The Vtrender commercialism space focuses on neat and Bank neat futures. We've got charts Of Market Profile and Order Flow, Live analysis, Live statement and live trades.

We apply the ideas of Market Profile and so therefore the Order Flow to the neat and therefore the Bank neat.

We use Real Market Profile trading strategies mostly commercialism ways in live moving markets.

This program is completely different from the other programs as a result of you may come in and see for yourself the Force that controls everything within the markets. We have a tendency to lay it vacant and open for you to check, to check and to trade it live. You may gain confidence to not simply understand however conjointly trade the market higher.

We square measure endowed in your learning, in building an environment for you to grow. As a result, we have a tendency to understand that if you wish to grow apples, you can't make out in Rajasthan, however you need to realize fertile ground in Cashmere.

Let’s say you're a small amount additional mature within the commercialism sphere, however the overwhelming majority can still go and shut the position at intervals the primary 5 minutes right.

An open that has exceeded the previous day’s high or the lows brings a part of uncertainty to the equation. The overwhelming majority of traders simply goes and shut that losing position at the primary chance.

But at Vtrender we have a tendency to square measure massive believers in Auction Market Theory and advocate the Market Profile approach to commercialism.

And we can say if you ever realize yourself in a very market that has opened outside the previous day’s vary, then wait.

It’s necessary to grasp in Auction Market Theory that short-run sellers could also be marketing to semi permanent consumers or short-run consumers to semi permanent sellers. there's a customer and a merchandiser at each flip of the market and prices move hoping that the dealer shows additional intent or a disposition to hit the bids or the offers.

Often it happens that once an enormous move, the dominant party (consumers or sellers) square measure unable to push costs in their direction to any extent further and exhaustion creeps in paving the manner for the alternative party to maximize and move the auction their manner.

This is often an especially sensible commercialism strategy for a one to five day holding amount and contra trend positions ab initio and with the trend position later square measure each doable if you perceive this commercialism strategy clearly.

It is referred to as an unsuccessful Auction theory. And it's highly regarded amongst Market Profile Traders World Health Organization trade in the short term.

The Initial Balance or IB because the name would counsel is that the initial hour of the session wherever we have a tendency to see two each consumers and Sellers fairly active in a very equal live or in a balance.

As markets do not forever keep at intervals the first hour of activity the complete day, the movements outside the initial balance typically manufacture some wonderful commercialism opportunities for all traders.

This variation of the move removed from the Initial Balance and into the Initial Balance is named the unsuccessful Auction.

This explicit variant of the unsuccessful Auction was popularized by a Market Profiler named Ray Barros.

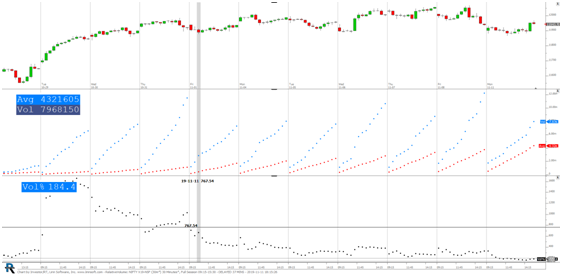

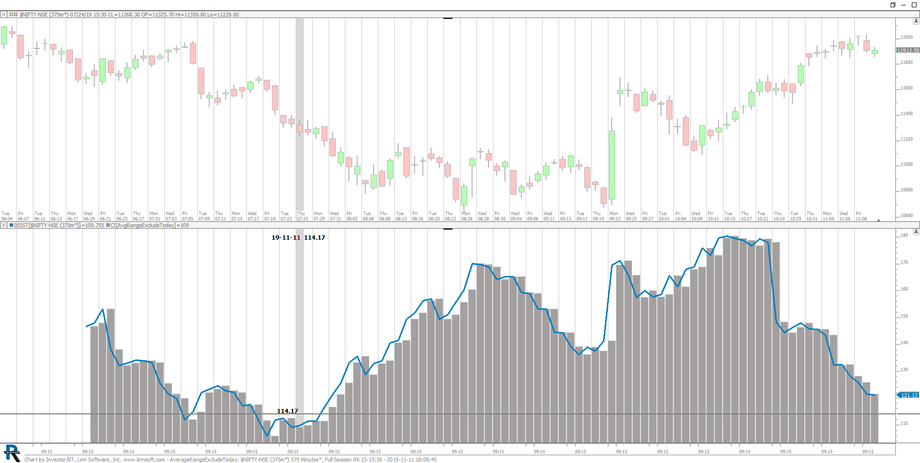

Here square measures some stats on the Nifty Future strategies and daily movement of everyone’s favorite commercialism instrument- The neat.

If you're an associate degree intraday dealer or carry positions at STBT or BTST then you would like to appear at these charts once more.

The charts square measure smoothened victimization associate degree SMA to three to even out the info.

The charts square measure from Gregorian calendar month 2018 to Nov 2019 and enclose in a very fifteen month commercialism vary