Exactly how to Acquire the Lowest Interest Rate For Your Car Loan

Exactly How to Secure Free Money - Borrow Money, Usage Some Of These Ways

Do you need to acquire money? You need to think about several various ways you can easily make use of to acquire the cash that you need. Below are some ways to discover exactly how to break out money.

The 1st way to obtain money is actually to visit your regional bank as well as talk to if they want to do business with you. They possess a great deal of individuals that wish to obtain money, as well as they typically don't charge high rate of interest. You may additionally look online for fundings.

Some of the most effective places to locate a loan is actually to obtain one on collection. The greatest perk of on-line financings is that you don't need to go by means of a broker and also it is very simple to apply. This makes it beneficial for individuals to get the money they need to have promptly.

If you do not possess a credit card, you can regularly receive a charge card. There are actually thousands of cards that are actually readily available for people with negative credit. They will definitely require to fill out a credit score application that are going to help them apply for the card. This assists in obtaining a loan.

You can additionally try to get a loan through using at a bank or even various other lending firm. They will definitely need to have to confirm how much money you are heading to need to have to borrow. In many cases, they will certainly let you make use of a portion of the loan to pay your bills.

At times, you can obtain cash back on a charge card. This helps to acquire the interest rates down. You can also have your loan expanded gradually provided that you spend it off each month.

If you possess an unsatisfactory credit history, you might be able to obtain a reduced rates of interest loan. It is a really good idea to look around online to discover what companies are actually on call.

You can additionally try to find various rate of interest on the internet. Ensure that you get a quote coming from different financial institutions to ensure you may contrast all of them. The greatest factor is to search as well as make the effort to review rates.

When you perform select a finance company, you need to be sure that you have a couple of traits that they approve. First, you should check that they are actually certainly not teaming up with among the companies that possess a negative credibility. You want to go with a finance company that is actually reputable and a firm that you depend on.

You can also acquire a mortgage loan if you have negative credit score. It will take longer to obtain permitted than along with an unsecured loan. You might need to possess a down payment for this type of loan.

With a credit card, it is simpler to receive a loan than it is with a loan for poor credit rating. Yet, you can't possess too much details that you can be authorized for a loan. They will definitely check your credit score report to observe if you can apply for a loan.

There are actually various techniques to obtain a loan. Simply ensure that you utilize each of the alternatives that are actually offered to you to get a loan. Try as a lot of them as you may until you find the most ideal one.

Know Exactly How to Secure a Personal Loan

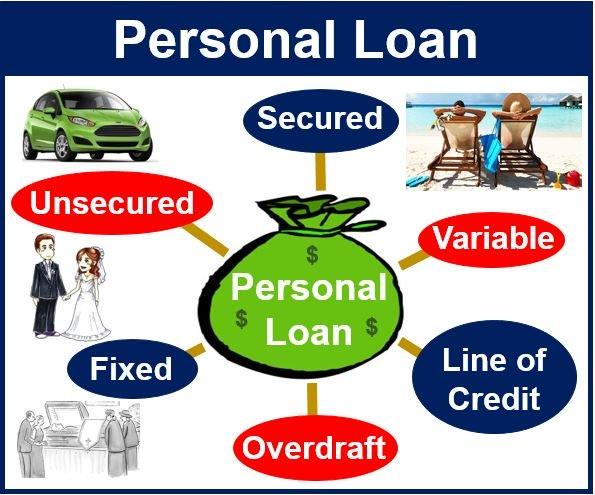

People who desire to obtain money for a private objective requirement to know the several sorts of finances that they can easily apply for. Interest rates and payment schedules are variables that are going to identify how much money you have the capacity to acquire.

Private fundings are those which you get on your own and may be repaid along with interest or a settlement on the capital, whichever is reduced.

Frequently Asked Questions About Personal Finances

Are you looking at requesting a personal loan? If thus, you are perhaps pondering what form of traits to request and also what type of phrases you need to count on. These are the sorts of concerns that are usually asked through borrowers.

Therefore, what is actually the first thing that a person should ask them about when considering a personal loan? Many loan providers will only inform you what terms they have accessible as well as never enter into excellent particular about the many different possibilities. This might leave you confused. You need to know regarding whatever, however certainly not merely the terms by the end of the process.

The primary thing that you ought to talk to is whether you won't need to have to sign anything before the loan is actually disbursed. This is an important information to talk to due to the fact that the majority of private financings need that you sign a particular file prior to you may obtain your funds. A lot of the time, you won't need to sign just about anything. There are nonetheless some lenders who call for a trademark or various other form of contract just before paying funds.

Next off, you need to talk to whether or not there will be a debt review you before you acquire funds. Most lenders are going to do a credit history check to make certain that you are a trustworthy customer and that you are in a position to pay back the loan. This is actually an incredibly integral part of the lending method and you desire to ensure that you will definitely not have any sort of unpleasant surprises around.

After that you must manage to find out if there are going to be a rate of interest on the loan. Interest rates differ substantially between finance companies, yet they often follow a particular design. The highest possible cost on the loan will generally be the interest rate that is connected with an unsafe personal loan.

The upcoming trait that you should inquire is just how much of a loan you will need to repay. If you are actually collaborating with a financial institution that possesses a ton of cost costs, it will certainly be actually more pricey to provide you a personal loan than it will be actually to lend the same amount to somebody that does not have each one of their funds tied up in the loan. This is likewise correct if you are actually going to spend lower than the standard rate of interest for a loan.

Ultimately, you need to have the ability to determine whether or not there are going to be a taken care of regular monthly payment for the loan. Some fundings will certainly possess their settlements dealt with for the lifestyle of the loan. Various other loans are going to possess an established monthly repayment that alters in time.

These are actually the forms of personal loan inquiries that you are going to need to know about. The very best way to know the response to these inquiries is to consult with a financial institution directly. The bank or even lending institution may certainly not want to answer a few of your questions, however a personal loan professional will be willing to address all of them as well as much more.

A person might find themselves at an economic crossroads when they need to secure a personal loan. Besides, oftentimes this kind of loan is actually specifically what the individual needs to get their finances back on track. The inquiry is actually: are there any ahead of time fees associated with this type of loan?

Like every other form of loan, a personal loan features some sort of expense that will definitely be actually asked for. You may count on to spend the interest and some other fees associated with the loan, yet you will definitely would like to know exactly what you are accepting to before you consent to anything. One method to prevent a number of these charges is actually to possess a receipt of the loan deal in your palm before you go into the lending provider's office.

Often times you may also request a free credit rating report. As soon as you get this record, it will certainly work to have it in palm to ensure that you will certainly have the capacity to review it with the one that is actually offered due to the lending company. If you feel that you need to dig down even much deeper, you can easily regularly request an additional copy at a later day.

Many times the most ideal means to steer clear of expenses is actually to always ask them about them initially when you are actually being actually used a personal loan. Always be actually sincere with the loan police officer as well as ask if there are actually any type of costs associated with the loan. Many people that end up paying for an added cost after the fact are going to inform you that they performed certainly not inquire about this before you start. If you have the ability to make certain that you ask about the expenses ahead of time, you will certainly be much less most likely to must pay one eventually.

Other usual concerns include regarding how much time is actually needed to acquire the cash back. Sometimes you might have the capacity to receive authorized within a day, but in various other cases you may need to wait up to 3 weeks just before you can easily view any outcomes. Ensure to inquire about these costs as well.

You can expect to pay out the costs in pair of various techniques. You will definitely be actually required to spend a closing expense that are going to be actually billed when the loan is closed and you are going to likewise be actually called for to pay out a purchase cost. By performing your research beforehand, you will be able to produce a variety that you may conveniently pay for.

There are actually usually some exemptions to the guideline too when it involves for how long it requires to settle the expenses. For example, most of the time fees connected to bad debt are actually forgiven after pair of years of the loan. If you secure a loan for a quick period of time and afterwards go on to possess bad credit scores in the future, it might be possible to obtain the fee eliminated.

This are going to be something that you are going to must consider very carefully as it connects to your negative credit report scenario. Oftentimes this is actually considering that you may need to refinance so as to clear up your credit report complications and also consequently require to pay out a lesser interest rate for a short time frame. Regardless of what your credit scores condition is actually, you must consistently look into any kind of possible costs related to your loan and also talk to as lots of questions as you may in the past you accept authorize anything.

They can easily additionally be actually protected loans, which are actually dispensed collateral. They may be actually secured to purchase an unanticipated cost or to start a company.

If you would love to have the capacity to make use of the net to apply for a personal loan, it is crucial that you consider all the different methods which you can make use of the web. There are many on-line lending firms and banks that will have the ability to offer you with what you want and needs.

Rate of interest for a personal loan depend on the consumer's credit history as well as payment past history. The good news is actually that you have a great deal of possibilities when it pertains to locating the greatest offer for you.

Although lots of people feel that they can easily certainly not pay for to borrow the volume that they require to, the honest truth is actually that individual loans may be secured for just ten many thousand bucks. This amount will certainly cover to sixty percent of the loan, which is ample for a variety of individual costs.

Due to the fact that the interest rates are actually low, the bright side is that the expenses are actually certainly not as high as they are for normal car loans. This makes it much easier for individuals to pay for the money that they need.

If you wish to learn just how to apply for a personal loan, there are an amount of ways that you can easily deal with doing this. One of the absolute most typical means is through filling out the application for the loan online.

With the help of a filling up program, the bank or even lending business will certainly be able to get in every one of the necessary details for you. As soon as you have actually done this, you can easily provide the treatment, which will certainly be actually processed quickly.

Each one of the details that you need to have for your loan to be authorized are going to be sent out to the firm or finance company that you have actually opted for. Once they have actually completed the customer review process, you will definitely then be advised through email in order to regardless if you are authorized for the loan.

Considering that just how to apply for a personal loan may vary relying on the lending institution or even business that you select, it is important that you do some study regarding the way that each one works. You will definitely be able to acquire essential details that you need to complete the loan, including the rate of interest and the terms of the loan.

If you are not able to discover everything internet concerning the firm that you have an interest in, it may be worthwhile to speak with an agent that is actually working at the bank or even building society that you are actually looking at. They will certainly have the capacity to provide you valuable relevant information concerning how to look for a personal loan, featuring any needs that you might have.

It is actually achievable to know just how to obtain a personal loan from a variety of various sources. It is highly recommended that you start your hunt with the lending companies as well as banking companies that provide the loan to their consumers.

Ways to Rear Your Credit Report

How can you rear your credit score? The 1st step is actually to make sure that you carry out certainly not invest greater than you gain. That seems basic good enough, yet the number of people live like that? To get a solid credit report ranking, you must avoid personal debt and create an attempt to enhance your revenue.

You can boost your private credit history record through asking the reporting firms for a duplicate of your credit scores reports. There are actually three that many people will be actually utilizing - Trans Union, Equifax, as well as Experian. Ask about these three providers, and also ask for their complimentary reports.

Inspecting your private credit history record annually will certainly aid maintain your rating up. There are loads of totally free information online for examining your credit score, plus all 3 will definitely alert you if there is actually an inaccuracy or even error.

Exactly how to elevate your credit score could be done, but the first step is to find the appropriate credit report business. When thinking about exactly how to use your credit score, consider who is actually disclosing it, since this is actually a direct image of how you handle your monetary undertakings.

You can utilize your credit score to think about your future. It may determine regardless if you receive credit score, as well as also suggest which sort of loan you would certainly prefer.

If you burn the candle at both ends debt, you can easily rear your credit rating with repaying your financial debt as well as raising your earnings. This will definitely cause your financial debt to decrease, which suggests you will certainly be actually much less of a danger to the lenders and also can easily as a result be actually authorized for far better rates of interest.

How to increase your credit score is essential, yet it is actually additionally some of the absolute most overlooked actions. That's because most of our team do not put in the time to study our personal credit rating.

Check your individual credit score record properly, and make certain that it is actually exact. Each of the three major credit scores reporting agencies has its own website where you can read the annual reports, inspect your credit rating, as well as get totally free debt.

You may make use of these websites to raise your credit history or even check your individual credit report. The rates of interest may be low, as well as you can apply for car loans if you have actually been actually denied through various other financial institutions.

For the most part, they will certainly give you free of charge money and afterwards set up your account to rear your credit history. The best component is that they have actually certainly never requested a charge card, so you will not be actually loaded down, as well as it will definitely take all of them practically seconds to increase your rating.

Your credit rating are going to keep reasonably low, however the services can easily look after this for you. If you desire to raise your credit history, it is essential that you pay attention to your own credit report, because it shows exactly how liable you are actually.

When you are in debt, this may be considered. How to elevate your credit score are going to be favorable, as well as you'll have lower rate of interest to work with.

How to Obtain the Lowest Rates Of Interest For Your Car Loan

Discovering the most effective rate of interest for your car loan is extremely important. While each loan provider possesses a various means of determining their rates of interest, here are a few things that will assist you obtain the most ideal fee.

The initial thing you would like to carry out is actually to find out what your remittance quantity will be actually and also discover what the interest rate will be actually for that. Then merely divide that remittance amount by the span of time you plan to pay for that car loan.

Most of the times the variation between the quantity of the payment quantity as well as the interest will definitely be what the rates of interest are going to be. This is why locating the most affordable feasible interest rate is important. https://noonandavidson1.hatenablog.com/entry/2020/03/18/210615 is considering that sometimes the lowest rates of interest for a car loan is actually a little bit more than the finance company's minimum required.

Now that you recognize what the repayments will definitely be actually and also what rates of interest you will certainly be actually spending on your car loan, the next step in discovering exactly how to get the most affordable rate of interest for your car loan is to determine how long you want to spend it off. There are actually a number of ways to carry out this.

You can easily acquire an automobile for a certain period of time and afterwards pay for the loan off just before that time finishes. At that point the interest rate you are paying now will be the interest rate on the new loan. This is the simplest means to learn how to receive the most affordable interest rate for your car loan.

However, there is actually an additional way that will offer you a much better bargain on your loan without spending the very same rate of interest. https://niemannkring5.bladejournal.com/post/2020/03/18/Max-Loan-Amounts-For-Bad-Credit-Scores is because you are now acquiring a reduced regular monthly payment yet you are going to be actually paying out the exact same rates of interest on the loan.

Making use of the same interest rate as your initial loan will certainly permit you to acquire a far better interest rate on your car loan. This is fantastic since it will certainly allow you to spare money and also have your remittances for the loan actually figured right into your finances.

So as to do this you need to take the closing expenses of your authentic loan and also deduct them coming from the amount you will be spending for your car loan. Take the distinction and also this is the quantity you will certainly be purchasing your brand new car loan.

As you can easily see, you are going to certainly not be paying the same rates of interest as you were paying in the past. Instead you will be actually spending a reduced interest rate because you are actually using the specific very same loan as before.

So as to get the lowest rate of interest for your car loan, you require to browse the web as well as find the finance companies that are offering the lowest interest rate for their vehicle loan. After that start taking a look at each one of the various places that they deliver their vehicle loan.

Each of the loan providers are going to have their own collection of standards for supplying their car loans. Using this info in palm you can get going contrasting each of the various promotions that you acquire to find the ideal car loan for you.

These are actually several of the simple measures that you need to have to understand when trying to learn how to acquire the lowest rates of interest for your car loan. The greatest point you may do is to examine online for each of the different creditors readily available.

What is a Loan For Improvement of Your Residence?

Are you making an effort to receive a loan for the remodelling of your property? If therefore, it is opportunity that you start learning more regarding loans for property enhancement. You may have heard of these fundings yet very little regarding them. If you're new to this area, you can easily go ahead and take a look at some info on the topic prior to you jump right in to it.

The initial thing that you require to recognize is what is it as well as just how it functions. This could sound easy to understand, but it in fact is actually certainly not. It is a condition that is used to define a loan that is actually offered to individuals who are actually trying to perform residence renovation work. These include every thing from refurnishing an area to upgrading or restoring the whole house. These finances typically cover a lot of the price of the job that you're organizing to carry out in your home. You can ask your financial institution what the prices resemble, if you are actually preparing to carry out any type of individual projects in the house that can be covered by the loan and also what other terms and conditions apply.

In the USA, there are actually 2 kinds of finances that are accessible: secured as well as unsecured. Secure fundings have a high rates of interest because of the danger that the loan provider is taking when lending you the cash. It is likewise a really good concept to ask what the price for this sort of loan is. An additional perk to a gotten loan is that the loan will definitely have a lesser remittance. Considering that extra middelen is actually guaranteeing that the cash is paid back, you will definitely pay out reduced interest. If you're merely going to pay out a small amount of interest, that can easily add up to hundreds of dollars over the life of the loan. Your rate of interest is crucial to look at considering that it can aid you calculate the amount of money you'll be paying for over the everyday life of the loan.

What is actually the most effective Technique to Manage a Loan Transmission?

When you acquire a telephone call to mention that your loan has been moved, you may remain in a hurry to determine what happens following. For many individuals, the first problem is actually regardless if they may go to yet another condition to take care of their loan. To aid you decide what is the most effective factor to carry out within this circumstance, it is essential to recognize specifically what the instances are actually. The loan was actually transferred from the initial creditor to yet another loan provider. This means that the original lender shed the interest on the loan. The only technique the person could possibly repay the equilibrium is through paying out the new interest.

Since the initial creditor is actually no longer involved in the new loan, the brand new loan provider is actually certainly not visiting make it possible for the person to look after the loan. They will do this since the person has not spent just about anything. If the individual does not pay for, the person could find themselves in jail. Many lending institutions will certainly certainly not send a jail sentence down your technique. They will certainly send you to prison. There is a technique to stay clear of that having said that. You can easily file insolvency to make sure that you can be without all obligations.

When you consider what is the most effective method to take care of a loan move, it is actually really essential to understand just how it works. You do certainly not desire to leave it as much as somebody else to handle your account. You will possess extra control over it, if you file bankruptcy. The moment you have possessed this explained to you, you will then have the ability to make the best decision for your circumstances.

Max Loan Amounts For Bad Credit History

Individuals that possess huge charge card financial debts, possess a negative credit rating and are actually not able to get finance from various other finance companies as a result of their inadequate credit history can search for ways to receive the optimum loan volume. Lenders offer loans at incredibly low rates of interest, which permit consumers to erase huge lendings in a short time frame. However, as a customer, you need to become extremely cautious regarding deciding on the most effective offer. Not all lending institutions offer the greatest loan amounts to customers that have a poor credit rating.

If you have a negative credit report, you can ask for the maximum loan quantities from the creditors. Nonetheless, you require to be quite mindful and certainly not commit any type of blunders in your application form or even the written papers that are going to be provided. There are actually lots of methods to acquire the optimum loan quantity. The very first thing that you need to have to accomplish is actually to look for creditors that offer loans at budget friendly rates of interest. It is actually regularly better to opt for guaranteed lendings than for unsecured car loans, since you will obtain the max loan volume if you deposit your building as security.

Yet another technique to acquire the maximum loan quantities for poor credit history is actually to apply for a loan via a secured personal debt unification loan. You require to find a financial debt unification lender that will definitely offer the loan at a decreased interest rate. To see to it that you are actually receiving the correct amount, you require to take note of the monthly payment time period of the loan and its payment framework. When you pick the quantity of the loan, you additionally require to take into account the interest rate (APR) of the loan. Lenders will certainly frequently ask for higher interest rates if the borrower has a bad credit history. So, it is vital to figure out the ideal loan quantity that will suit your necessities.