The primaries interviewed for this study included experts from the industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1 and tier 2 companies engaged in offering single-use bioprocess containers across the globe, and administrators and purchase managers of biopharmaceutical companies and research institutions.

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (biopharmaceutical manufacturing units, CROs & CMOs, research institutes, etc.).

The secondary sources referred to for this research study include publications from government sources; corporate & regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines & research journals; press releases.

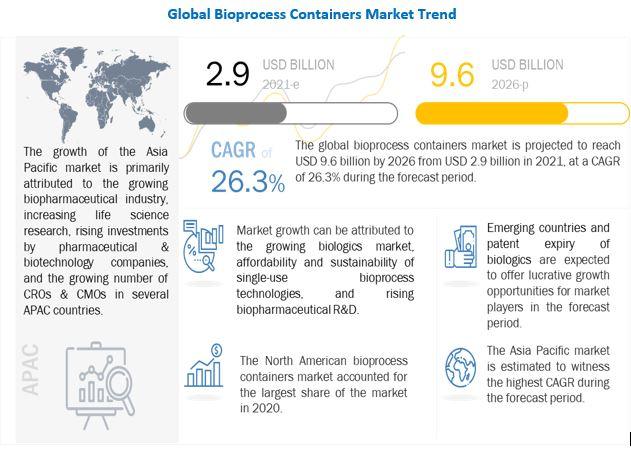

Growth in the bioprocess containers market is mainly driven by factors such as the growing biologics market, affordability and sustainability of single-use bioprocess technologies, and rising biopharmaceutical R&D.

For More Info, Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=107645832

In recent years, more biologics having higher potency that require smaller production volumes, advancements in biosimilars targeting smaller markets, and ongoing improvements in production yields and efficiencies that create production operations at much smaller scales have increased the use of single-use technologies such as single-use bioprocess containers.

As many patented products are going off-patent in the future, companies are falling short of funds to invest in their R&D pipelines. According to data published in the Generics and Biosimilars Initiative Journal, around twelve biological products with global sales of more than USD 67 billion will be exposed to biosimilar competition by 2020.

The patent expiry of blockbuster drugs has resulted in increased R&D spending by pharmaceutical and biotechnology companies. Patent expiry of biologics leads to increasing R&D of biologics and shifts biologics from the pipeline to commercial production.

Compared to traditional bio-manufacturing technologies, single-use systems (SUS) have many advantages, such as reduced requirements for process validation and higher manufacturing flexibility, which ultimately results in higher operating efficiency and reduced manufacturing costs.

The solid waste generated from single-use assemblies such as bioprocess containers creates several challenges for biomanufacturing companies, such as the disposal of solid waste and an increase in waste management costs.

Read Full Press Release @ https://www.prnewswire.com/news-releases/bioprocess-containers-market-worth-9-6-billion-by-2026--exclusive-report-by-marketsandmarkets-301386429.html