There are centralized platforms and decentralized platforms. Traders and investors use both types. Examples of such an interchange are Binance (the most popular platform that can be quite difficult for novice traders) and WhiteBIT (a young exchange with a good reputation and easy-to-operate interface). Let us know more about the types of cryptocurrency exchange platforms and which are the top crypto exchanges in 2022.

Centralized Exchanges (CEX)

CEX, or centralized exchanges, is a set of traditional exchanges, brokerages, and investment banking functions that gather a huge number of users and trading volume. It also brought enough trading depth, providing sufficient asset liquidity. Some of the examples are,

- Binance

- KuCoin

- CoinBase

- bitFlyer

- Huobi Global

Decentralized Exchanges (DEX)

Decentralized exchanges, or DEXs, are blockchain-based exchanges that do not store user funds or personal information. Instead, it only works as an infrastructure to match buyers and sellers who want to buy and sell digital assets. With the help of the matching engine, such transactions occur directly between the participants (peer-to-peer). Some of the examples are,

- Defi Swap

- Uniswap

- Pancakeswap

- Curve

- 1inch

Peer-To-Peer Exchanges (P2P)

Peer-to-peer sharing is a concept where long-distance or global networks can cooperatively share data routing methods, facilitating more efficient routing for each party. This arrangement allows for more productive and longer-range networks, where networks would have to search for additional routes for data packets without a peer exchange.

A peer-to-peer or P2P network is a computer network in which a series of nodes (each machine, computer=node) behave as equals to each other. That is, they act simultaneously as clients and servers for the other nodes of the network. Computers connected by P2P networks can exchange information directly in any format.

Peer-To-Peer exchanges can refer to an agreement between networks or a centralized partner that enables network sharing, collaboration, or common points for data routing. Core peer exchanges operate in certain locations to allow the extension of data transfer networks across those locations. Networks that need to route data through a particular region often advertise the benefits of Internet Protocol (IP) protocol peer exchanges, including support for effective speeds and connectivity.

Instant Exchangers

The financial market is gradually entering the digital ecosystem, and the community is more concerned with the market trends and exchange rates of cryptocurrencies rather than fiat currencies.

Since 2016, when cryptocurrencies became more or less mainstream, many cryptocurrency exchanges have sprung up every month. - c hybrid exchanges, centralized and decentralized. But the ones gaining momentum now are instant non-custodial crypto-to-crypto exchanges.

There are dozens of instant crypto exchangers on the internet, but it could be a challenge for the community as each has its own advantages and disadvantages.

Well, there seems to be a solution. It is called a 'cryptocurrency exchange aggregator. It takes you through the dark crypto jungle and helps you find the best exchange rates, the safest exchange provider and the exchanges with the lowest fees - all in the same interface.

Decentralized Exchanges Vs Centralized Exchanges

Most exchanges are Centralized, and each controls deposit accounts, order books, and order matching. Only the traded assets themselves are decentralized to the central exchanges. Due to KYC (know your customer) and AML (anti-money laundering) regulations, centralized exchanges are required to store their user's personal information.

Decentralized exchanges do not use a central server, and the nodes of the networks are distributed. Technically, this means that users maintain these exchanges. Decentralized exchanges can be currency-centric or currency-neutral. Currency-centric exchanges are associated with specific blockchains. For example, if they are built on Ethereum, they are only compatible with ERC-20 tokens. Currency-neutral exchanges offer users more freedom as they are not associated with a single blockchain. Such exchanges are truly P2P as order books, matching, and deposits take place on the blockchain.

DEXs are essentially smart contracts. Traders must provide a certain amount of coins or liquidity to fulfil an order associated with a smart contract. Funds will not be released until all parties fully meet their commitments. Some traders use a different method: a trader proposes a trade, the transaction is signed, and the order book is added to the blockchain if both sides reach an agreement. Then the coins are exchanged between the wallets of buyers and sellers. Trading requires no fees. It makes DEXs cheaper to use.

Centralized exchanges are user-friendly and similar to traditional banks, while DEXs are less common and less convenient for most people. Currency-focused exchanges have a small selection of trading instruments. Additionally, DEXs do not support fiat money, making decentralized exchanges unattractive for traders and first-time buyers. These factors result in low exposure to decentralized exchanges, resulting in lower trading volume on those exchanges.

Centralized exchanges are user-friendly and similar to traditional banks, while DEXs are less common and less convenient for most people. Currency-focused exchanges have a small selection of trading instruments. Additionally, DEXs do not support fiat money, making decentralized exchanges unattractive for traders and first-time buyers. These factors result in low exposure to decentralized exchanges, resulting in lower trading volume on those exchanges.

Centralized exchanges have a simple structure. It makes them more vulnerable to hacking attacks. Massive amounts of money have been stolen from major exchanges such as Binance. DEXs are more sophisticated, making it harder for hackers. Additionally, there is less money supply for the DEXs. The P2P network and secure blockchain technology are other factors that make decentralized exchanges a less attractive piece of cake for thieves.

Cost to Launch Own Crypto Exchange Platform

When it comes to the crypto exchange platform, the two main options are: you use software that you have personally developed, or you can purchase a white label platform.

Developing your own crypto exchange platform requires finding a dedicated development team to take charge of the research and development from scratch. There are many factors to consider, but most importantly, you need to estimate the costs and time associated with the platform's internal development, maintenance, and continuous upgrading. Due to the complexity of developing an exchange platform, the cost of developing exchange software from scratch can be expensive.

You may need at least USD 1,000,000 to launch your own crypto exchange platform. This range may vary based on your needs and the agency you hire.

You can go for a white label exchange platform if you don't want the hassle of dealing with technical requirements, implementation, ongoing maintenance, and licenses.

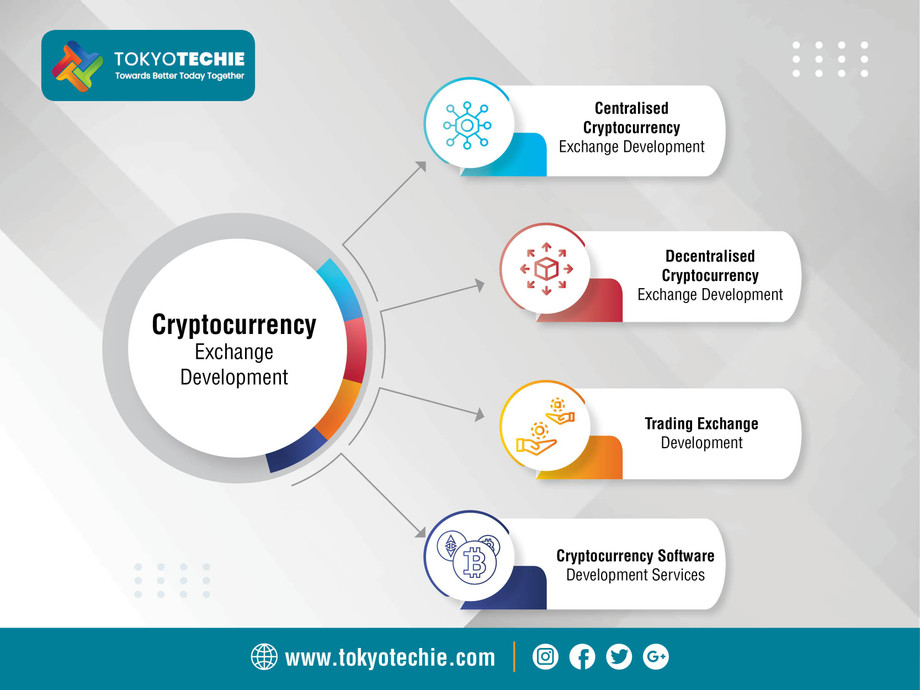

How can TokyoTechie Help you?

TokyoTechie is the best global blockchain development company that delivers a secure exchange platform based in India.

We offer a range of blockchain services that allow you to settle payments quickly and in real-time for trade finance, remittances, payment processing, and much more with the TokyoTechie Blockchain exchange platform development service.

With our best possible services, our expert team specializes in software solutions, multi-currency support, machine learning, AI, Big Data, biometric authentication, and Internet of Things solutions to deliver the best crypto exchange platform.

FAQ

What is the best crypto exchange platform?

BINANCE: Trading volume is the largest on Binance, the best cryptocurrency exchange.

Pros:

- More than 150 cryptocurrencies.

- Reputable.

- Low cost.

- Easy to use website interface.

- High level of security.

Fees: 0.1% (manufacturer and receiver). You can choose to earn interest on your coins by betting on a time and earning an interest rate of 0.5-10%.

You can buy cryptocurrencies using bank deposits, bank transfers, and credit/debit cards, so there are plenty of payment options. However, a 4.5% charge is for purchases made with a debit card.

There is a security fund as insurance on Binance, and the platform has a 2-factor authentication system to protect your funds.

Which is the Best Crypto Exchanges of 2022

As the best cryptocurrency exchange in 2022, eToro is available in almost every country. Their top-notch platform boasts over 40 markets, all of which are paired in euros and dollars and in more than a hundred and a half coins. Through eToro, you will only have to pay a spread that opens at 1% when you make operations with cryptocurrencies. You will have at your disposal Bitcoin, Ethereum, Solana, Shiba Inu, Polkadot, XRP, Litecoin and more with the lowest fees and the tightest margins.

In addition, you must consider that when you deposit your funds (the minimum is US$ 50), the platform does not apply any commission or fee. And not only that, it offers a good variety of options to carry out this procedure, starting with PayPal and reaching electronic transfers from national and international banks, debit and credit cards, Neteller, ACH, and more.

Another feature worth mentioning about eToro is that, although the minimum requirement to deposit is US$50, already much cheaper than others that compete, its minimum trade is US$10.

Now, one cannot be left out of its benefits for anything in the world is its cryptographic credit cards, offered from 2022.

What do we like about eToro?

- 56 cryptocurrencies to trade

- unlimited demos

- $50 minimum deposit

- Minimum trade of US$ 10

- Regulated by several top-tier international entities

- It has a wide range of options to deposit

- Very easy to use app and platform

- eToro charges a transparent fee of 1% when buying or selling cryptocurrencies.