What is Oligopoly?

Oligopoly is a market structure where only a few large sellers of the same product dominate the market. Consequently, these dominant sellers control the total demand for products there. Hence, they are price-makers and are mutually interdependent. The most common example is OPEC.

Following are the characteristics of oligopoly:

- NON- PRICE COMPETITION

- BARRIERS TO ENTRY

- INTENSE COMPETITION

- CONTROL OVER SUPPLIES

- LACK OF UNIFORMITY

TYPES OF OLIGOPOLY

Based on the degree of collaboration between the sellers in the market, it is of two types:

- Collusive Oligopoly: To avoid cut-throat competition amongst themselves, the sellers cooperate with each other. They jointly take mutually beneficial decisions.

- Non-collusive Oligopoly: The sellers compete with each other and also behave independently.

OPEC

One of the finest examples of Oligopoly is OPEC (Organization of the Petroleum Exporting Countries). It is a permanent organization of oil-exporting countries that coordinate decisions regarding Petroleum Policies. OPEC has to ensure price stabilization. Additionally, it includes controlling the economy, efficiency, and supply. The interest of investors also has to be secured.

Member countries of OPEC

Currently, the organization consists of 13 countries:-

- Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, and Venezuela.

WHY ARE THE PRICES IN THE OIL MARKET ON A SUDDEN RISE?

IMPACT OF COVID-19 IN THE OIL-EXPORTING DEVELOPING COUNTRIES->

The International Energy Agency claimed that gas and oil revenues have dropped by 50-85%. Other than that, the major crisis is the collapse of the structural market.

Developing countries mainly rely on a single resource as a significant source of revenue. That makes them highly volatile in current situations. They spend the majority of their income on consumption and wasteful infrastructure rather than on priority projects. Consequently, they are touching the rock bottom of good Governance.

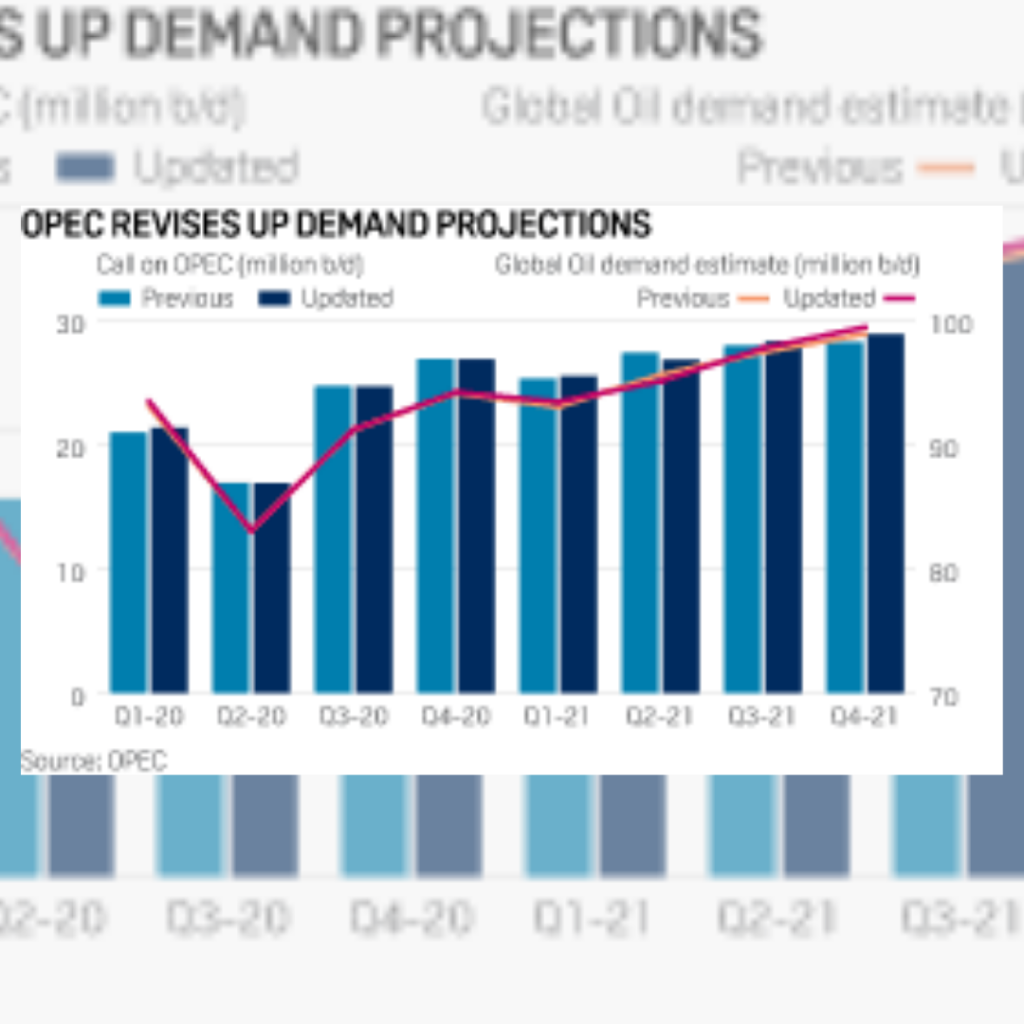

IMPACT OF DEMAND AND SUPPLY ON THE MARKET

- DEMAND- Due to Covid-19, the economic disruptions and restrictions around the globe have decelerated mobility. The latest statistics show a 35% decrease in demand. To balance the reduced demand, they have cut down the production.

- SUPPLY- Low production during COVID influenced the supply. However, it ought to increase by December.

THE TRAP OF DEBT

- With the start of COVID, several developing countries are suffering from high debt. Even when the price of oil is high, revenue generated is low. As a result, a vicious cycle of debt traps them.

- Many of these countries like Angola, Congo, and Equatorial Guinea have seen their debt increase up to five times.

- Some of them have agreed with the IMF (International Monetary Fund) on issues like self-financing the country.

- The effect of collateral loans or resource-backed loans is Payment-in-kind (PIK). Countries like Angola and Chad have opted for it.

STEPS TAKEN TO ENSURE STABILITY IN OPEC

- Building Back Better (BBB)- This approach helps in having a development that is economical and sustainable.

- Capacity building- Analytical support helps in acquiring more skills and knowledge.

- Finance diversification- Expectations are that established oil-producing countries will bridge the financial gap by mobilizing additional financing through ODA (Official Development Assistance).

- Natural Resource Revenue Management- It aims to promote fiscal transparency and debt stability in oil production. Additionally, promoting motives such as anti-corruption.

Check out other interesting articles here.