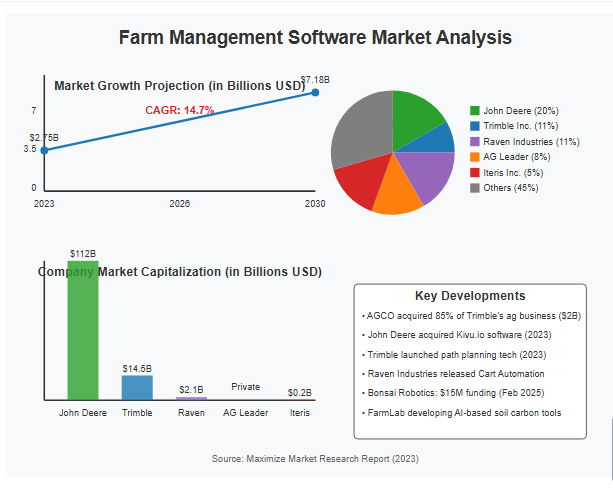

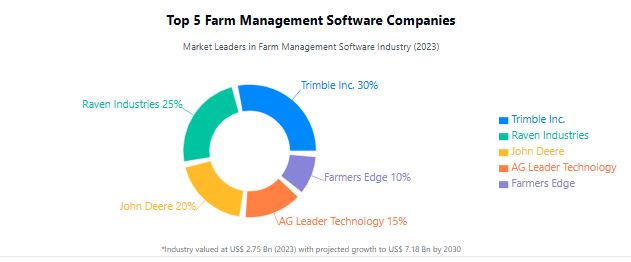

The value of the Leading Companies in the Farm Management Software Companies Sector was US$ 2.75 billion in 2023, and the revenue is expected to grow at a CAGR of 14.7%, reaching nearly US$ 7.18 billion by 2030. The growing demand for these solutions is attributed to the rising use of precision agriculture practices that enable farmers to improve their productivity and operational efficiency.

These claims are supported by the fact that the issuance on farm management software is booming, in part due to new technologies and the growing need for more effective agricultural solutions. This press release covers the five largest companies in the market, mergers and acquisitions, new developments, and new funding initiatives.

Top 5 most market-share in the companies

Solinftec — A Brazilian trailblazer in offering farm-related software and hardware. We also track innovative tools that optimize everything from farming operations to productivity and sustainability.

Raven Industries: Based out of the United States, Raven Industries focuses on precision agriculture solutions, including autonomous farming technologies and guidance systems.

Ag Leader Technology — Based in the U.S. and the company that created a one-stop shop for planting, harvesting, water and much of the farm management tools needed to tie them together.

Cropin: Cropin is another Indian company focused on digitizing farm operations through AI-powered insights that allow farmers to observe what is happening with crop productivity and improve their efficiency.

Tell us about Agrivi Agrivi, based in the United Kingdom, delivers data-driven farm management solutions, enabling farmers to meet sustainability objectives, while improving productivity.

Here's a table summarizing the top five companies in the farm management software industry, along with their estimated market shares, recent mergers and acquisitions, new funding and investments, and net worth:

| Company | Estimated Market Share | Recent Mergers and Acquisitions | New Funding and Investments | Net Worth (Market Capitalization) |

|---|---|---|---|---|

| Trimble Inc. | Approximately 11% | In 2024, AGCO Corporation acquired an 85% stake in Trimble's agriculture business for $2 billion, leading to the formation of a joint venture focused on developing autonomous and retrofitted farm equipment. | Notable investments include the development of path planning technology to enhance automation in agricultural equipment. | $14.5 billion |

| Deere & Company (John Deere) | Approximately 20% | In October 2023, John Deere acquired precision agriculture software company Kivu.io to strengthen its farm management platform. | Collaborated with Microsoft in September 2023 to develop AI-powered farm management solutions, leveraging Microsoft's Azure cloud platform and AI tools. | $112 billion |

| AG Leader Technology | Approximately 8% | No significant recent mergers or acquisitions reported. | Focused on internal development and innovation in precision farming technologies. | Privately held |

| Raven Industries | Approximately 11% | No significant recent mergers or acquisitions reported. | Launched pre-orders for its Raven Cart Automation in August 2023 to enhance efficiency in harvesting operations. | $2.1 billion |

| Iteris Inc. | Approximately 5% | No significant recent mergers or acquisitions reported. | Focused on developing smart farming solutions combining weather data, soil analysis, and crop modeling to aid farmers in data-driven decisions. | $0.2 billion |

Request for free sample Report: https://www.maximizemarketresearch.com/request-sample/265409/

Mergers & Acquisitions Most Recent

Mergers & Acquisitions Most Recent

There has been significant consolidation and collaboration in the industry:

Seedz Acquires Perfarm: Seedz, a data platform for farm management to help farmers with the decision making process and save costs in the processes, was acquired by Seedz in 2022.

AGCO Acquires FarmFacts — In 2023, AGCO acquired FarmFacts to build on its precision agriculture offerings with a leading farm management information system.

Latest Market Drivers

The farm management software industry is experiencing rapid breakthroughs:

AI and IoT Combined: MapMyCrop uses AI and IoT technology to allow real-time insights into agricultural sustainability practices and suggest associated changes.

Growth in Emerging Markets: Companies are focusing on areas such as Southeast Asia and Africa to solve local agricultural problems with customized solutions.

Product Launches: The new tools range from farm credit score systems based on AI to other systems for making decisions and improving efficiency.

New Funding and Investments

The industry is still drawing major investments:

2025 – MapMyCrop Secures $1.8 Million Seed Funding by YourNest Venture Capital The proceeds will be to scale operations, accelerate product development, and solidify market presence.

Conclusion

Innovation and collaboration are leading the charge at the forefront of farm management software in agriculture. As prominent players push innovations, strategic mergers and acquisitions take place, and funding remains strong, the industry is prepared for continued growth that responds to global agricultural challenges and builds toward a sustainable future.