How Mortgage Closing Procedure can Save You Time, Stress, and Money.

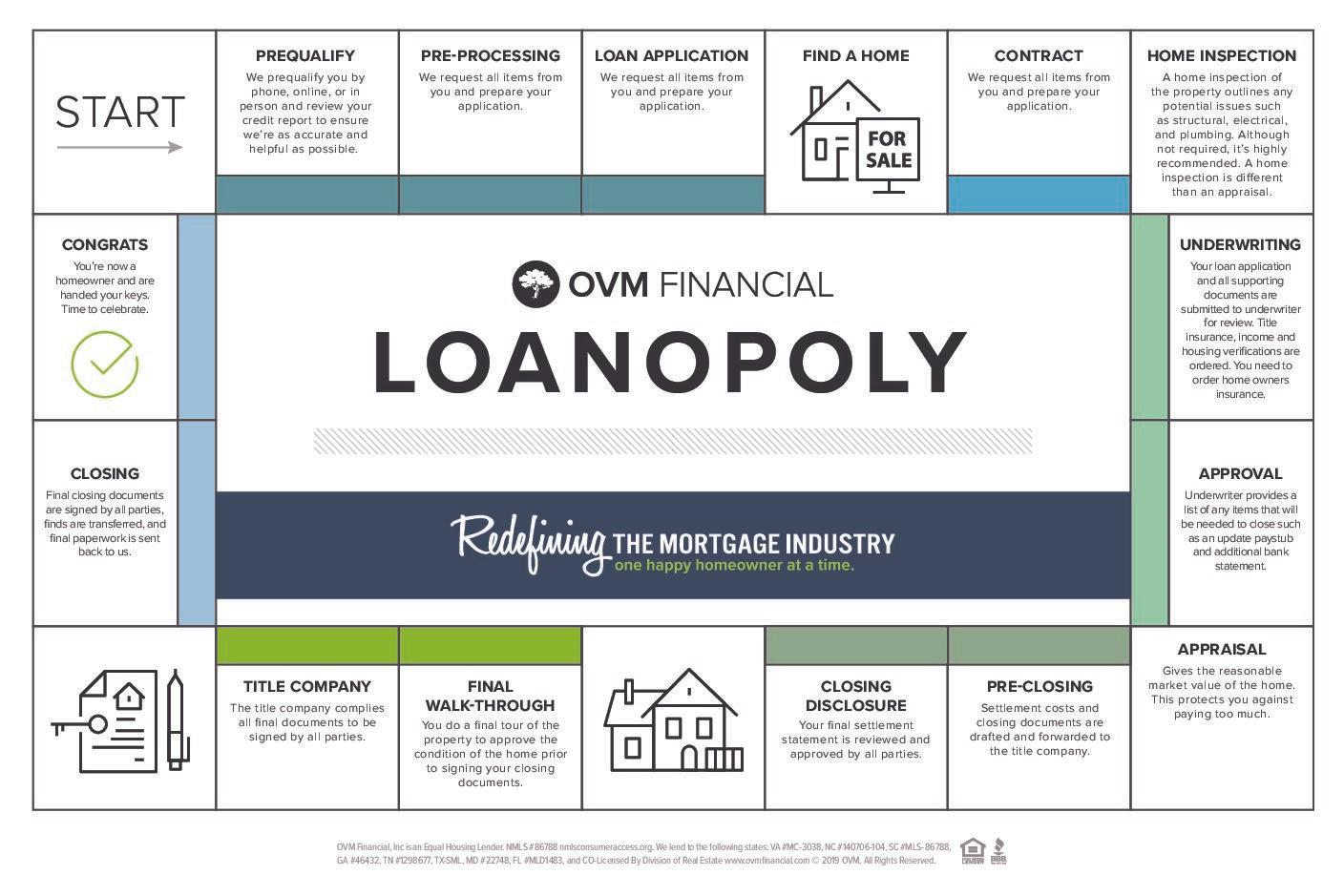

Closing a residential property offer can be a long as well as demanding workout that involves great deals of steps and step-by-step formalities. Closing happens when you sign the papers that make the residence your own. Yet prior to that fateful day arrives, a lengthy list of things needs to occur. This article offers essential standards for a property buyer that have to be followed throughout the closing procedure from the moment your deal is approved to the moment you get the tricks to your new house.

Given that home sale involves numerous actions which makes the effort that can extend weeks, the very best way to reduce the danger of either the seller or the customer obtaining swindled is to have a neutral 3rd party hold all the cash as well as records connected to the purchase till everything has been settled.

A title search as well as title insurance coverage offer assurance as well as a lawful guard so that when you buy a home, no person else can attempt to claim it as theirs later, be it a rejected loved one that was left out of a will or a tax obligation collecting company which had not been https://barbaratillmanbfzs814.hatenablog.com/entry/2019/11/08/004305 paid its charges.

The Only Guide for Closing Procedure For Mortgages

If there are any insurance claims, those may need to be fixed prior to the customer obtains the building. Title insurance policy is indemnity insurance that safeguards the holder from economic loss sustained from issues in a title to a home and protects both actual estate owners and also lending institutions against loss or damage taking place from liens, encumbrances, or issues in the title or real ownership of a building.

The complex jargon usually discussed in the building papers is challenging to recognize also for the well-read individuals. For an appropriate cost, opinion from an experienced actual estate attorney can use several benefits, consisting of hints of any kind of possible troubles in the documents. In some states, an attorney's involvement might eventually be called for by regulation to take care of the closing.

In turn, being pre-approved can provide you much more bargaining power when working out as it signifies to the seller that you have solid economic backing. Obtaining pre-approved for a home mortgage additionally enables you to understand the limitation up to which you can choose buying a home. It assists in saving time as well as effort while searching for the homes that fit right into your budget.

More About Closing A Mortage

A 0.25 percent surge in rates of interest can considerably raise your payment amount, repayment period or both. It is a good idea to secure the rates of interest for the funding in breakthrough, as opposed to being at the grace of the marketplace variations which can be a large threat if the rates increase prior to you complete your property purchase.

Though chargeable prices go through numerous factors, like candidate's credit rating, geographical region, residential property as well as the kind of financing obtained, attempts to secure at beneficial rates can be valuable. Right from an escrow account to realty attorney, all involved solutions as well as entities set you back cash and can grow out of control right into a huge amount.

Scrap costs, a collection of costs that a lending institution imposes at the closing of a home mortgage and is usually unexpected by the customer and also not plainly clarified by the lender, are a big cost. Junk fees consist of products like management costs, application evaluation costs, assessment review costs, ancillary charges, handling costs and negotiation charges.

Our Home Loan Closing Procedure Diaries

If you agree to speak out and stand your ground, you can normally get junk costs and also other fees gotten rid of or at the very least decreased. A home inspection, a health examination of the condition of a property home, is a needed action to not only understand about any kind of issues with the home however additionally obtain a feel and look of the environments.

A pest inspection is separate from the residence assessment and includes a professional seeing to it that your residence does not have any type of wood-destroying pests, like termites or woodworker Go to this site ants. The bug problem can be ruining for residential properties made largely of wooden product, and numerous mortgage firms mandate that also small pest issues be fixed prior to you can shut the bargain.

Wood-destroying pests can be eliminated, but you'll intend to ensure the issue can be solved for a price you locate affordable (or for an expense the vendor agrees and also able to pay) before you complete the purchase of the home. Bug assessments are legally required in some states and also optional in others.

Rumored Buzz on Action In Closing A Mortgage

You might additionally keep the acquisition cost the exact same yet attempt to obtain the vendor to pay for repair work. Though you may not have much extent to require repairs or a cost decrease in situation you're buying the residential property "as is," there is no injury in asking. You can likewise still back out without charge if a major problem is discovered that the seller can't or won't repair it.

Nevertheless, in some acquisition arrangements, backups are passively authorized (additionally called constructive approval), if you don't object them by their specified target dates. It, consequently, comes to be essential for buyers to recognize the authorization process and also follow taking required activities by the discussed days. You most likely transferred earnest money when you signed the purchase arrangement, which is a down payment made to a vendor showing the customer's great belief, severity as well as authentic passion in the building transaction.

If the vendor backs out, the cash is returned to the buyer. To complete your acquisition, you'll have to deposit added funds right into escrow. Considering that the original earnest money down payment is normally applied in the direction of the deposit, it is necessary to schedule the different settlements required at various times, prior to the bargain is shut.

Getting My Mortgage Closing Process To Work

One of the last steps prior to you sign your closing documents ought to be to go through the home one last time. You intend to make certain no damages has occurred given that your last home inspection, needed solutions have been used by the seller, no brand-new troubles are discovered, and absolutely nothing has been removed that is included in the acquisition.

In spite of there being a pile of papers loaded with intricate legal terms and lingo, it is very recommended to review it on your own. In situation you do not comprehend specific terms or parts, one can look them up for explanation on the Web or speak with a property lawyer. Your representative will certainly also be valuable in making feeling of this complex Helpful hints lawful language.

Specifically, make certain the rate of interest price is proper and all other agreed terms, like no early repayment charge, is plainly mentioned. A lot more normally, contrast your closing expenses to the good confidence quote you were given at the start of the process and also throw a fit about any kind of costs that might appear off.

All about Mortgage Closing Procedure

It might look like the closing process is a great deal of complicated work, it is worth the time as well as effort to get things ideal instead of hurrying up as well as signing a deal that you do not understand. Be wary of the pressure created to close the deal quick by the involved representatives and entities that exist to help you for their cut, but may not be really in charge of the troubles you might encounter in the future from a negative offer.

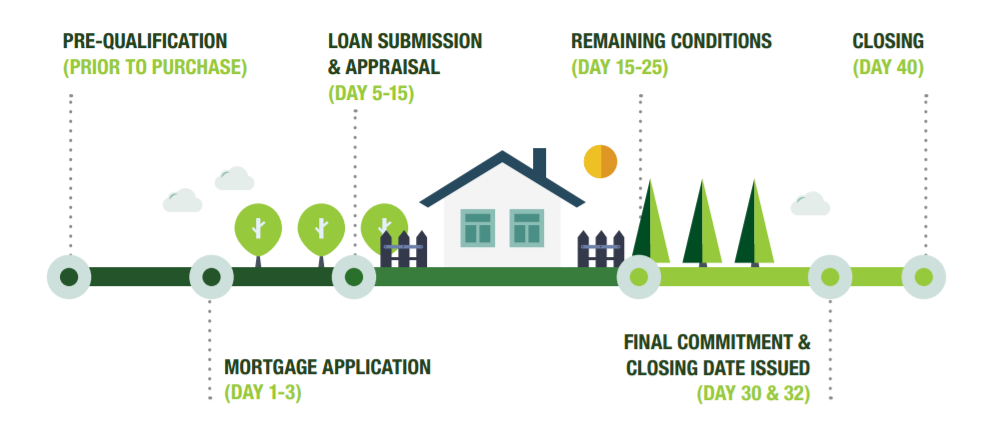

Pre-closing After getting the clear to shut from your home loan loan provider, you need to validate the car loan closing date. An estimated closing day was most likely defined in the sale contract, yet a firm day needs to be set by you, the residence vendor, as well as your lender. You intend to make sure the settlement occurs before your funding commitment expires and prior to any type of price lock contract (guaranteed terms of the car loan) run out.