The growing companion animal population, a growing number of veterinary practitioners in developed countries, technological advancements, and the rising demand for pet insurance and increasing pet care expenditure. Moreover, untapped emerging markets in developing countries are creating lucrative opportunities for the market players.

According to data from the AVMA Census of Veterinarians and Veterinary Practice Owners, veterinarians saw fewer patients per hour, and average productivity declined by almost 25% in 2020, compared with 2019. During the pandemic’s earliest months, veterinary practices operated as essential businesses, seeing only urgent cases.

Based on end user, the veterinary clinics segment is expected to register the highest CAGR during the forecast period. Factors responsible for the growth of this segment are wide adoption of ultrasound in veterinary clinics and the growing number of veterinary clinics across the globe.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=10482074

This can be attributed to the increase in the number of ultrasound procedures resulting from the clearing of the backlog, as well as new cases, and fully reopened healthcare services. Thus, the veterinary ultrasound market experienced short-term negative growth in this period. However, there will be minimum or no change in the long-term fundamental drivers affecting the demand for veterinary Ultrasound devices.

The cost of traditional cart-based ultrasound systems is higher than that of portable ultrasound systems. Advanced ultrasound systems from Esaote SpA (Italy) and GE Healthcare (US) are priced at a premium. Similar to ultrasound systems, the cost of veterinary ultrasound procedures is also high. For instance, abdominal ultrasound costs around USD 250–500.

Specialists such as cardiologists, oncologists, and radiologists offer more expensive services ranging up to USD 500 per area of animal body. The high cost of these procedures has long been a restraining factor for the market, as it prompts pet owners to avoid an ultrasound until it becomes necessary.

The veterinary clinics segment accounted for the largest share of the global veterinary ultrasound market. The large share of this segment can be attributed to the widespread adoption of ultrasound in veterinary clinics and the growing number of veterinary clinics across the globe.

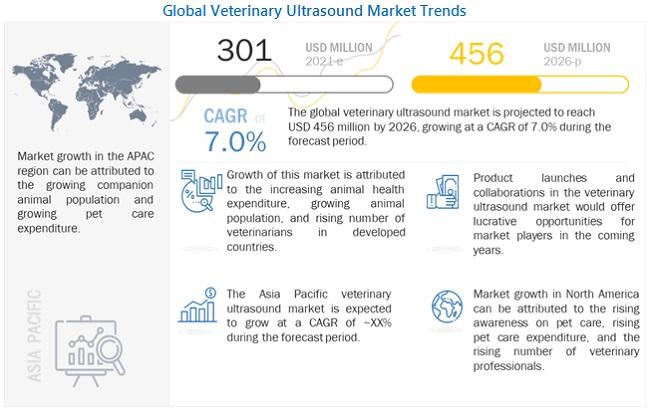

The rising number of veterinary practices, growing companion animal population, and growth in animal health expenditure are the key factors responsible for the large share of North America in the veterinary ultrasound market.

Some of the prominent players in this market are GE Healthcare (US), Esaote SpA (Italy), Shenzhen Mindray Bio-medical Electronics Co., Ltd. (China), Siemens Healthineers (Germany), and FUJIFILM Holdings Corporation (Japan), Heska Corporation (US), Samsung Medison Co., Ltd. (South Korea), Diagnostic Imaging Systems, Inc. (US), IMV Imaging (UK), Shenzhen Ricso Technology Co., Ltd. (China), DRAMIÑSKI S.A. (Poland), Clarius Mobile Health (Canada), Shantou Institute of Ultrasonic Instruments Co., Ltd. (China), E.I. Medical Imaging (US), and SonoScape Medical Corp. (China).