Rate action trading is a method for monetary market speculation which includes the evaluation of fundamental price activity throughout time. It's used by numerous retail investors and frequently by institutional traders and also hedge fund managers to make predictions on the future direction of the price of a security or financial market.padef3

Simply put, rate action is how cost modifications, i.e., the 'action' of cost. It's most easily observed in markets with high liquidity and volatility, however actually anything that is gotten or marketed in a free enterprise will generate rate action.

Cost action trading disregards the basic factors that influence a market's movement, and also instead it looks primarily at the marketplace's price history, that is to claim its cost movement throughout a time period. Hence, cost activity is a kind a technical analysis, however what separates it from most types of technological evaluation is that its major emphasis is on the connection of a market's current rate to its past or recent prices, as opposed to 'used' values that are stemmed from that price history.

To put it simply, price activity trading is a 'pure' type of technical analysis considering that it consists of no used, price-derived signs. Cost activity investors are entirely interested in the first-hand information a market generates concerning itself; it's cost activity in time.

Price action evaluation permits a trader to make sense of a market's cost activity as well as supplies him or her with descriptions that serve as means for the trader to build a psychological scenario to explain the current market framework. Experienced price activity traders typically associate their one-of-a-kind psychological understanding and also 'gut feel' of a market as the major factor for their rewarding trading.

Price activity investors use the past history of a market's price activity, a lot of usually concentrate on the recent price action of the last 3 to 6 months, with a lighter focus on farther rate history. This cost background consists of swing highs as well as turn lows in a market, in addition to support as well as resistance degrees.

An investor can utilize a market's price activity to attempt and also define the human thought process behind a market's activity. Every participant in a market will certainly leave price action 'clues' on a market's price chart as they trade their markets, these clues can then be analyzed as well as made use of to attempt as well as forecast the next relocate a market.

Cost Activity Trading-- Keeping it Simple

Rate activity investors often utilize the phrase "Keep It Simple Stupid" in reference to the truth that trading is something many individuals over-complicate by clouding their graphes with numerous technical indications and usually over-analyzing a market.

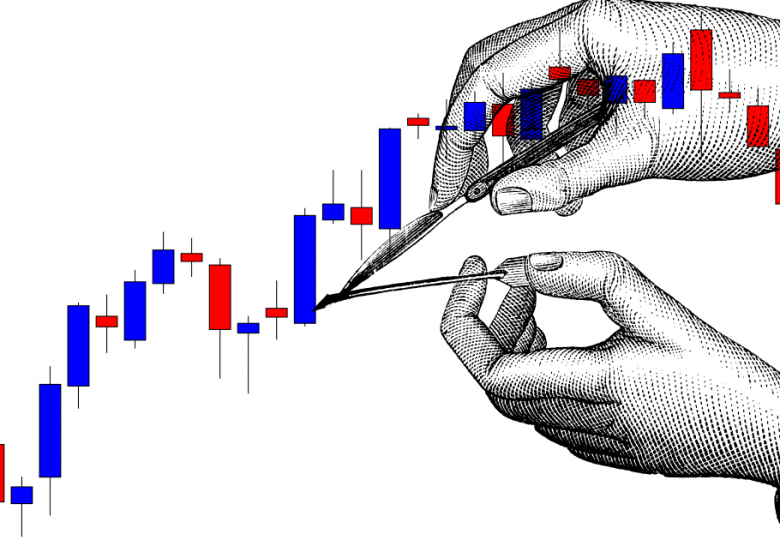

Cost action trading is likewise often referred to as 'clean chart trading', 'naked trading', 'raw or all-natural trading', in reference to trading from a simple rate activity only rate chart.

The basic stripped-down approach of rate action trading, suggests there are no indicators on a trader's graphes as well as no economic events or news is utilized in making one's trading decisions. The single focus is on a market's price activity, and also the idea among cost action investors is that this cost activity reflects all the variables (information events, eco. data etc.) that affect a market as well as create it to move. As a result, the effects is that it's much easier to just evaluate a market and also profession from its rate action, instead of attempting to decode as well as sort the many various variables affecting a market daily.

Cost Action Trading Methods (Patterns).

Cost activity patterns, additionally called cost action 'causes', 'setups' or 'signals', are truly the most crucial element of cost action trading, because it's these patterns that offer an investor with strong clues as to what cost may do next.

Inside bar pattern.

A within bar pattern is a two-bar pattern, containing the within bar and also the previous bar which is generally described as the "mommy bar". The within bar is consisted of totally within the high to low series of the mom bar. This price activity approach is commonly utilized as a breakout pattern in trending markets, yet it can also be traded as a turnaround signal if it forms at an essential graph degree.

Pin bar pattern.

A pin bar pattern includes a single candle holder and also it shows denial of rate as well as a turnaround on the market. The pin bar signal works terrific in a trending market, variety bound market as well as can additionally be traded counter-trend from a vital support or resistance level. The pin bar indicates that rate might relocate contrary from the instructions the tail is directing; as it's the tail of the pin bar that reveals rejection of cost as well as a reversal.

Fakey pattern.

The fakey pattern consists of a false outbreak of an inside bar pattern. To put it simply, if an inside bar pattern breaks out quickly however after that turns around as well as closes back within the series of the mom bar or inside bar, you have a fakey. It's called a "fakey" because it fakes you out, the marketplace appears like its damaging one means but then comes back in the contrary direction and triggers a price movement in that direction. Fakey's are fantastic with patterns, versus trends from vital levels and also in trading varieties.

Verdict.

I wish you've appreciated this price activity trading tutorial. You currently have a strong standard understanding of what price activity is and exactly how to trade it.

Moving forward, you ought to aim to expand your rate action trading understanding and knowledge as there is far more to it than is covered right here.

For a full education and comprehensive insight right into basic yet powerful cost action approaches, along with understanding into the globe of specialist trading from a seasoned trading veteran, check out my price action trading course for more details.