The apparently simple act of printing checks may rapidly become an expensive and inefficient ordeal in a fast-paced corporate environment. Many organizations use checks as a payment mechanism, traditional check printing methods are fraught with challenges that can disrupt operations and drain resources. From high costs and restricted flexibility to operational inefficiencies, the challenges associated with check printing are numerous and frustrating. Imagine making your business's check printing procedure easier and cheaper. It's time to unearth the hidden flaws of traditional check printing and explore creative options that can improve your financial productivity if your present approach is expensive, limited flexibility, and error-prone.

Complexity and Time-Consuming Processes

Take “Greenfield Grocers,” a small retailer that physically drafts and prints checks for various suppliers every month. Jane, the proprietor, spends hours a week ordering, storing, and safeguarding pre-printed checks. Manually writing checks causes errors and payment delays. Inefficiencies affect supplier relationships, who need prompt payments to ensure cash flow. Jane spends her time managing administrative responsibilities instead of expanding her business.

High Costs and Security Risks

Consider “BuildRight Constructions,” a medium-sized construction company that employs pre-printed checks for financial transactions. The company pays a lot to buy these checks in bulk and store them securely. Despite these measures, the company experiences a security breach where some pre-printed checks are stolen, leading to instances of check fraud. The financial loss and damage to BuildRight's reputation create significant distress, and the organization must invest in extra security measures, raising operational costs.

Lack of Customization and Flexibility

Consider “TechTrend Innovations,” a fast-growing tech business that needs to modernize its branding and finances. The company uses pre-printed checks with limited customization. When TechTrend rebrands and has to update the logo and contact information on its checks, they face delays and additional costs due to the inflexible nature of traditional check printing methods. This lack of customization and flexibility affect TechTrend's ability to provide a professional image to clients and partners, affecting its brand consistency and reputation.

4 Game-Changing Solutions to Transform Your Check Printing Process

On-Demand Check Printing: Use instant check printing to avoid expensive pre-printed checks. This strategy reduces waste and bulk order costs by printing checks as needed.

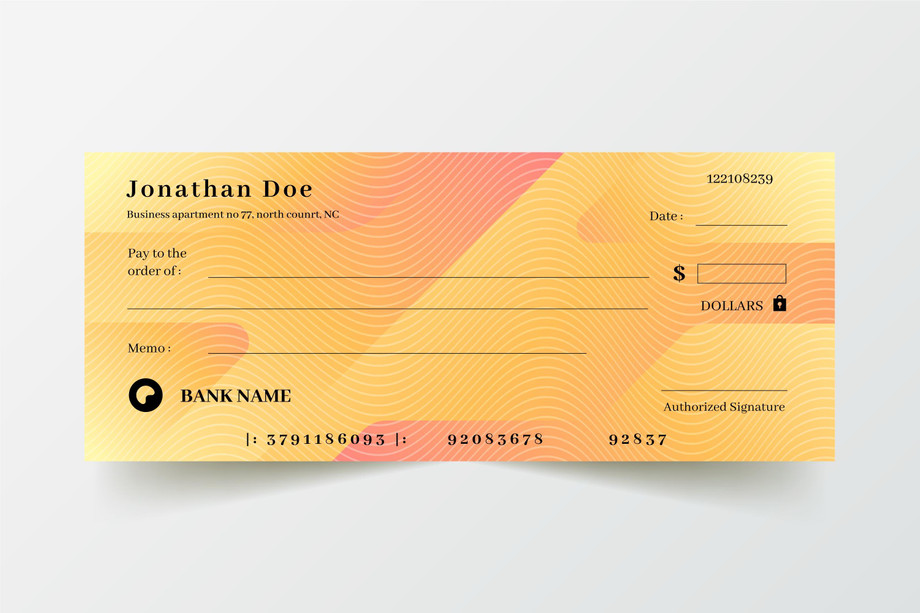

Enhanced Customization: Utilize modern check printing solutions like Zil Money that offer extensive customization options. Customize your checks with logos, unique layouts, and advanced security features to reflect your brand and safeguard against fraud.

Automated Processes: Implement automated check printing systems to minimize manual errors and simplify payment processes. Automated solutions help ensure accurate amounts and payee details, reducing the risk of financial discrepancies and delays.

Digital Integration: Opt for check creator online software that integrate smoothly with your accounting and financial management software. This integration simplifies financial workflows, enhances record-keeping, and facilitates easy reconciliation of payments.

These innovative solutions help transform check printing from a frustrating task to an efficient process. On-demand printing, customization, workflow automation, and financial system integration minimize costs, errors, and improve financial management. These enhancements can boost operational efficiency and help you compete in today's business environment.