaper Chains to Combine.'

WASHINGTON POST

(T)he efficiencies wrought by the merger may also result in publications that rely less on local reporters and more on USA Today-type stories produced or edited remotely and published in dozens of the company’s publications. Journalists across the country fretted over whether the deal would mean a wave of layoffs.

Andrew Pantazi, a reporter for the Florida Times-Union and president of the newspaper’s guild, said journalists in his newsroom were anxious about any cuts, particularly the elimination of editor roles. Pantazi said some newsrooms have lost editors because they were reorganized into hubs. “We’re afraid of that big number: $300 million,” Pantazi said. “We’re afraid of what happens when you have fewer journalists working in the state of Florida.”

In a memo Gannett sent to employees Monday that was acquired by The Washington Post, management noted employees’ concerns about possible layoffs. The memo said Gannett expects there will be “some duplication and overlap in roles” and that in coming months, executives will review “how the operations of our organizations will come together.”….

Rick Edmonds, a media business analyst at The Poynter Institute, said other media companies will be looking to cut costs and consolidate. Edmonds specifically noted talk of deals between McClatchy and Tribune Company.,,,

GateHouse’s parent, New Media Investment Group, will purchase Gannett for $12.06 in cash and stock per share. Media executive Paul Bascobert has been named chief executive of the combined company. Gannett’s board unanimously approved the deal, which is expected to close by the end of the year.

The combined company will also enjoy an expanded digital platform that executives are expected to pitch as an attraction to advertisers. GateHouse publishes 156 daily newspapers and 464 community newspapers, reaching more than 22 million people each week.

Gannett remains the country’s largest publisher by circulation, led by its flagship USA Today and publications including the Arizona Republic, Indianapolis Star and Louisville Courier-Journal.

“Bigger is better if you’re going after digital reach,” said Doug Arthur, an analyst at Huber Research. “So there will be a lengthy conversation around how this is going to be a digital powerhouse.”

Greater digital ambitions aren’t likely to spare more short-term newsroom cuts, which have already ravaged the local news industry in recent years. Whatever the ownership structure of newspapers, so many of them have closed in recent years that there are at least 1,800 fewer newspapers in America than there were 2004, according to a study by the University of North Carolina.

Employment in the newspaper industry fell about 47 percent between 2008 and 2018, a decline worse than coal mining over roughly the same period.

Most recently, the Youngstown Vindicator, a locally owned Ohio paper, closed for good shortly after its 150th anniversary. Its owners said they had lost money in 20 of the previous 22 years. A number of other once-daily papers have reduced their print schedules to four or even three days per week in an effort to save money….

The Gannett-Gatehouse merger could well put more pressure on other chains to consolidate, said Michael Kupinski, an analyst at Noble Financial. As of the start of 2018, daily newspapers in the U.S. numbered 1,277 with a circulation of 29.2 million, according to the latest data book from Editor & Publisher.

. Gannett and GateHouse both instituted layoffs earlier this year and have indicated in public filings that cost savings will be an ongoing focus. [A hedge fund’s ‘mercenary’ strategy: Buy newspapers, slash jobs, sell the buildings]

Most newspapers still derive the majority of their revenue from printed ads and print subscriptions, both of which have been in decline for years. Digital ads remain a minority of the revenue pie, primarily because the competition for advertising is dominated by tech giants such as Google and Facebook and because digital ads sell for mere fractions of the cost of the print kind.

Ever since Gannett spun off from Tegna, its broadcasting arm, four years ago, it has been looking to grow through mergers or acquisitions, with little to show for it.

In some cases, the companies could save money by printing their newspapers at one facility instead of two, and by combining and centralizing copy editing, design and daily print layout functions. Further savings might result from volume discounts on the company’s massive purchases of paper and ink.

But newspaper companies have been employing similar corporate machinations in search of a solution for local news for more than a decade, with no end to the industry’s problems — particularly in small-town and rural America — in sight.

“If you’re not The Washington Post, the New York Times, hopefully the L.A. Times and to a lesser extent the Dallas Morning News or the Chicago Tribune, this has become sort of a death spiral,” Arthur said.

Paul Farhi and Aaron Gregg contributed to this report.

New Media shares fall on details of $1.4 billion Gannett deal

By Keith J. Kelly August 6, 2019 | 10:13pm

The biggest publishing merger of the year is starting to look like a bust.

Shareholders of New Media Investment Group — the publicly traded subsidiary of newspaper owner Gatehouse Media — have sent the stock on a dizzying downward spiral since Monday. That’s when Gatehouse, the second-biggest newspaper chain in the country, unveiled its $1.4 billion cash-and-stock deal to devour USA Today owner Gannett Corp., the nation’s largest newspaper publisher.

At the time, the deal looked like it was going to give $12.06 a share for Gannett shareholders as it included a payout of $6.25 in cash and 0.5427 worth of New Media Investment Group stock for each share of Gannett stock. But on Tuesday, the New Media Investment Group stock plunged over 18% — after a 7% drop on Monday. The stock hit a new 52-week low of $8 a share Tuesday before settling at $8.06. “It’s a slaughter,” said one source close to Gannett. “How do you react if you’re a Gannett shareholder?” he asked.

One big surprise that has emerged since the deal was unveiled is that Apollo Global Management is providing 100% of the financing — or nearly $1.4 billion to cover the cash-and-stock portion of the acquisition as well as nearly $400 million to cover Gannett’s existing debt—for a total of $1.792 billion.

Making matters worse, the interest on the senio rsecured debt is a sky-high 11.5% — and the note only has a five-year term instead of the standard seven years. Apollo could end up with a virtual lien on the entire combined company if the new company’s revenue continues to drop and it has trouble meeting the covenants on its debt.

When Gannett and New Media Investment Groupannounced the deal Monday, they were predicting savings of $275 million to $300 million a year by joining forces. But as Ken Doctor, the Newsonomics columnist, told Media Ink, it will probably cost $100 million in severance and other one-time costs before any of the synergies can be realized.

Gannett’s stock was also off Tuesday by 7.6%, to close at $10.20. And shareholders seem to be bailing. There were 11,040,463 shares of New Media exchanged Tuesday — a 17-fold increase over its average volume of 626,459. Gannett was also trading heavily at 12,667,030 shares trading, above the average daily volume of just under 1.3 million shares.

Right now shareholders in both companies seem to be saying it does not look like a good deal for either company. Michael Reed, the chairman and CEO of New Media, has a big selling job ahead of him.

New York Times --Gannett, the Owner of USA Today, Is About to Get a Whole Lot Bigger By Marc Tracy Aug. 5, 2019

Once combined, GateHouse and Gannett will publish more than 260 daily newspapers in the United States, along with more than 300 weekly publications, in 47 states, as well as Guam. The new company will go by the name Gannett.

One result has been the increase in so-called ghost papers — thin versions of once robust publications put out by bare-bones staffs. Although print newspapers are in steep decline, Wall Street-backed companies like GateHouse Media and MediaNews Group, see them as still valuable, if distressed, assets.

In 2018, the print business still brought in $25 billion, according to a study by the University of North Carolina. New Media Investment Group, a publicly traded company with headquarters near Rochester, N.Y., has put money into journalism through GateHouse Media.

In recent years, GateHouse Media has shrunk newsrooms while pursuing shareholder value, in part by consolidating operations in regional hubs and merging newspapers. Gannett, which has been in the news business for nearly a century, laid off journalists across the country this year.

In a conference call Monday, Michael Reed, the New Media chief executive who will run the combined company, declined to specify how cost savings would result from the merger, citing “efficiencies” and “cost reallocation.” New Media is managed by the New York investment management firm Fortress Investment Group through an affiliate. Fortress is owned by SoftBank, a Japanese conglomerate.

John Jeffry Louis, the chairman of Gannett, said in a statement, “We see numerous opportunities to leverage the combined company’s enhanced scale and financial strength to continue to drive growth in the digital future.”

Penny Abernathy, a journalism professor at the University of North Carolina who has studied the decline of newspapers, said layoffs were all but guaranteed. Noting that both companies house business functions and even editors in regional centers away from the newsrooms, Ms. Abernathy added that the combinations of shrunken newsrooms and distant management could have a bad effect on local coverage.

“Often you have a publisher responsible for five or six newspapers,” she said. “There’s no way, when you’re removed from that community, that you understand what’s happening on the ground in the same way that you would understand it if you lived in that

Common Dreams Tuesday, August 06, 2019

'Another Nail in the Coffin' of Democracy and Journalism as US Newspaper Giants Gannett and GateHouse Announce $1.4 Billion Merger

"Hundreds of communities and ultimately our democracy will pay the price for this deal. Less journalism and less deep-dive investigative reporting will only lead to less informed citizens."

Members of the press and democracy advocates issued grave warnings about the future of journalism in the United States on Monday after the nation's two largest newspaper publishers unveiled plans for a $1.4 billion merger that, if approved, will spawn an "unprecedented" media conglomerate.

GateHouse Media announced Monday that it will purchase Gannett, which owns USA Today and other major American newspapers. While the media giants touted their commitment to "journalistic excellence" in a press release, the merger announcement came with plans for $300 million in annual budget cuts.

"Another nail in the coffin for the state of our news and information system. Combining the two largest newspaper chains would lead to cost-cutting strategies straight out of the Wall Street playbook."

—Michael Copps, Common Cause

"Not good news for journalism," tweeted New York Times reporter Eric Lipton in response to the planned cuts.

Michael Copps, former FCC commissioner and Common Cause special adviser, said in a statement that the cuts mean "we can expect to see more reporter layoffs and consolidated newsrooms."

According to Common Cause, a "combined GateHouse-Gannett entity would own one in every six newspapers in the nation and control over 100 local news operations."

"The profits generated from cutting costs won't be invested into improving the news but rather to pay off financing arrangements and shareholders," Copps added. "Hundreds of communities and ultimately our democracy will pay the price for this deal. Less journalism and less deep-dive investigative reporting will only lead to less informed citizens.,,,"

Local papers, faced with the complex and expensive process of building digital businesses to replace declines in print ads and circulation, have been consolidating madly in recent years. Although papers with national readerships like the New York Times and the Washington Post have had success adding digital subscribers, local papers with local readerships find it much more difficult. Hundreds of such papers have closed, and newsrooms have slashed jobs.

According to a study by the University of North Carolina, the U.S. has lost almost 1,800 local newspapers since 2004. Newsroom employment fell by a quarter from 2008 to 2018, according to Pew Research, and layoffs have continued this year.

"We're afraid of that big number: $300 million," Andrew Pantazi, a reporter for the Florida Times-Union and president of the newspaper's guild, told the Washington Post. "We're afraid of what happens when you have fewer journalists working in the state of Florida."