Investing in mutual funds online has become increasingly popular in recent years. Mutual funds are a type of investment vehicle that pools money from multiple investors and invests it in various securities such as stocks, bonds, and money market instruments. The returns from the investments are then distributed among the investors in proportion to their investment.

Investing in mutual funds online is a simple and convenient process that can be done from the comfort of your home. Here is an introduction on how to invest in mutual funds online:

- Choose a reliable online investment platform: There are several online investment platforms available, such as Groww, Scripbox, Zerodha, etc. Choose a reliable platform that offers a user-friendly interface and has a good track record.

- Complete the registration process: Once you have selected an investment platform, complete the registration process by providing your personal and bank details.

- KYC (Know Your Customer) verification: To invest in mutual funds, you need to complete the KYC verification process. This involves submitting your PAN card, Aadhaar card, and other documents as required by the platform.

- Select the mutual fund: Once your KYC verification is complete, you can select the mutual fund that you want to invest in. You can filter the funds based on various criteria such as fund type, investment objective, past performance, etc.

- Invest in the mutual fund: Once you have selected the mutual fund, you can invest in it online by specifying the amount you want to invest and completing the payment process. Most investment platforms allow you to invest through various payment modes such as net banking, UPI, debit/credit card, etc.

- Monitor your investments: After investing in a mutual fund, it is important to monitor your investments regularly. You can track the performance of your investment through the online platform and make any necessary changes to your investment strategy.

We will discuss how to invest in mutual funds online in this article by:

- assessing the effectiveness of mutual funds

- Choosing the appropriate strategy for your portfolio

- following a straightforward procedure to begin

Assessing the effectiveness of mutual funds

A wonderful place to begin your money creation journey is with mutual funds. Yet, the investment goals of various mutual funds vary. This determines the performance, risk, and asset allocation.

Hence, it's crucial to assess its performance and make sure that it's in line with your long-term financial objectives and lets you invest in mutual funds online.

Compare data:

You can start by comparing the performance of the fund to the performance of its benchmark. A good mutual fund should outperform the benchmark in the long-term. You should also compare the performance of similar funds in the same category from other asset management companies. It is important to check whether the fund’s returns are consistent over a longer period of time.

Read the Factsheet:

Every mutual fund scheme is required to publish a factsheet each month. On the website of the relevant AMC, it is conveniently available. To learn more about the fund, its investment goal, risk, NAV, and portfolio characteristics, read the factsheet. In terms of allocation and risk, keep in mind that a strong mutual fund doesn't stray from its investment aim.

Track Record:

It is equally crucial to evaluate the fund manager's experience and long-term track record in addition to the fund's performance.

You may obtain a fair sense about the performance of mutual funds using these factors and invest in mutual funds online.

Choosing the appropriate strategy for your portfolio

In addition to assessing a mutual fund's performance, it's critical to determine whether it is a good fit for your portfolio.

To do this, you must first decide on your financial objectives and investment goals. Some examples of short- and long-term goals you might have include getting married, buying a house or car, saving for retirement, or getting an education.

You should also determine your investment horizon and risk tolerance in addition to this. Next, consider what your portfolio needs in terms of diversification or asset allocation.

You can seek advice from the knowledgeable professionals at Globe Capital on all of these fronts. You can choose from a variety of mutual fund categories at Globe Capital, including high return, tax-saving, top firms, etc.

Following straightforward procedure to begin:

Mutual fund investments can be made using a one-time lump amount or a systematic investment plan (SIP). The main distinction between the two is that with a lump sum investment, you must make the entire investment at once, whereas with a SIP, you can make monthly fixed-amount investments in a specific mutual fund scheme. SIP calculators can be used to calculate the amount and frequency of to invest in mutual funds online.

Some of the popular SIP options include Regular SIP, Top-up SIP, Flexible SIP, and Perpetual SIP.

As you are aware, there are numerous types of mutual fund schemes on the market right now. It is important to have a thorough understanding of the product, its risks, and potential benefits before selecting the best mutual fund scheme. So, you should consult a knowledgeable expert before making a mutual fund investment.

You can invest in mutual funds online to gain access to a variety of mutual funds and the appropriate counsel.

Just carry out these actions.

- Open a Globe Capital account. It is a totally cost-free, paperless procedure.

- Next, choose Mutual Funds as your preferred segment.

- Complete the questionnaire on risk profiler-cum-asset allocation.

- Choose a fund that matches your financial objective, level of risk tolerance, and investment horizon.

- Start investing

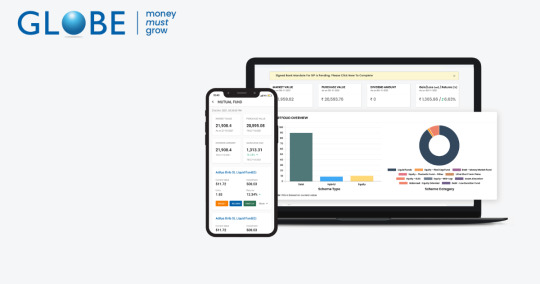

You can also download the Globe Capital app as a Globe Capital client, which serves as a one-stop shop for all of your mutual fund investment requirements. You can use it to manage your investments, obtain reports with lots of useful information and performance analysis, and conduct online transactions for your mutual fund purchases.

In conclusion, buying mutual funds online is a straightforward and practical approach. To guarantee that you meet your investment objectives, it is crucial to pick a reputable platform and to constantly review your assets.