Texas has several positive qualities. One is the abundance of tacos and BBQ. However, the state’s steadfast support of its economic community may be more significant.

Texas has the advantage of having the second-largest population in the country and several metropolitan areas experiencing rapid growth.

Texas’ low company licensing costs, absence of red tape, and quantity of very inexpensive real estate demonstrate the state’s support for small businesses.

Few states can claim the same lax regulatory environment that allows firms to immediately start a business.

Consult licensed specialists for the legal, accounting, and tax guidance you require while you research for running a business in Texas.

This article does not provide legal, tax, or financial advice and is purely for informational reasons. Here are 11 Such Steps on How to Start a Business in Texas Go Through Them:

Steps on How to Start a Business in Texas

1) Right Business Idea

Choosing what kind of business to launch is the first step toward business ownership and your goal of doing business in Texas. Find a concept that aligns with your hobbies, your objectives, and your inherent talents.

It can significantly increase your chances of success and help you stay motivated when things become challenging.

To assist you in getting started with choosing the right business idea, we have a list of top trending businesses.

2) Choose a Business Name

This essential phase acts as the basis for a company’s brand identity. The majority of small businesses immediately link their brand name to the goods and services they offer in their marketing materials.

Accordingly, you should choose a name for your company that both resonates with your audience and complies with Texas’ naming regulations.

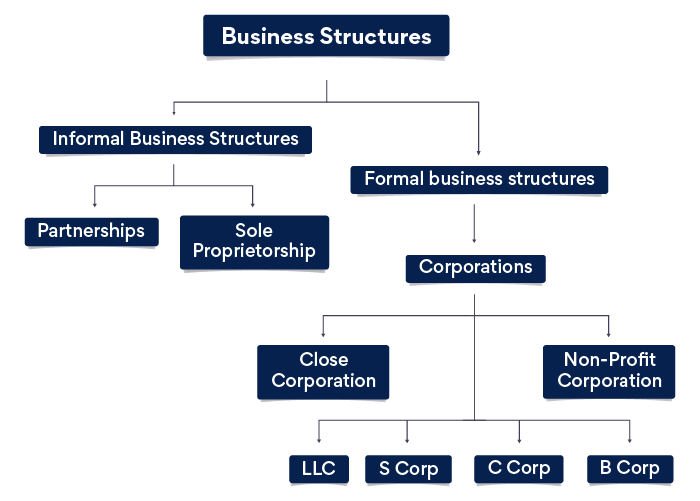

3) Choose a Business Structure

The choice of the company’s legal structure has an impact on the owners’ liability, tax consequences, and the level of compliance complexity required to maintain the business.

Understanding the advantages and disadvantages of the options depending on your specific scenario is necessary when choosing the best business structure.

You can choose the right entity type for your business by consulting an attorney, accountant, and tax advisor.

Also, your business structure should match your business purpose.

In Texas, the majority of enterprises fall under one of the following categories:

-

Sole Proprietorship

A single person operating a business without filing a legal entity with the state is a sole proprietorship.

An Assumed Name Certificate must be filed with the county where the business maintains a physical premise if it intends to operate under an assumed name (a name that excludes the owner’s legal name).

If the sole proprietor doesn’t keep up a physical presence, it is necessary to file assumed name certificates in each county where it does business.

The cost to file certifications under an assumed name varies by county.

-

General Partnership

It’s comparable to a sole proprietorship but is for two or more people. Although it is a separate legal entity from those individuals, creditors may still seize the partners’ personal assets to cover obligations.

-

Limited Liability Company

Owners’ liability is limited in LLC, compliance requirements are kept straightforward, and management and tax treatment options are flexible.

A Limited Liability Company (LLC) might have one member or many members. To list members may be individuals, partnerships, corporations, trusts, or other legal or commercial entities.

An LLC is automatically given pass-through business tax responsibilities treatment. Members can pay taxes as a corporation through its members only pay self-employment taxes on the income they receive as wages and salaries.

4) Business Location

You must choose a location for your company. Think about your clients’ wants and whether your industry could profit from a foot or highway traffic.

Consider the costs of operating your business in the chosen area. Such as rent and utilities, before fixing a location.

To determine whether you can afford your ideal site during the early stages of your firm, you might look back at your business strategy.

Operating your business from your house is an option for finding a new site for it.

Review your lease (if you rent your house) and any applicable homeowners association laws as well, as both may prohibit some or all home businesses.

5) Write a Business Plan

Have a business plan or prepare to fail, according to the saying. Entrepreneurs who don’t have a business plan lose the chance to outline their vision for the company and its future.

The roadmap to business success is laid out in a business plan.

It is a dynamic document that summarises the company’s goals, the industry outlook, a description of its goods and services, competitive advantages operational structure, and financial forecasts to assist business owners in setting their priorities and activities.

Business plans are crucial for a company’s internal operations. It is also necessary for lenders and investors before approving financing for a venture.

You don’t have to create your business plan from scratch because Upmetrics is here to help you.

6) Get Funding

You need capital to launch a business, but there are a few steps you must do before you can get the financing you need to pay for beginning expenses.

Before searching for any outside financing, calculate all your business costs. It will assist you in selecting the best fund source for your start Texas business.

Next, develop a thorough financial plan to get organized and practice wise spending.

-

Bootstrapping:

It is a do-it-yourself method of raising capital for a business in which you use both your existing revenue and personal resources to finance the operation.

-

Friends And Family:

Getting the money you require to launch your small business through loans from friends and family might be a terrific option. Establishing a formal agreement and payback plan is a wise idea when conducting business with friends and relatives.

-

Grants For Small Businesses:

Grants for small businesses are essentially loans that you don’t have to repay. By applying to a grantor, you can get a small business grant.

-

Small Business Loans:

A bank or other lending organization is normally where you can apply for a small business loan. Although this funding option involves payback, it will give you enough money to meet your startup fees and more.

7) Register Your Business In Texas

Here are the Texas business formation forms and accompanying filing fees:

- For-Profit Corporation Certificate of Formation – $300

- Limited Liability Company Certificate of Formation – $300

- Limited Partnership Certificate of Formation – $700

- Professional Corporation Certificate of Formation – $300

- A professional association’s certificate of formation costs – $700.

- Professional Limited Liability Company Certificate of Formation – $300

8) Obtain For Trademark For Your Business

The Texas Secretary of State’s office asserts that registering your company does not immediately grant you ownership of your company name or bar other companies from using it within the state.

However, filing a trademark application with the Texas Secretary of State demonstrates that a company has asserted its right to use a mark in Texas.

A certificate of registration confirms the exclusive right to use the mark in Texas, should the state accept it.

The United States Patent & Trademark Office can help you protect your brand in all 50 states by registering it.

9) An EIN

Even if they don’t intend to hire staff, the majority of firms require an Employer Identification Number (EIN).

When a business files federal taxes, it is identified by an EIN, also known as a Federal Tax ID Number. Before they will open a business bank account, the majority of banks demand an EIN.

EINs are freely given out by the IRS. It should be noted that EIN applications can only be made by those who have a Social Security Number or Individual Taxpayer Identification Number.

10) Licenses And Permits

You must abide by federal, state, and local laws to legally start a business in Texas. This frequently entails acquiring one or more business licenses and permits.

Depending on the kind of business you’re operating, you’ll need a different license or permit to start a business.

11) A Business Bank Account

For the protection of the personal assets of a business employer, it is crucial to use business bank accounts and credit cards.

Your assets, your home, your vehicle, and other valuables are in danger if your firm is sued if your personal and business accounts are combined. It is piercing of corporation veil in business law, so why take the risk?

With these three measures, you may safeguard your company:

-

Open Business Bank Account

- Separation of your personal assets from those of your business is a requirement for personal asset protection.

- Simplifies bookkeeping and tax filing if you open a business in Texas.

-

Get A Business Credit Card

- Aids in the division of personal and company expenses.

- Creates a credit history for your business, which might be helpful in the future when you need to raise money.

-

Set Up Business Accounting

- An accounting system makes it easier to file your taxes each year and helps you monitor the performance of your company.

- Accounting is quick and simple with the help of good accounting software that allows you to retrieve your bank and credit card transactions.

- Find out more about the significance of accounting and how to begin using it right now.

- You might also employ a business accountant to assist you with all your payroll, sales tax accounting, and filing requirements.

All Set To Start Your Business?

You’re lucky if you want to establish a business in Texas because many resources are available to you, and the entry barrier is low. Even now if you are confused about anything, then read our startup checklist.

Don’t take it for granted that Texas is interested in seeing you succeed. Today’s economy makes it difficult enough to survive, so having a state government on your side is an advantage that few people should pass up.

Above all, first things first business plan is necessary for financing, forecasting, employment, and whatnot. So, visit Upmetrics for an impeccable business plan.