Four Should Know Cost Action Trading Approaches

Did you know that price action trading techniques are just one of the most generally used methods in today's economic market? Whether you are a temporary or lasting investor, evaluating the rate of a security is perhaps one of the simplest, yet also the most powerful, means to gain an edge in the market.

Besides, every trading sign in the world is stemmed from rate, so it makes good sense to really examine it, recognize it, learn from it as well as use it in your trading. In this article, we cover all you need to know about cost action trading such as: what is cost action and also why you need to think about trading rate activity forex - in addition to - undergo how to trade 4 cost action trading approaches.

What is Price Activity?

The term 'rate activity' is simply the study of a protection's rate motion. In rate action trading, traders would certainly look to examine historical cost to recognize any kind of ideas on where the market can relocate next off. One of the most frequently utilized rate activity indication is the research study of rate bars which give information such as the open and closing price of a market as well as its low and high price levels during a particular time period.

Evaluating this information is the core of rate action trading. Actually, in responding to the question 'what is cost activity?', it could be said that it is truly the research study of the activities of all the customers as well as vendors actively associated with any kind of given market. As a result, by evaluating what the remainder of the market participants are doing, it can give traders an one-of-a-kind edge in their trading choices.

One of the most generally used price bars which are made use of as a price activity indicator, are called candle holders. All trading platforms on the planet deal candle holder charting - verifying simply how prominent cost action trading is.

What is a Rate Activity Indicator?

As talked about over, we now recognize that rate action is the research of the activities of all the purchasers and also sellers proactively associated with a provided market. The most commonly made use of cost action sign is a candlestick, as it offers the trader valuable info such as the opening as well as closing price of a market as well as the low and high price levels in a user-defined period.

If you were to check out a day-to-day chart of a security, the above candle lights would certainly represent a full day's worth of trading. Both candle lights provide useful details to a trader:

- The low and high price levels tell us the highest rate and also cheapest price made in the trading day.

- The vendor candle light, shown by a black, or occasionally red, body informs us that sellers won the fight of the trading day. This is because the closing price level is lower than the opening price level.

- The buyer candle, shown by a white, or in some cases green, body informs us that buyers won the fight of the trading. This is since the closing price level is higher than the opening price level.

Utilizing this basic candle configuration is just one of the first steps towards developing a price action method. For instance:

- If after the seller candle light, the next candle goes on to make a new reduced after that it is a sign that vendors want to go on selling the market. This weakness will trigger some investors to start short positions or hold on to the brief positions they already have.

- If after the buyer candle, the next candle takes place to make a brand-new high after that it is an indication that customers want to keep on getting the market. This strength will certainly create some traders to initiate long (buy) settings, or hang on to the long positions they currently have.

This kind of cost action evaluation is just one means to make use of candlesticks as a cost action indication. Nevertheless, the candles themselves typically form patterns that can be utilized to develop a cost activity technique. Prior to we consider these patterns, allow's very first take a look at where they work best.

Cost Action Foreign Exchange Trading

As price action trading includes the evaluation of all the customers as well as sellers active on the market, it can be made use of on any type of monetary market there is. This consists of forex, stock indices, stocks and shares, assets as well as bonds. You can check out instruments within all these markets on candlestick graphes as well as, as a result, carry out a cost action method on them.

Nonetheless, the foreign exchange market has some details benefits for price activity investors, such as:

- Open 24 hr a day, five days a week - a true representation of buying and selling throughout all continents.

- Large liquidity - allowing you to sell and out of markets within nanoseconds.

- Low spreads - some, not all, forex currency pairs use low spreads which can keep the investors' commission costs low.

- Leverage - foreign exchange trading is a leveraged item definition you can control a large position with a small down payment. This could imply big wins however also large losses, so please profession sensibly.

These are just some of the reasons that cost activity foreign exchange trading is prominent. In the next section, we will certainly use rate action foreign exchange as examples before carrying on to a forex cost activity scalping technique.

Rate Action Trading Techniques

A trading technique requires three various components: the why, just how and what.

The 'why', is the reason you are taking into consideration to trade a certain market. This is where rate action patterns come in use. With your price action evaluation, you will gain a side on what is more probable to occur following - the market rising or down.

The 'exactly how', is the mechanics of your profession. In essence, it is the manner in which you will trade. This evaluation includes knowing your price levels for entrance, stop-loss as well as target. Besides, trading is everything about probabilities so you must protect on your own, and also reduce losses, in case the marketplace moves versus your setting.

The 'what' is the outcome of the profession. What are you wanting to attain from it? Is it a temporary trade or long-lasting profession? This boils down to just how you take care of the profession to profitability and manage yourself if the outcome is not what you desire.

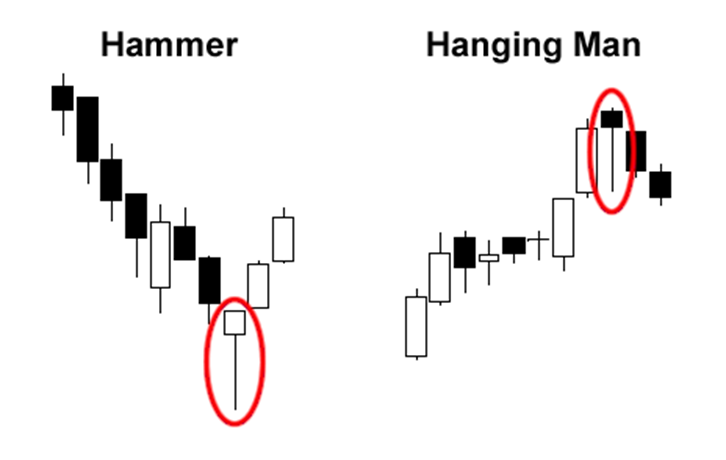

Cost Action Strategy # 1: The Hammer

The hammer cost action pattern is a favorable signal that indicates a higher probability of the marketplace relocating greater than lower and is made use of largely in up-trending markets. Right here is an instance of what a hammer candle appears like:

A hammer shows vendors pressing the market to a brand-new reduced. However, the sellers are not strong sufficient to stay at the reduced and also choose to bail on their positions. This causes the marketplace to rally back up, leading buyers to also enter the market. The open as well as close price levels must both remain in the upper half of the candle light. Typically, the close can be below the open however it is a stronger signal if the close is above the opening price level.

THE ENTRY: A possible price level to go into a profession, could be when the next candle ultimately takes care of to break the high of the hammer candle light. The high of the hammer candle light - which formed on the week of February 10, 2019 - is 1.2959. For that reason, an entry price could be 1.2960.

THE STOP-LOSS: A feasible stop loss level could be at the low of the hammer candle. If the marketplace sets off the entrance price yet no other purchasers step in, it's an advising indication the market may require to go lower for any customers to be discovered. For that reason, you would certainly not want the stop loss to be as well close to your access. With the reduced of the hammer candle at 1.2727, a possible stop loss could be 1.2726.

THE TARGET: There are multiple ways to exit a sell revenue such as leaving on the close of a candle light if the profession remains in profit, targeting levels of support or resistance or utilizing tracking quit losses. In this circumstances targeting the previous swing high degree would certainly lead to a target cost of 1.3200.

THE PROFESSION: With an entry cost of 1.2960 as well as stop loss of 1.2726 the overall threat on the trade is 234 pips. Trading at 0.1 whole lot would mean that if this profession triggered the entry price, then hit the stop loss, the overall loss would be $234. In this circumstances, the market traded greater to the target rate resulting in an approximate trade profit of $240.

Rate Activity Strategy # 2: The Shooting Star

The shooting star rate action pattern is a bearish signal that represents a greater chance of the marketplace relocating less than higher and also is utilized mostly in down trending markets. Essentially, it is the opposite of the hammer pattern.

A shooting star reveals purchasers pressing the marketplace to a brand-new high. However, the customers are not solid sufficient to remain at the high as well as choose to bail on their settings. This triggers the marketplace to drop reduced, leading vendors to additionally step into the market. The open as well as close price levels must both remain in the lower fifty percent of the candle. Traditionally, the close can be above the open however it is a stronger signal if the close is listed below the opening price level.

THE ACCESS: A feasible price level to enter a profession, could be when the marketplace finally manages to break the low of the shooting star candle. The low of the 3rd shooting star candle light - which based on the week of November 4, 2018 - is 1.2957. Consequently, an entrance cost could be 1.2956.

THE STOP-LOSS: A possible stop loss degree could be at the high of the shooting star candle light. With the high of the shooting star candle light at 1.3173, a possible quit loss could be 1.3174.

THE TARGET: There are numerous ways to leave a trade in revenue such as exiting on the close of a candle light if the trade is in earnings, targeting degrees of support or resistance or utilizing trailing quit losses. In this circumstances targeting the previous swing reduced level would lead to a target rate of 1.2663.

THE TRADE: With an access rate of 1.2956 and also quit loss of 1.3174 the overall danger on the profession is 218 pips. Trading at 0.1 great deal would imply that if this profession caused the entry cost, after that struck the quit loss, the total loss would be $218. In this instance, the market traded lower to reach the target cost causing an approximate trade profit of $293.

Price Activity Approach # 3: The Harami

The harami cost activity pattern is a 2 candle pattern which stands for uncertainty on the market and also is utilized largely for breakout trading. It can also be called an 'inside candle formation' as one candle kinds inside the previous candle's array, from high to reduced.

A bearish harami forms when a seller candle's high to low range develops within the low and high series of a previous buyer candle light. As there has been no continuation to form a new high, the bearish harami represents indecisiveness in the marketplace which can bring about a breakout to the drawback.

A bullish harami kinds when a buyer candle's high to reduced array establishes within the high and low series of a previous seller candle. As there has been no continuation to create a brand-new low, the bullish harami represents uncertainty out there which could result in an outbreak to the upside.

Trading The Favorable Harami Price Activity Pattern:

- Determine bullish harami pattern (a customer candle light's high and low array that develops within the high and low series of a previous seller candle light).

- Get in one pip above the high of the last candle light.

- Location a stop loss one pip below the low of the previous candle light (to give the profession some space to take a breath).

- Target a one-to-one benefit to risk which suggests targeting the exact same amount of pips you are risking from entry cost to quit loss price.

- If the profession has actually not caused by the open of a brand-new candle light, cancel the order. If the profession has set off leave it in the marketplace until stop loss or target levels have been reached.

Trading The Bearish Harami Price Action Pattern:

- Determine bearish harami pattern (a vendor candle's high and low range that creates within the low and high range of a previous purchaser candle).

- Get in one pip below the low of the last candle light.

- Location a quit loss one pip over the high of the previous candle light (to provide the trade some space to take a breath).

- Target a one-to-one reward to run the risk of which suggests targeting the very same quantity of pips you are risking from access cost to quit loss cost.

- If the profession has actually not set off by the open of a new candle light, cancel the order. If the trade has triggered leave it in the market up until stop loss or target levels have actually been gotten to.

Price Action Technique # 4: Forex Price Action Scalping

There are a range of forex cost activity scalping strategies offered to traders. Nevertheless, as scalping includes taking extremely short-term trades several times a day, there are much more filters required to trade a price activity configuration.

A vital filter may be to find markets that are in a 'fad' which assists investors determine who is in control of the marketplace - the customers or vendors. Relocating standards (MA) are a beneficial trading indication that can aid identify this. As scalpers are looking for short-term actions, faster moving averages - such as the twenty period and also fifty duration relocating standard - are generally used.

Final thought

Rate activity trading is a powerful device as well as commonly utilized by investors all over the globe. Is it time for you to integrate it into your trading?

Profession Risk-Free With A Trial Account

Did you know that it's possible to patronize online currency, making use of real-time market information and also understandings from expert trading professionals, without putting any one of your funding in danger? That's right. With an Admiral Markets' risk-free trial trading account, specialist traders can examine their techniques as well as ideal them without risking their money.