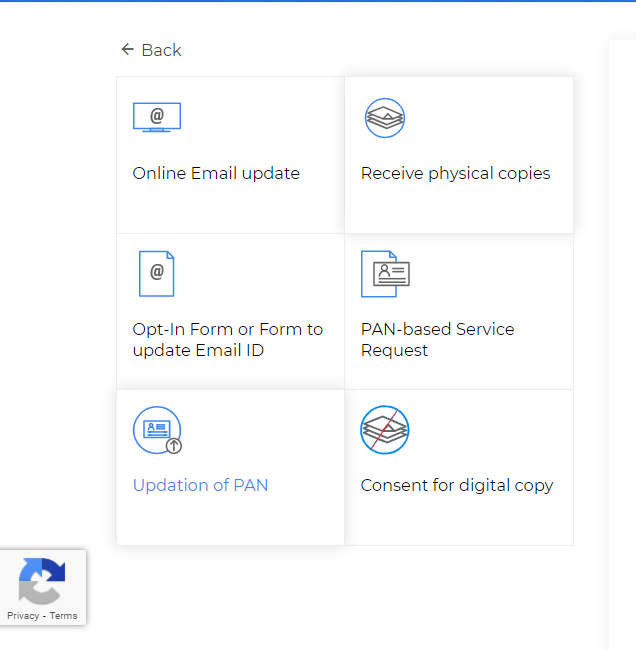

SIPs online for investors - As per existing PMLA guidelines & SEBI regulations and thereafter issued from time to time, SEBI registered intermediaries like Mutual Funds are mandated to carry out appropriate due diligence of the customers by collecting prescribed officially valid documents, in-person verification, photograph and so on. While PAN is mandatory for investments from a specific period of time, those investors who have not provided PAN or not completed the relevant KYC process are now requested to update their PAN and complete the KYC process. This facility is provided to such investors to update their PAN in their respective folios where PAN is not available or Invalid PAN is available in their Folio.