Diversset was made by a former institutional trader and treasurer to help investors find value or growth stocks depending on investors’ investment goals and construct well-diversified investment portfolios. No financial knowledge is required to use the app. In this article, I will explain how to use Diversset for both risk-averse investors and risk-seeking investors.

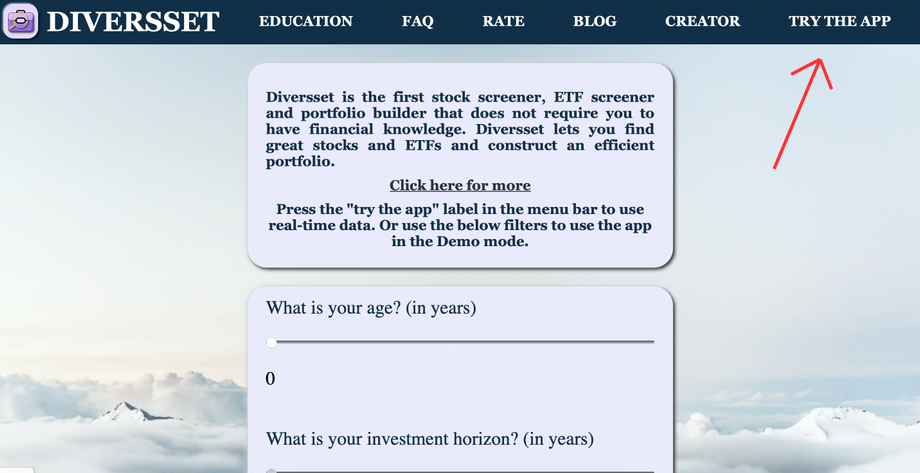

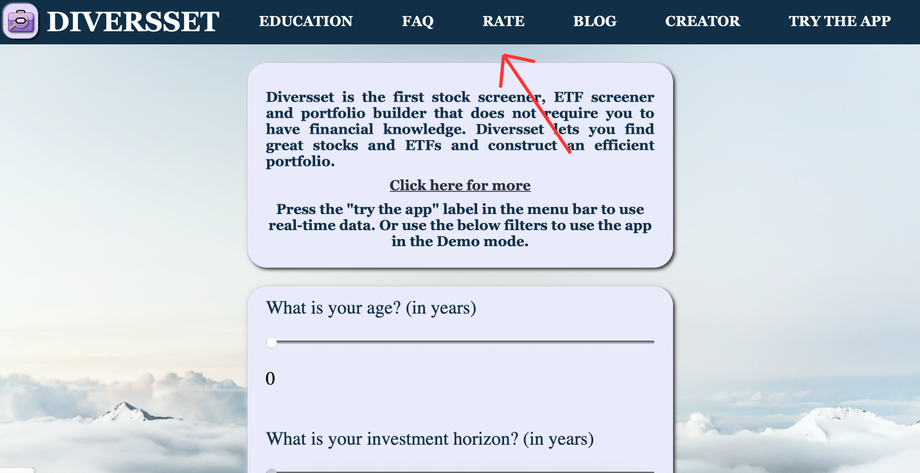

The first step, visit Diversset and press the “TRY THE APP” label at the navigation bar (top bar), as shown in the picture.

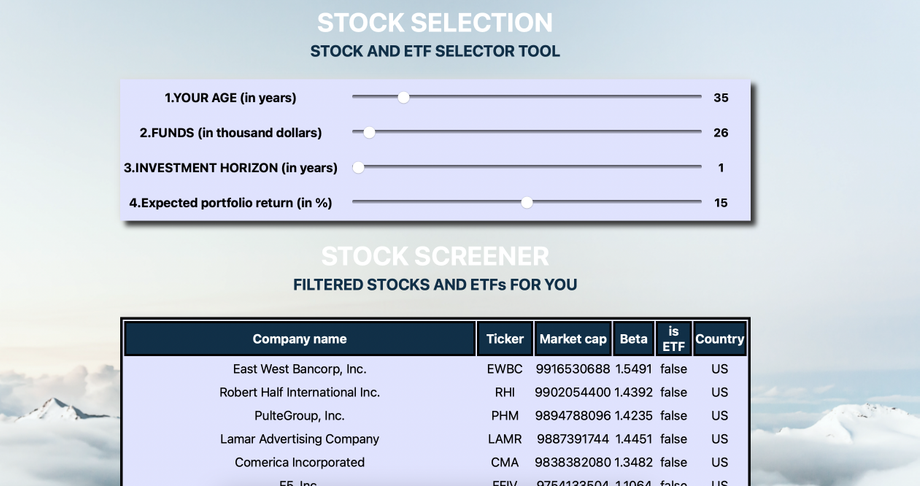

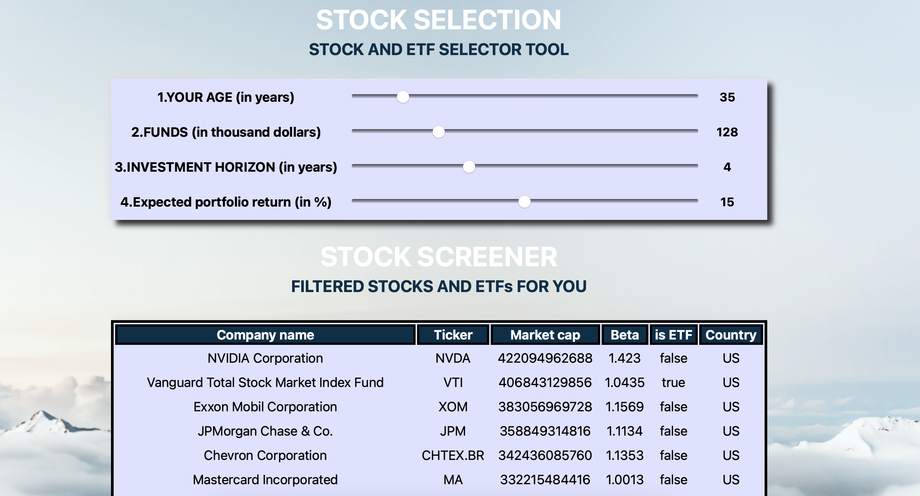

After you log in, the main screen will appear. First, let me show you how to choose stocks if you are a risk-seeking investor. On the main screen, use the scrolls to answer four different questions. To find riskier stocks and ETFs indicate smaller funds and a one-year investment horizon. You can put scrolls in the same positions as shown in the picture. You can put any expected return, and your age should be around 30-40 years; if you indicate your age as above 40, you may end up with less risky stocks. That is why it is recommended to keep your age in the mid-range. You will get an extensive list of stocks, to scroll down the list, use a mouse or a trackpad. Diversset uses live financial data for calculations, that is why the stock list can change regularly. So tomorrow, you may have a different list of stocks under the same scroll positions. But those stocks would also be riskier.

After that, press the “BUILD THE PORTFOLIO” button, as shown in the picture.

Now let me show you how to search stocks if you are a risk-averse investor.

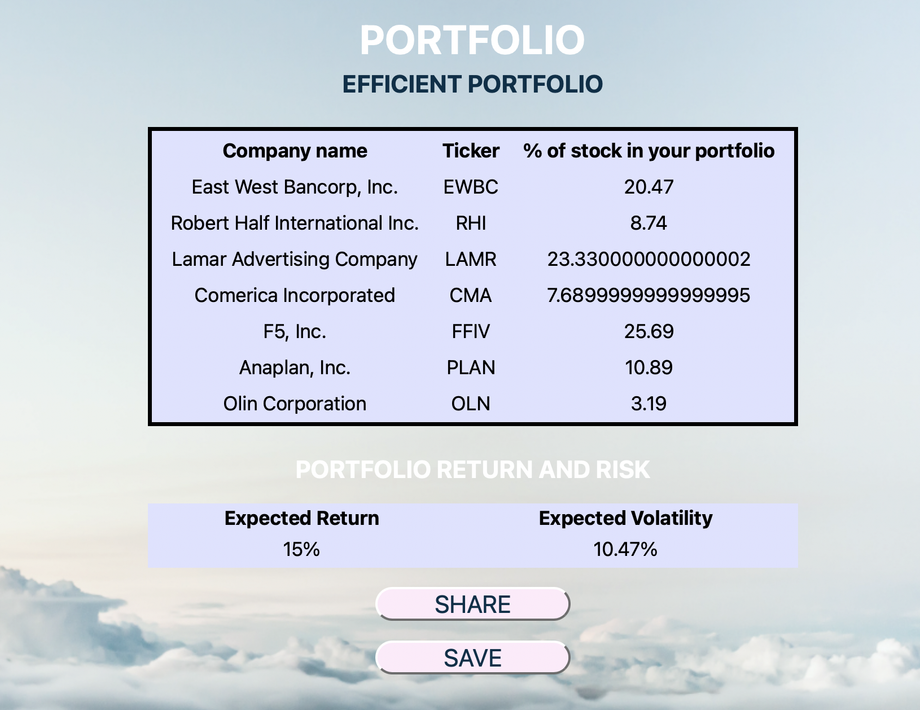

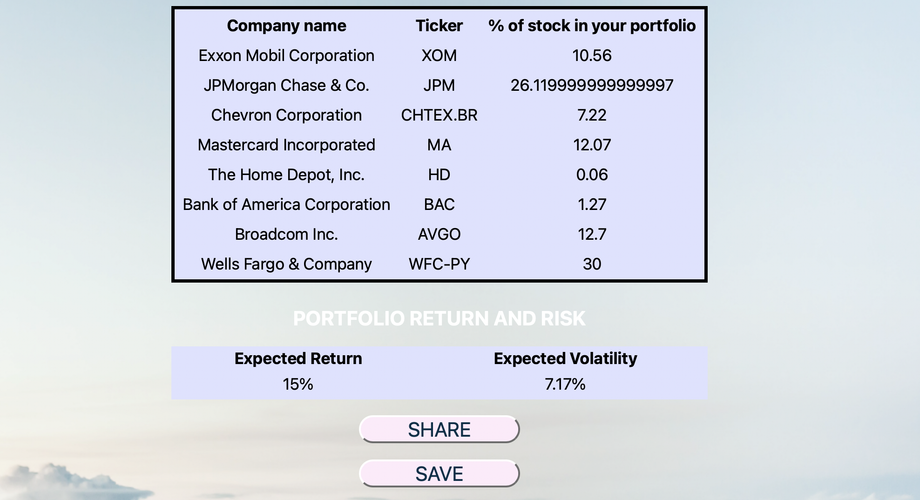

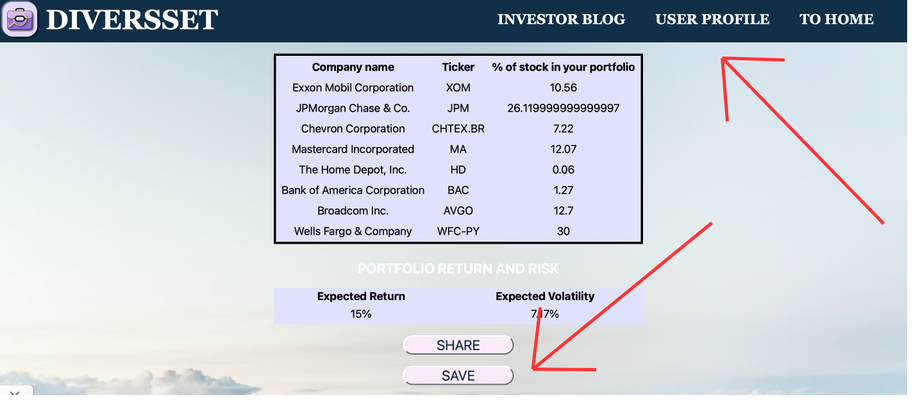

Diversset will construct your efficient portfolio and distribute stock and ETF weights in your portfolio to get the lowest possible expected loss, given your required return. Please note that in the below example, the expected volatility is 7,17% because the current market is very volatile as of the 19th of May 2022; this is due to the inflation pressure on the United States stock market and tighter monetary policy. But if you construct your portfolio the other day, the volatility would be lower when there is no market pressure. The current portfolio’s stock and ETF weights provide the safest possible option.

You can save your portfolio result by pressing the “SAVE” button. And you can also see your savings if you go to the user profile by clicking on the “USER PROFILE” label at the navigation bar and clicking the “VIEW SAVED PORTFOLIO” button.

Thank you for reading my post. Don’t forget to rate the app if you liked it or leave your comments or suggestions. Thanks.