Check routing numbers are essential in the banking industry for guaranteeing the precise and efficient processing of financial transactions. When routing numbers are incorrect, it can cause major issues like delayed transactions, failed payments, or money being routed to the wrong bank. If payments are made late, there might also be financial penalties or additional costs. Knowing routing numbers is crucial whether you're moving money, making payments, or setting direct deposits. Let's explore check routing numbers, their significance, and efficient management techniques with this blog.

What is a Check Routing Number:

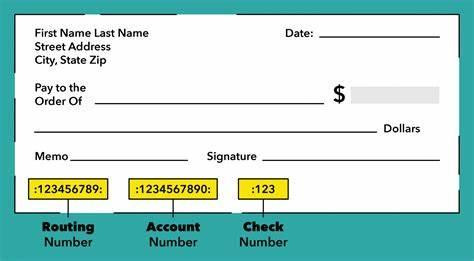

The purpose of a check routing number is to precisely guide funds to the correct bank and account by providing a unique nine-digit code that uniquely identifies the financial institution engaged in a transaction. This number is found in the lower left corner of checks. It is essential for handling various financial activities such as automated payments, wire transfers, and direct deposits. The routing number is associated with the Federal Reserve system to facilitate the safe and efficient transmission of funds between banks and accounts.

Print Checks with Check Printing Software and Prevent Routing Number Errors:

Routing number mistakes resulting from ordering pre-printed checks can occasionally be caused by ineffective or inaccurate information supplied by the printer, or by differences between the formats of the checks and bank data. These mistakes can have big effects on financial deals, like payments being late or funds being sent to the wrong place. To solve this, you can print checks utilizing the most current and correct routing information straight from your bank's records if you use check printing software like OnlineCheckWriter.com - Powered by Zil Money. You may reduce errors and improve financial transactions by customizing and printing checks in-house to guarantee they have the correct routing number and other important information.

Ensures Accurate Wire Transfers and ACH Transactions:

Routing numbers are needed for wire transfers and ACH transactions because they make sure the money goes to the right bank account and organization. You must supply the recipient's account number as well as their routing number for wire transfer. Similar to this, the routing number aids in directing ACH transactions through the ACH network to the beneficiary's bank. Before beginning these transactions, it is essential to confirm the routing number with the beneficiary or your bank in order to prevent mistakes and guarantee the efficient processing of money. Routing numbers should be used correctly to preserve the security and accuracy of electronic financial transactions.

To sum up, check routing numbers are an essential part of the banking system that guarantees accurate and effective processing of financial transactions. It is impossible to emphasize how important it is that they transfer funds to the right accounts and institutions because mistakes can result in delays, fines, and even fraud. By managing and double-checking routing numbers with check printing software, you may cut down on errors and simplify your financial procedures. Knowing how routing numbers enable wire transfers and ACH transactions aids secure and precise electronic payments. In a world where financial precision is essential, handling money properly and being aware of routing numbers are essential to dependable banking operations.