"Homeowner Insurance

Insurance coverage is sort of a difficult thing. The majority of us have a love-hate relationship with insurance coverage. Yes, we may like our representative however we sure dislike paying that premium. All of us desire our home repaired, or rebuilt, in the case of a fire. We anticipate someone, primarily the insurance business, to pay out numerous countless dollars to restore our house, pay for our rent for us to reside in another location while our home is being rebuilt, and change all our individual valuables that were destroyed by the fire, smoke, and water. When that annual premium reveals up in the mail, however, we whine and grumble and our hand ends up being very hesitant to write that check.

We are in the last days. Throughout the next 30 plus years, we are going to be having increasing pestilence, floods, tornadoes, fires, earthquakes, and other natural disasters. We are informed that these will be of larger magnitude and more regular period than anything we have collectively experienced. You will be significantly at threat, no matter where you live, that your home could be ruined along with everything in it in an immediate. The sensible thing to do would be to have sufficient insurance coverage to cover this.

When I refer to house owners insurance coverage I am including tenant's insurance coverage, apartment, and property manager coverage also. Whether you rent or own you must have house owners insurance protection. Similar to your automobile insurance, the liability protection of your property owners' policy pays for damages brought on by you or your dependents to others that you are legally obligated to pay. The liability protection ought to fulfill or surpass the value of the house.

Yes, the liability portion covers things like individuals slipping on the ice in your driveway and getting injured or dropping the stairs in your home. It covers you if your canine attacks someone, an injury occurs at your pool or a mishap on your trampoline. It also covers you for things that have absolutely nothing to do with your house.

For instance, let us suppose your 8-year-old kid takes a can of spray paint and tries to help ""fix"" all your next-door neighbor's cars by painting the scratches. There may be several thousand dollars worth of damage that is triggered by somebody you are lawfully responsible for. Your renters' or house owners' policy would spend for all those vehicles to be repainted.

Due to the fact that you can be demanded a good deal of loan for accidents that arise you require to have proper coverage. The Seventh Seal will be a time of bro versus sibling and more suits. Many individuals do not care about their next-door neighbors. They appreciate getting justice, getting even, getting vengeance, and getting money for perceived wrongs. Having a low liability limitation of $100,000 on your house owners' policy is not enough. Simply like the automobile insurance plan you need to have greater limits that will cover possible liability.

Individuals ask me how much they must be insured for. My response is, ""How much do you think somebody with a lawyer could sue you for?"" This is not a location to be cheap. If you are 25 years old, have no properties, and no children then the $100,000 might be adequate. If you own a house, have a dog (it can bite someone), have a couple of children, and have a lot of assets then $500,000 might not be enough.

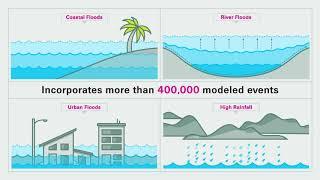

You could be bankrupt overnight by having your home damaged in an earthquake and not having earthquake insurance coverage on your house. The exact same goes for a flood. Floods and earthquakes are not part of a basic property owners policy. Water is the leading reason for damage to house and residential or commercial property nationwide. The method homeowner's insurance coverage defines a ""flood"" is outdoors water that comes into your house. Floods can take place whenever and anywhere from additional rain, to mudslides, to a broken sprinkler pipe. Even if you haven't had a flood in your location over the last a century does not imply that a person can't or will not occur. Flood insurance is, for that reason, extremely essential.

Floods are any water that is outside the home which enters your home. ""Floods"" can be from rainwater, a damaged sprinkler pipe, a mudslide, or an inflamed river. Floods can occur at any time and to any home or apartment or condo. Flood insurance likewise protects the house from natural catastrophes other than earthquakes.

Earthquakes are more typical or anticipated in specific areas. However in the last days, there will be earthquakes in ""diverse"" locations. This indicates there will be more earthquakes and in lots of areas. If you reside in the ""Ring of Fire"" zone where many earthquakes occur, or the capacity for a larger earthquake is higher, you would be rather absurd not to have earthquake coverage on your home or apartment.

In my viewpoint, everybody ought to have flood insurance for their home, apartment, or rental properties. Many people would be smart to consider earthquake insurance too. Get with your representative and make sure you are correctly covered.

You can purchase Brian's brand-new e-book: Constructed Upon A Rock, Financial Self Dependence in Troubled Times for a 50% discount."