Candlestick chart creation is generally credited to an eighteenth-century Japanese trader known for adeptly gaming the rice trading markets. Through the ages, his methods underwent even more modification and adjustment to become more compatible with conditions obtainable in modern times. “Japanese candlestick charting techniques “by Steven Nison introduced the West to candlesticks. Candles trading is, therefore, a byword for success in trade.

Candlesticks are now a staple of every trading platform. Close to every financial trading vehicle uses candlesticks for its charting programs. Info depth and component simplicity make candlestick charts popular among traders. The ability to chain together diverse candlesticks to give an underlying pattern makes it a tool for interpreting price action forecasts and history. Candlestick chart literacy is a true yardstick of trading skills.

Candles Trading Chart: an overview

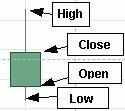

On a candlestick chart, each candlestick points out the open, high, low, and close price for the time frame the trader has opted for. For instance, provided the trader sets the time frame to five minutes, a new candle can be created every 5 minutes. For an intraday chart, the open and close prices are those meant for the start and finish of the five minutes. The trading session is not being analysed here.

Regardless of the price moving up or down over time, candlesticks show the current prices even as they form.

-

Open price

- The top/bottom of the candlestick body will point out the open price. This will depend on if the asset appreciates /depreciates during the five-minute period. Provided the price trends up, the closing is higher relative to the opening. The opening is shown by the body’s bottom, the close being shown by the top.

- When the price trends down, closing lower relative to the opening, the open is shown as the candlestick’s top, the close is shown as the bottom.

- Candlesticks that close lower are frequently filled in either a green or a white coloured candle.

- Candlesticks that close lower are frequently filled in as a red or black coloured candlestick.

-

High price

During the candlestick period, the high price is shown by the shadow’s top or the tail above the body. Were the open/close the highest price, there would be no upper shadow.

-

Low price

The low is shown by the shadow’s bottom or tail below the body. Were the open/close the lowest price, there would be no lower shadow.

-

Close price

The last price traded during the candlestick, the close, is shown by either the top or bottom of the body.

Even as a candle forms, it continually changes with the price movement. The open remains the same. However, till the candle is finished, the high and low prices keep changing. With candlestick formation, the colour changes.

For instance, it may go from green to red, provided the current price was above the open price, but then plummets.

The candle time period ending, the close price is the last price. A new candle begins forming, soon as the candle begins forming.

-

Price direction

- By the candlestick’s colour and positioning, the price movement’s direction can be seen during the candlestick’s time frame. Therefore, Candlestick patterns for day trading are vitally important to understand.

- Were the candlestick green, the price would close above where it opened. The candle would be located above and to the right of the foregone one. Were the candlestick red, the price would close below, to the right of the preceding one.

-

Price range

The distance between the upper shadow’s top and the lower shadow’s bottom is the price movement range during the candlestick’s time frame. Subtracting the low price from the high price gives the range.

Candles trading patterns: interpretations

It’s so easy to practice reading candlestick charts. You only have to open a demo trading account. There are free web-based charting platforms, where you can practice to profit.

Set the chart type to the candlestick. When you select a one-minute time frame, you have lots of candlesticks to observe and study.

Once you find a reasonable footing in the field, you can search for real-world trading opportunities based on candlestick charts. An Instance would be the three black crows and the abandoned baby.

Reading a candles trading stick chart

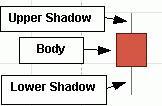

A candlestick has three components – the upper shadow, lower shadow, and body. The body is coloured green or red. Each candlestick stands for a segmented time period. Candlestick chart data gives us the gist about executed trade activity during said period of time. For instance, a 5-minute candle stands for 5 minutes of trades data. Every candlestick has four data points: high, low, open, and close.

For the said period, the open is the very first trade. The very last trade for the period is the close.

The body of the candle is made up of the open and close. Therefore, the highest-priced trade is high and the lowest priced trade is the lowest for said candles trade.

A vertical line extending from the body’s top to the highest price represents the high. The highest price is called a shadow, wick, or tail. The low candle is the tail or lower shadow, shown by a vertical line extending from the body. Provided the close is higher than the open, the body is coloured green, standing for a net price gain.

When the open is higher than the close, the body is coloured red, showing a net price decline.

Candles trading chart patterns

Every candlestick chart relates the story of a showdown between the bulls and bears. You have to bear in mind that the majority of candle patterns require confirmation on the basis of the context of preceding candles and the ongoing candle. Rookie traders make the general mistake of spotting one candle formation without context, thus stagnating candles trading.

For instance, a hammer candle shows a near-term capitulation bottom in case it forms following three previous bearish candles, while a hammer candle that forms on flat sideways candles is generally useless. Hence it pays to make sense of the story that each shows to have a firm grasp on candlestick chart pattern mechanics. They have the tendency to repeat themselves continually.

The context must never be overlooked. That’s when you know you have learned how to read candlesticks – correctly.

A candlestick chart shows more emotion owing to body colouring. Therefore, it is wise to ascertain that they are included with other indicators to give the best outcomes.

Common candlestick reversal patterns

Hammer candlestick

A bullish reversal candlestick, the hammer is one of the most famously followed candlestick chart patterns. It determines capitulation bottoms. A price bounce follows, used by traders to enter long positions.

Forming at the end of a downtrend, a hammer candlestick shows a near term price bottom. Making a new low in the downtrend sequence, the hammer candle has a lower shadow. The same subsequently closes back up close to or above the open. The tail or lower shadow has to be a minimum of two or four times the body size. This shows the long that finally decide, stopping out as shorts begin covering their positions.

Here is where the bargain hunters come in, using candles trading to their advantage.

A volume appreciation helps to solidify the hammer. For the hammer candle to be confirmed, it is vital for the forthcoming candle to close above the low, at best above the body. As a rule, a buy signal would be an entry above the candle’s high, following the hammer with a trailing stop, ether below the body low or the hammer candle low.

Timing the entry with MACD, RSI or stochastic, would be wise. How to read a candlestick chart for day trading gives you the right training.

Shooting star candlestick

A bearish reversal candlestick, the shooting star shows a peak or stop. It is the antithesis of a hammer candle. The star has to form following a minimum of three to four green candles showing a rising price and demand. By and by, buyers lose patience, running after the price to new highs. Then it is that they come to the realisation they overpaid.

As a rule, the wick or the upper shadow ought to be twice as large as the body. This shows the last of the hysterical buyers have entered the stock. At that instant, profit traders unload their positions. Then follow short-sellers heading the price down, closing the candle close to or beneath the open. This really detains late buyers who chased the price too high.

Traders highly strung by candles trading, the very next candle ought to close at or under the shooting star candle, setting off a panic selling spree. Late buyers curb losses in a panic.

The general short sell forms when following candlestick’s low’s price is interrupted by trail stops at the body’s high or the shooting star candlestick’s tail.

Doji candlestick