Table of content

- What Is Finance App?

- What Does A Personal Finance App Do?

- How Do You Make Your Own Money App?

- How Much It To Making A Personal Finance App

- Conclusion

You could make money by making a personal banking app with lots of useful features.

Personal funds like bills, receipts, income sources, spending, overhead costs, policies, set deposits, and other financial things have become hard for people to handle.

People would love to have an app that lets them keep track of all their money in one place. It is possible to keep track of all of your money, investments, and other spending in one place. With this kind of app, you can also handle your money without using paper.

People can handle their money in a more responsible way with this kind of app. So, making personal banking apps might be a good idea.

Even though there are already a lot of apps like Mint on the market, you can quickly get a big share of the market if you have any unique features or benefits to give your users.

One thing is for sure, though: your personal finance app needs to be very functional, simple to use, and easy to browse.

Our lives are much easier and more comfortable now that we have technology. It's easy to call a taxi or order food from home when you have a smartphone.

Let's look at some numbers about mobile apps before we get into the details:

It's now normal to use mobile apps. These numbers only show the same thing.

You've chosen to make a personal finance app. But do you know all the little things that go into making an app? We'll talk about everything you need to know to make a personal finance app.

What is finance app?

An all-in-one personal finance app keeps track of all your assets, debts, bills, bank transfers, investment records, and other financial information. The app keeps all of these records in a neat order and makes it easy to keep track of your financial actions.

Not only that, but a personal finance app also helps you better handle your money by giving you tax advice, investment advice, and other money-related help.

A Look at the Market

It's a good idea to do a lot of study on the market before you start anything. It will tell you about the market, your competitors, and other things that will help you figure out if your idea is possible.

Personal banking apps are already out there in a number of different forms. Here are some of them:

Mint: Mint is a free app for personal banking that lets users keep track of their spending.

You Need a Budget : is another money app that can help you pay off debt and make a budget.

Prism: People can pay their bills online with this app.

Spendee: Spendeee lets you keep track of your shared costs.

EveryDollar : is an app that helps you make a budget and keeps track of your spending.

PocketGuard: The app's interface is easy to use, and it helps you keep track of your money.

Not only that, but a lot of banks are getting into personal finance with good apps.

We can see one thing: there is competition in this market. But if you can give your audience something that no one else can, you can get ahead of the market and build your own audience.

What Does a Personal Finance App Do?

Making a personal finance app should be all about making it easier for people to handle their money. The app needs to have features that make managing money easy and quick for people, which will make their lives better.

The app should be able to do some of the following:

- People should be able to keep track of their bills and other services with this app.

- The app should let users figure out how much money they make and how much they spend.

- People should be able to make good budget plans with this app.

- The app should help people order their money in a smart way.

- The app needs to be able to make results that are useful.

You can make two kinds of apps for managing your own money.

- An app with only the most basic features

- An app with a lot of complicated features

A simple app lets users enter information by hand. While the app doesn't ask you to connect your bank account, there are no risks involved. Also, making a simple app costs less than making a complicated app.

Complex apps, on the other hand, let users connect their cards to the app. It has a lot of advanced tools that let users do advanced tasks. In addition, the app gives users real-time updates that help them better handle their money.

Here are the steps you need to take to make a personal finance app that stands out, gives users what they want, and gets you more downloads.

How Do You Make Your Own Money App?

Here are the steps you need to take to make an app for small business owners.

1. Figure out who you want to reach.

The first thing you should do is figure out who you're writing for. Describe them by their age, where they live, their gender, and other factors. For example, you can target the group of housewives who have trouble keeping track of their spending. An app that is easy to use can help them keep track of their bills, expenses, and other services.

Once you know who you're writing for, write down the problems they are having. For their pain points, it's important that you meet their needs. Plan how you will deal with those problems by adding features that will help them.

2. Do research on your competitors

It is very important to know who your rivals are and what they are doing. You will learn a lot that will help you with making apps.

Check out the apps that your rivals are making and see what features and functions they offer. You can learn a lot by looking at how they make money.

The most important thing is to look at the services they don't provide to their guests. The features you want to add to your app will depend on the service gap you find.

3. Explain why you want to make an app.

Why do you want to make a personal business app? This is how to make a personal banking app, which is what you asked.

Once you know what you want to do, you can make a plan for how to build your app. At this point, you should also decide what kind of information you need from users and what features you want to add to your app.

4. Don't forget about safety

When you ask for private personal information like financial information from your customers, your app needs to be very safe and follow all the security rules set by the government. The most important thing about your personal finance app is its security, and making mistakes is not at all okay.

When it comes to data protection, compliance authorities like GDPR and others take extra care. As long as you follow these rules, you won't have to worry about fines, other problems, or your brand's image.

Here are some safety steps you might want to think about:

- To protect the data, Two-Factor Authentication asks people for two different ways to prove who they are.

- Also, cut down on the session mode, like you see in banking apps.

- For users' personal financial information to be shown on the screen, don't use bright colors and fancy styles.

- Pay attention to the rules set by groups in charge of data security, like PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

- If you've added the ability to chat to the app, use data protection methods.

5. List the features of your app

Now is the time to make a list of all the features you want the app to have. Make a list of all the things that a personal finance app should have.

You can add things like user registration, a profile, tracking of income and expenses, notifications, linking of bank accounts, calculations, reports, an investment guide, the ability to share on social media, the ability to post reports, and more.

6. Pick a tech stack

You need to choose the right technology stack for your app now that you have a short list of features. A very important part of making an app is picking the right tech stack.

Databases, libraries, frameworks, computer languages, front-end and back-end technologies, and more are all part of this tech stack.

The front end of creation is all about how people will use the app. To get people to look at this, you need an easy-to-use and powerful UI.

To get the best UI for your app, be smart about the front-end technology you pick. For front-end programming, you can use technologies like HTML, CSS, and JavaScript.

Backend technologies, on the other hand, are all about loading data, keeping things safe, and making deals easy. For building the back end, you can use computer languages like Ruby, Python, C#, and C++.

7. How to Make the Best UI/UX Design

A user interface (UI) has a big effect on how people think about and use your app. It takes a lot of time and money to make sure that your app's user experience is the most innovative and easy to use possible.

It should be clean and simple, but still very useful and appealing. That's the only way to give users the best experience. Get the best designers for the job and let them use their skills to give you the best UI/UX choices.

8. Making and testing apps

In this step, the app is actually built. Hire professional mobile app makers who have worked in this field before.

Ask the developers to work on the most basic functions first, then the more complicated ones. Make sure you follow an agile app development method so that the app can be made on time.

After that, testing and fixing bugs come next. Developers and quality testers usually work together to find bugs and other mistakes and fix them as the project is being built.

But make sure there are no bugs or mistakes in the app and that all of its features work well before you launch it.

9. Starting up an application

Once all the problems with how it works have been fixed, it's time to start the app. The first thing that should be done is to give the app to a small group of people and ask them what they think. Based on the comments and suggestions you get, you can make some changes to the app.

10. Maintenance and changes

This is the last step in the process of making an app. You need to make sure that the app is still being watched by writers and updated from time to time after it has been released.

Sometimes problems happen for no clear reason. When this happens, you need to act quickly to fix the problems and give your users a good experience.

How much it costs to make a personal finance app

There aren't any hard and fast rules about how much it costs to make an app. A lot of things come into play, like the features you want to add, the size and scope of the app, where the workers are located, and more.

Most of the time, making a personal banking app will cost between $40,000 and $60,000. It could cost more if you want to add third-party APIs to make features better.

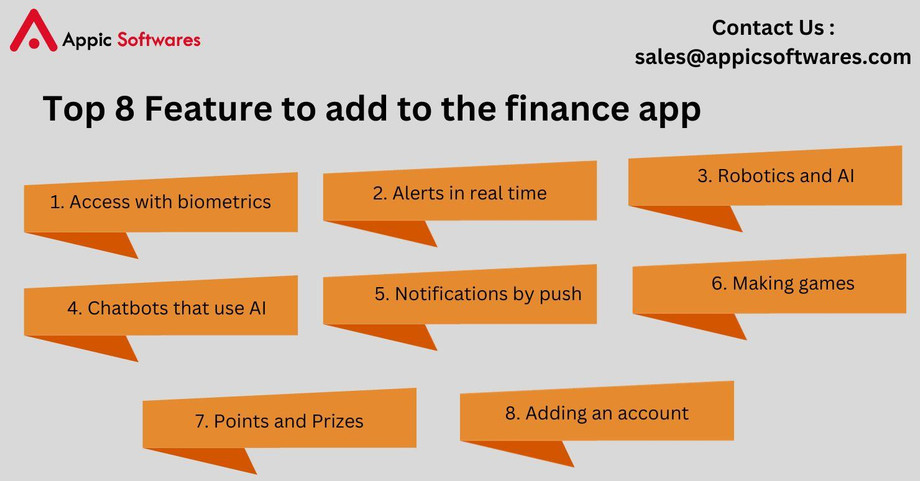

More advanced features will be added to the personal finance app.

If you want to make your personal finance app more useful for your users, here is a list of advanced features you should add.

1. Access with biometrics

Biometric entry is a way for the app to make sure that the user is who they say they are. It uses something special about a person, like their voice pattern or fingerprints, to prove who they are.

These days, adding this feature to an app to make it safer is pretty widespread.

2. Alerts in real time

This function gives users updates in real time to build their trust. Make sure that users are always up to date on the latest news and information by giving them notifications about it.

3. Robotics and AI

AI is a tool that helps companies understand data better so they can give users a more personalized experience. AI systems can help you give app users a more tailored experience.

In this case, the app can let users know when they are spending too much on a certain area, like groceries or entertainment. You can also make things easier for users by showing graphs of spending for different groups.

4. Chatbots that use AI

This is for people who are having trouble with the app or are looking for special information. Chatbots that use AI can also look at customer data and patterns of behavior to make personalized ideas, recommendations, or tips. It helps them keep track of their money better.

5. Notifications by push

You can keep your customers up to date on news, deals, suggestions, and other things with push alerts.

Say you want to let people know about a deal on a yearly subscription. You can do this through push notifications. It's also okay to remind them of things like bill due dates.

6. Making games

Adding a game-like element can help you keep your users interested. People can have a great time with the app and spend more time on it.

7. Points and Prizes

People really enjoy it when they are rewarded for their hard work.

You can reward your viewers with things like cashback, points, discounts, and coupons. That way, your app users will be more likely to use it.

8. Adding an account

Credit cards, debit cards, loans, mutual funds, fixed deposits, and other types of financial details should all be able to be added to the app by users. One app should be enough to keep track of all the info.

In conclusion

How to make a personal banking app is already something we've talked about. We've gone over everything here, including the step-by-step guide, features, price, and other important information.

You can easily make money with a personal finance app, and you can give people a one-stop shop for managing their money well.

Hire a mobile app development business that works in this area and have them make you a personal finance app that is complete, has lots of features, and works.

Finance app development company Appic Softwares has the best tools for businesses and large organizations to hire.

They can give you the best developers, designers, and quality analysts at the best price on the market, whether you need a single developer or a whole team of devoted developers. Now is the time to hire professionals to help you make an app.