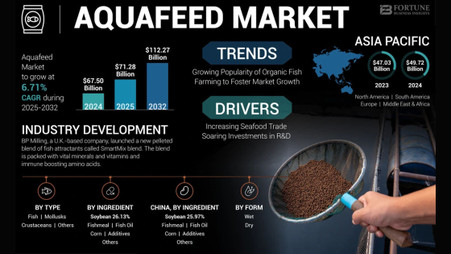

The global aquafeed market was valued at USD 67.50 billion in 2024 and is expected to expand from USD 71.28 billion in 2025 to USD 112.27 billion by 2032, registering a CAGR of 6.71% during 2025–2032. Asia Pacific remained the dominant region, accounting for 73.65% of the global share in 2024. In addition, the U.S. aquafeed market is projected to witness strong growth, reaching USD 2.85 billion by 2032, supported by the presence of leading companies such as Cargill Incorporated, Archer Daniels Midland Company, and Alltech Inc.

The COVID-19 pandemic had a significant and immediate impact on the global aquafeed industry, primarily due to supply chain disruptions and temporary production halts. While the pandemic initially led to reduced output and distribution challenges, the market is expected to regain momentum as demand and operations return to pre-pandemic levels.

The aquafeed sector experienced setbacks as restrictions on transportation and the closure of processing plants disrupted raw material sourcing. The industry, which depends heavily on marine ingredients—many imported from South America—faced delays and logistical challenges. For example, China’s reliance on Chilean fishmeal imports was affected by limited shipping and air freight availability during the pandemic.

Information Source: https://www.fortunebusinessinsights.com/industry-reports/aquafeed-market-100698

Market Dynamics

Key Drivers

The continuous rise in global seafood consumption remains a critical growth driver for the aquafeed market. According to the Food and Agriculture Organization (FAO), global seafood consumption is expected to surpass 20 kg per capita by 2030, underscoring increasing demand for aquaculture feed. Growing seafood trade volumes, coupled with advancements in aquaculture technologies, are expected to further boost demand.

Governments across emerging economies are supporting aquaculture development through subsidies and policy initiatives. For instance, the Government of India allocated USD 73.84 million under the Blue Revolution Scheme (FY 2020–21) to promote marine fishery, aquaculture, and mariculture development, thereby stimulating the adoption of high-quality feed.

Restraints

Despite positive trends, fluctuating prices of raw materials such as fishmeal, soybean, and corn can affect feed production costs and profit margins, posing challenges to market stability.

Market Segmentation

- By Type: Fish, Crustaceans, Mollusks, and Others

- By Ingredient: Soybean, Corn, Fish Oil, Fishmeal, Additives, and Others

- By Form: Dry and Wet

- By Region: North America, South America, Europe, Asia Pacific, and the Middle East & Africa

Regional Insights

Asia Pacific – Market Leader Driven by Expanding Fish Production

The Asia Pacific region continues to dominate the global aquafeed market, primarily due to high fish production levels in China and India, which together contribute over half of the region’s market value. Rising investments in aquaculture infrastructure and strong domestic demand for seafood further strengthen regional growth.

Europe – Growth Supported by Salmon Farming

Europe is anticipated to witness steady growth, fueled by advancements in aquaculture practices and increased interest in salmon farming across Norway, the U.K., and Scotland.

North America – Expanding Through Technological Advancements

In North America, the market is projected to expand at a notable pace due to the presence of major aquafeed producers, robust R&D efforts, and growing seafood exports, particularly from the U.S. and Canada.

Competitive Landscape

Innovation and Expansion Strategies Drive Competition

Leading aquafeed manufacturers are investing in product development, technological innovation, and capacity expansion to strengthen their global footprint. Strategic mergers, acquisitions, and partnerships remain key approaches to enhance market presence and distribution networks.

For example, in January 2020, BioMar A/S opened a new production facility in Wesley Vale, Tasmania, with an annual output capacity of 110,000 tonnes, significantly increasing its regional manufacturing capabilities.

Key Players in the Global Aquafeed Market

- Cargill Incorporated (Minnesota, U.S.)

- Archer Daniels Midland Company (Illinois, U.S.)

- Alltech Inc. (U.S.)

- Purina Animal Nutrition (Missouri, U.S.)

- Ridley Corp Ltd (Australia)

- Nutreco N.V. (Amersfoort, Netherlands)

- Aller Aqua A/S (Christiansfeld, Denmark)

- BioMar A/S (Denmark)

- Dibaq Aquaculture (Spain)

- Beneo GmbH (Germany)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/aquafeed-market-100698

Recent Industry Development

- May 2021: BP Milling (U.K.) introduced “SmartMix,” a pelleted fish attractant blend enriched with essential vitamins, minerals, and amino acids designed to enhance immunity and promote fish health.

Report Highlights

- Comprehensive industry analysis using Porter’s Five Forces and SWOT frameworks

- Assessment of COVID-19’s impact on supply chains and production

- Detailed profiles of major industry players

- Insights into emerging trends and product developments

- Segmentation analysis by type, form, and ingredient