The demand within the global natural gas liquids market is rising at a sturdy pace in recent times. In the contemporary scenario, use of hydrocarbons has gained momentum in several industries and sectors. The residential, commercial, and industrial sectors have emerged as important consumers of natural gas liquids. Domestic uses of these liquids have helped in driving sales across the global market. Furthermore, the humongous demand for hydrocarbons in industrial manufacturing has also created a plethora of opportunities for market maturity. Some of the common industries where natural gas liquids are used are plastics, detergent manufacturing, and anti-freeze agents. The next decade has witnessed the inflow of increased revenues over into the hydrocarbons industry.

- The transportation sector has emerged as an important consumer of hydrocarbons in recent times. This factor has directly influenced the demand within the global natural gas liquids market in the years to follow. Blowing agents used for polystyrene foam have become an important industrial ingredient, and have helped in driving market demand and maturity.

- Heating applications in the residential and commercial sectors involve the use of natural gas liquids. Blending of propane and gasoline is also an important chemical process that also necessitates the use of natural gas liquids. The total volume of natural gas liquids used in the industrial sector has increased in recent times.

- Ethanol is extensively used for manufacturing personal care products such as perfumes and sprays. LPG cylinders experience increased demand in recent times, and this is an important dynamic of market growth. Blending vehicle fuel necessitates the use of new-age technologies. This factor has also generated fresh demand within the global natural gas liquids market. Gasoline and solvent manufacturing are other important areas of application for natural gas liquids. The revenue index of this market shall improve in the following years.

The onset of the coronavirus has paralyzed commodity supply chains in China due to cancelled shipments and delayed stocks that are now piling up. Short-term sales of natural gas liquid and crude oil in China have come to a halt, thus slowing down the economic activity of the region. On the other hand, buyers in China’s natural gas liquid market are concerned about legal actions that could be taken against them in case they honor purchase agreements. Moreover, spot crude trade has also reached a halt, thus affecting imports for independent refiners.

According to popular news outlets, sellers of crude oil and natural gas liquid managed to sell some cargoes for the month of April before the Chinese New Year. However, consecutively, all trade activities have been stopped. Chinese buyers are increasing efforts to invoke the force majeure clause on imports. However, producers state that they have not received any notices from buyers so far. In order to avoid damaging the relationship with sellers, Chinese buyers are resorting to divert or resell cargoes for the time being.

U.S. Companies Expand Exports to Australia amidst Geopolitical Uncertainty

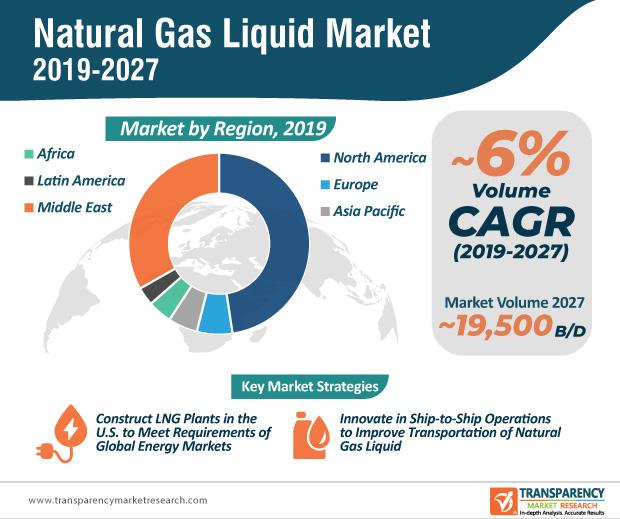

Traders are expected to tap incremental opportunities in the U.S. natural gas liquid market after all economic activities are put to practice post the COVID-19 pandemic. The flourishing liquefied natural gas (LNG) industry of the U.S. is grabbing the attention of traders whilst North America is estimated to dictate the highest revenue among all regions in the market landscape. Hence, companies are increasing efforts to construct natural gas liquid plants in the U.S. that are capable of transforming global energy industries. Thus, under construction infrastructure projects worth billions of dollars are anticipated to create revenue streams for stakeholders.

Companies in the U.S. natural gas liquid market are increasing their production capabilities to supply LNG to Europe and Western Europe. This explains why the global market is anticipated to reach an output of ~19,500 Thousand B/D by the end of 2027. However, complexities surrounding the market for natural gas liquid in the U.S. such as prevailing geopolitical uncertainty and increasing competition are likely to hamper market growth. Hence, companies are advancing in liquefying technologies by expanding their exports to Qatar and Australia.

REQUEST FOR COVID19 IMPACT ANALYSIS –https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=9767

Unprecedented Rise in LNG Production Fuel Transportation Innovations

Transport innovations are one of the most prominent trends revolutionizing the natural gas liquid market. As such, companies are increasing their focus in ship-to-ship operations to improve oil and gas transportation. For instance, Fluenta— a specialist in flow sensing and ultrasonic technology, revealed that container ship Wes Amelie received natural gas liquid fuel with the help of the innovative ship-to-ship technique, thus marking an important step in the global energy industry. Such innovations play an instrumental role in boosting market growth, which is estimated to progress at a modest CAGR of ~6%.

The natural gas liquid market is witnessing a rapid rise is production activities, owing to technological innovations. Marine vessels in the market for natural gas liquid are adapting to the unprecedented surge in LNG production, as they make efforts to retrofit barges with cooling facilities to efficiently store the novel fuel.

Europe Attracts LNG Supply by Switching from Coal-to-Gas in Power Sector

Natural gas liquid is being highly publicized as low-carbon energy system, which is building the credibility of companies in the market landscape. Europe is anticipated to absorb most of the natural gas liquid supply from exporters, as users are switching from coal to gas in the power sector. As such, Europe is projected to dictate the third-highest revenue in the natural gas liquid market.

A modest rise in imports to Asia are benefitting traders in the natural gas liquid market, owing to rising electricity generation in Japan and South Korea. According to the U.S. Energy Information Administration, Australia, is predicted to emerge as one the largest global exporters of LNG in the coming years. Companies are initiating strategic ties with traders in Japan, China, and South Korea to generate revenue opportunities.

Natural Gas Liquid Market: Introduction

- Natural gas liquids (NGLs) are primarily hydrocarbons and they belong to the same family as that of crude oil and natural gas. Hydrocarbons are primarily composed of carbon and hydrogen. Ethane, propane, isobutane, butane, and pentane are all NGLs.

- Ethane is an organic chemical compound. At standard temperatures and pressures, ethane is a colorless and odorless gas. Like several hydrocarbons, ethane is separated on an industrial scale from natural gas and as a petrochemical byproduct of petroleum refining.

- Propane is a three-carbon alkane, with the molecular formula C₃H₈. It is a gas at standard temperatures and pressures. However, it can be compressed to form a transportable liquid.

- Propane is commonly used for space and water heating, for cooking, and as a fuel for engine applications such as forklifts, farm irrigation engines, fleet vehicles, and buses

- N-butane, also known as normal butane, is a flammable, colorless, and mostly non-toxic gas with odor similar to that of natural gas. Normal butane can be used for gasoline blending, as a fuel gas.

- Isobutane is a colorless gas, with faint petroleum-like odor. It is shipped as a liquefied gas under its vapor pressure. Contact with this liquid can cause frostbite.

- Pentanes plus is a mixture of hydrocarbons, mostly pentanes, which are heavier. It is extracted from natural gas. Pentanes plus contains isopentane, natural gasoline, and plant condensate.

Purchase A Report-https://www.transparencymarketresearch.com/checkout.php?rep_id=9767<ype=S

Rise in Utilization of Unconventional Gas Resources to Drive Natural Gas Liquid Market

- Natural gas is a hydrocarbon gas formed in over thousands of years from burying of dead plants and animals. High temperatures and pressures caused by burying of dead plants and animals triggers a reaction, which leads to formation of natural gas. In some cases, special or advanced production techniques are employed to extract natural gas. The gas obtained in this manner is termed as unconventional gas. Unconventional gases include shale gas, tight gas, gas hydrates, and coal bed methane. Unconventional oil and gas has been an important breakthrough for the global oil industry.

- According to the World Energy Council, the U.S. has 1,161 trillion cubic feet of technically recoverable unconventional gas. China has 1,115 trillion cubic feet of unconventional gas. The U.S. was the leading country in terms of production of unconventional gas in 2018. Its annual production of unconventional gas stood at 22 trillion cubic feet in 2018. China’s production output stood at 10 trillion cubic feet in the year.

Volatile Crude Oil Prices to Hamper Natural Gas Liquid Market

- Prices of crude oil are affected by events that can potentially disrupt the supply of oil and gas. These include geopolitical events and weather-related issues. Geopolitical events is a major factor that can create uncertainty about future supply of or demand for oil and gas. This can lead to higher volatility in prices of oil and gas.

- The Middle East accounts for a major share of the global oil & gas industry. It is a highly unstable region, due to political issues that create uncertainty amongst investors investing in oil and gas production. Prices of oil and gas have witnessed steady rise since the decrease in prices of crude oil in 2014.

- Volatility in prices of crude oil affects the production of oil and gas. This, in turn, is expected to restrain the global natural gas liquid market from 2019 to 2027.

Declining Natural Gas Prices Worldwide to Provide Opportunities to Natural Gas Liquid Market

- The U.S. Energy Information Administration (EIA) forecasts that the average U.S. natural gas prices would decrease by 9% at the end of 2020. The EIA expects that lower prices of natural gas would be the result of continued growth in production of natural gas, primarily in response to the following factors:

- Improved drilling efficiency and reduction in costs of drilling

- Higher production of associated gas from oil-directed rigs

- Increased takeaway pipeline capacity from the Appalachian and Permian production regions

- Prices of natural gas have been decreasing since 2009, but they dropped significantly in 2012. This downward trend of natural gas prices is expected to continue throughout the forecast period, with a few exceptions. Oversupply of and low demand for natural gas have led to decline in natural gas prices.

- However, natural gas production has neither decreased nor is it expected to decrease during the forecast period. Natural gas producers and natural gas processing plant operators have started shifting their attention toward natural gas liquids (NGLs) for increasing profitability and keeping business operations viable, as NGLs have higher prices and they witness higher demand.

- Moreover, the EIA expects that use of natural gas in the electric power sector in the U.S. to likely to increase by 1.3% by the end of 2020, as a result of natural gas-fired generation of electricity that continue to replace coal-fired generation

- Thus, lower prices of and low demand for natural gas can boost the sale of natural gas liquids during the forecast period

Recent Developments, Expansions, Acquisitions, and New Contracts in Natural Gas Liquid Market

- In May 2019, Occidental Petroleum announced conclusion of an agreement to acquire Anadarko Petroleum in a transaction that is expected to be completed during the second half of 2019. The combined company is estimated to have an enterprise value of more than US$ 100 Bn. Also, these two companies together would hold a diverse portfolio of midstream, chemical, unconventional and conventional assets.

- In December 2018, Easton Energy LLC, a U.S.-based midstream company, announced to have acquired approximately 416 miles of Gulf Coast natural gas liquid (NGL) pipelines from The Williams Companies, Inc. by paying US$ 177 Mn. These pipeline assets previously owned by The Williams Company have been primarily used to transport natural gas liquids from various supply sources to petrochemical consumers in Texas and Louisiana, the U.S. The acquisition was completed in partnership with Easton's financial sponsor i.e. Cresta Energy Capital, a private equity firm located in Dallas, the U.S.