7 key differences between LLP and Partnership Firm

Before starting a partnership business, the first thought that a business person has is what type of partnership business they want to register. The most common type of partnership business structure is LLP (Limited Liability Partnership) and Partnership Firm. To clear up confusion regarding this two terms, we have included basic information about LLP and Partnership Firm, as well as the difference between LLP and Partnership Firm.

Introduction

Partnerships registered under the Partnership Act, 1932 were once a very popular type of Business Entity in India due to their ease of registration and upkeep. The introduction of the LLP company registration in India through the Limited Liability Partnership Act, 2008, has replaced the prominence of partnerships. LLPs are simple to set up, provide a variety of benefits to promoters, and are simple to run, making them ideal for many small and medium-sized businesses.

What is Partnership Firm?

A Partnership Firm is a popular business structure in India and is one of the oldest. A partnership firm is simple to establish because it must follow a minimal set of rules and regulations.

A partnership is defined as an agreement between two or more people who pool their capital and resources to contribute to the business and agree to split the profits. When all of the partners/individuals enter into a partnership agreement/deed and conduct business under the partnership firm name, the partnership firm is formed.

A partnership firm is not required to be registered. Even if the partnership firm is not formally registered, the law recognises it, and all of the firm partners are liable for any loss caused to third parties by the firm.

What is LLP (Limited Liability Partnership)?

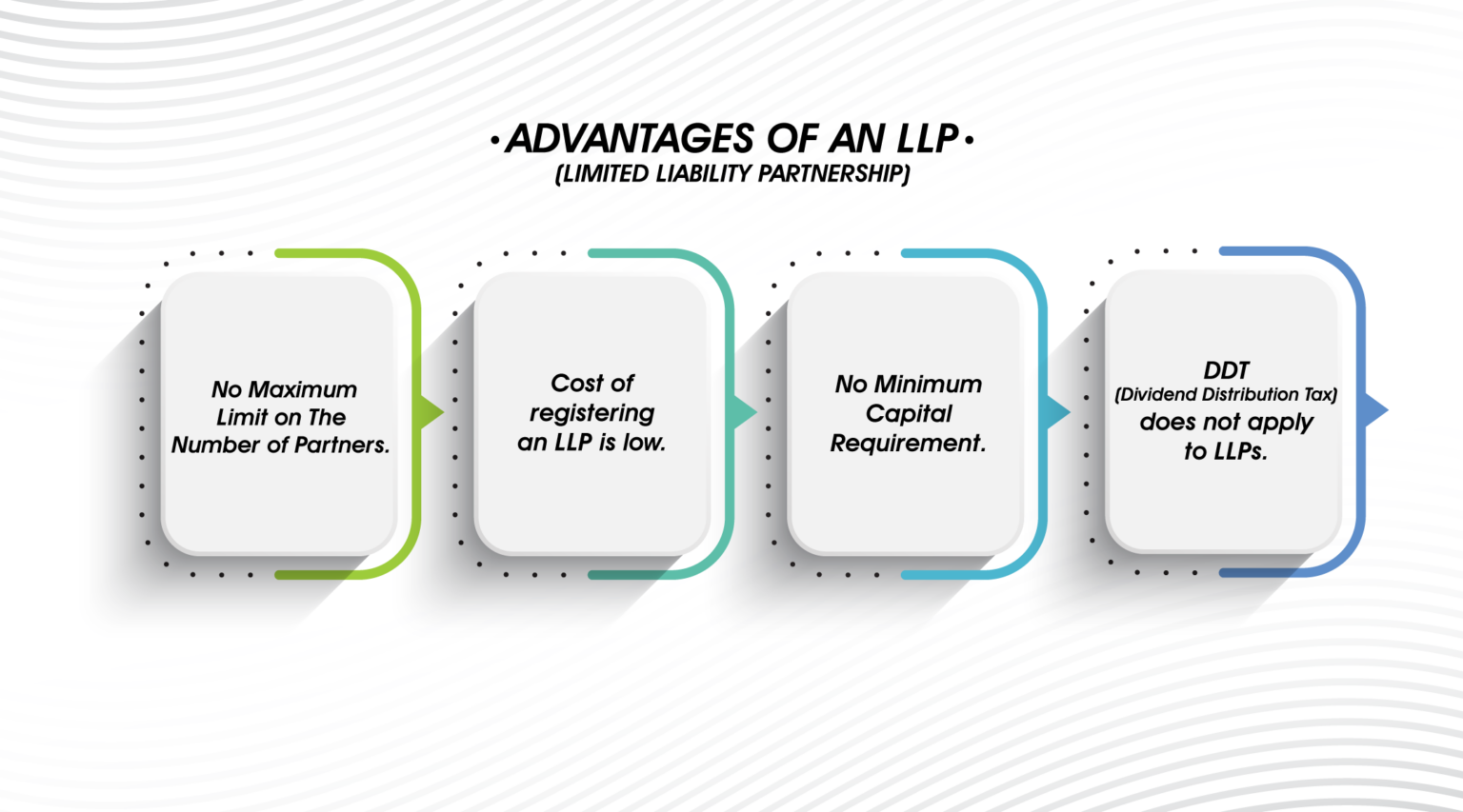

An LLP is a business structure that combines the advantages of a partnership and a company. It is a cross between a company and a partnership because it combines elements of both structures.

In the eyes of the law, an LLP (Limited Liability Partnership) is a separate legal entity, and it is liable for the full extent of its assets. The liability of a partner is limited to their contribution to the LLP. An LLP’s partners are only responsible for their own actions.

The LLP allows professionals, entrepreneurs, and businesses engaged in scientific and technological disciplines or providing any type of service to form commercially efficient vehicles tailored to their needs. Because of its structural and operational flexibility, forming an LLP is appropriate for small and medium-sized businesses, as is obtaining investment from venture capitalists.

Difference between LLP and Partnership Firm

The following are the 7 key differences between the LLP and the Partnership Firm:

|

|

Partnership Firm |

Limited Liability Partnership |

|

Governed By |

Partnership Firm governed by Indian Partnership Act, 1932. |

An LLP is governed by Limited Liability Partnership Act, 2008. |

|

Partners Liability |

A partnership firm’s liability for its partners is unlimited. |

An LLP partner’s liability is limited to the amount of capital contributed to the LLP. |

|

Document |

Partnership Deed is the prime document in a Partnership Firm. |

LLP Agreement is the prime document in an LLP. |

|

Separate legal entity |

A partnership firm cannot be a separate legal entity under the law. |

An LLP can be a separate legal entity under the law. |

|

Ownership of an assets |

All of the partnership firm’s assets are owned jointly by the partners. The assets cannot be owned by the company. |

The LLP owns assets that are not owned by any of the partners. The assets of the LLP are not owned by any of the partners. |

|

Audit of accounts |

According to the provisions of the Income Tax Act, all partnership firms must have their accounts audited. |

According to the LLP Act, all LLPs (except those with a turnover of less than Rs.40 lakh or a contribution of less than Rs.25 lakh) must have their accounts audited annually. |

|

Perpetual Succession |

A partnership firm does not have perpetual succession, and its survival is contingent on the will of its partners. |

An LLP has perpetual succession, which means that its existence is unaffected by the addition or departure of partners. |

Bottom Line

An LLP and a partnership firm are similar types of entities, but they differ in how they operate, how their accounts are kept, how they are dissolved, and so on. Different Acts and Rules govern them. Knowing the differences between them will help an entrepreneur choose the best type of partnership structure for his or her business.