Javni, zasebni in bruto zunanji dolg Slovenije - BS, UMAR, IMF

Mediji in posamezne politične stranke objavljajo delne podatke, s katerimi utemeljujejo svojo interpretacijo finančnega stanja Slovenije. Dejstvo, da tudi nekateri ekonomisti, ki se oglašajo v javnosti, pristajajo na tovrstne interpretacije, me je spodbudilo k pregledu uradnih interpretacij Banke Slovenije (BS), Urada RS za makroekonomske analize in razvoj (UMAR) in Mednarodnega denarnega sklada (IMF).

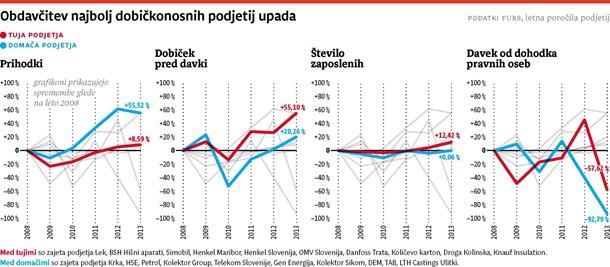

Presenetljivo, podatki za leto 2013 pokažejo, da:

- se je bruto zunanji dolg Slovenije znižal, povečal pa javni dolg;

- imata Slovenija in Slovaška najmanjši bruto zunanji dolgo v evrskem območju;

- IMF meni, da so pravilni vladni ukrepi pripomogli k ponovni rasti, veliko boljšim finančnim razmeram in na splošno večjem zaupnaju v Slovenijo.

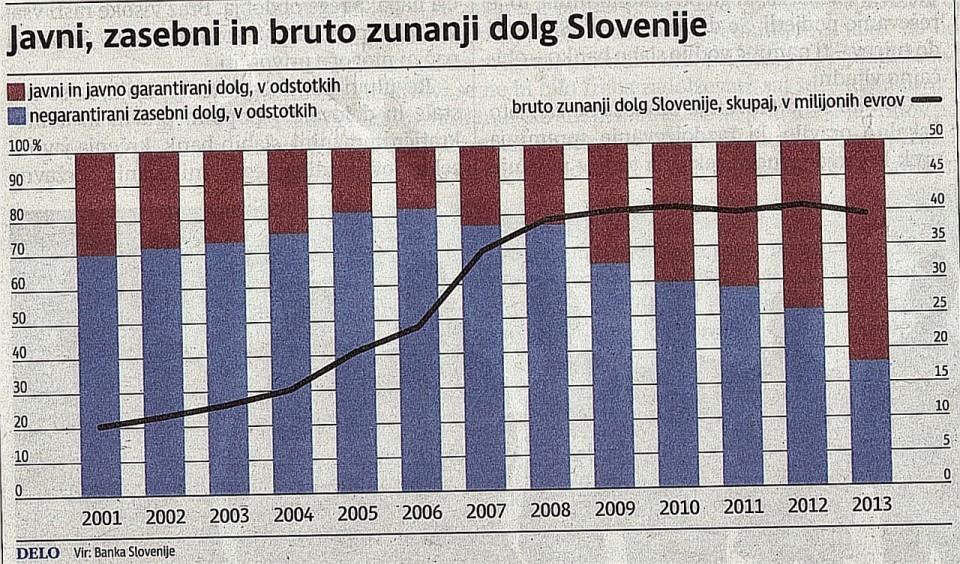

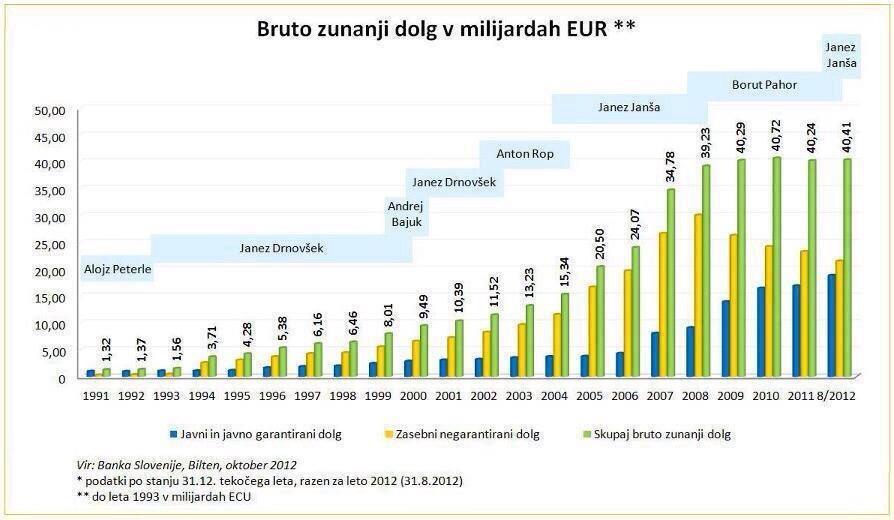

A: BRUTO ZUNANJI DOLG SLOVENIJE = B: JAVNI IN JAVNO GARANTIRANI DOLG + C: NEGARANTIRANI ZASEBNI DOLG.

Bruto zunanji dolg je narastel z 20 na 39 mrd EUR v obdoju od 2005 do 2008 (v glavnem kot posledica rasti zasebnega dolga), potem pa nič več. Po letu 2008 pa se je spreminjala struktura obeh komponent.

Obe kategoriji - javni in zasebni dolg - sta med seboj neločljivo povezani. Če je ekonomska politika preudarna nikoli ne dopusti previsoke rasti zasebnega dolga, ker se to nujno z nekim zamikom odrazi na povečanju javnega dolga. Vzrok za povečevanje javnega dolga od leta 2009 naprej pa je posledica izjemne rasti privatnega dolga od leta 2004 do 2006 (splošne evforije celotnega zasebnega in predvsem finančnega sektorja, da bo 15-25-odstotna rast kar trajala, vlada in BS pa nista znali pravočasno odreagirati) in poznejše sanacije gospodarskega sistema z zniževanjem zasebnega dolga (podjetij in bank) v obdobju 2008-2014.

Kako je nastal dolg 24 mrd.? http://www.dnevnik.si/1042709411

Bruto zunanji dolg se je v letu 2013 znižal kljub izrazitemu povečanju dolga sektorja država, saj so se zmanjšale obveznosti BS do Evrosistema, nadaljevalo pa se je tudi razdolževanje poslovnih bank.

Ob lanskem največjem povečanju dolga državnega sektorja od začetka krize se je njegov delež v skupnem zunanjem dolgu povečal na 39,0 %, delež poslovnih bank pa je po petem letu razdolževanja padel na 18,9 %.

V strukturi dolga glede na jamstvo se je v letu 2013 povečal le javni dolg.

Slovenija ostaja za Slovaško država z najmanjšim bruto zunanjim dolgom v evrskem območju.

Del predstavitve poročila IMF:

http://www.imf.org/external/np/tr/2014/tr012414.htm

Transcript of a Conference Call on Slovenia

Washington, D.C.

Friday, January 17, 2014

IMF STAFF

Antonio Spilimbergo, Mission Chief for Slovenia, European Department

“… in the period 2006-2007, at the time of entry of Slovenia in the euro, there was an additional issue to consider. There was the credit boom; credit was growing at an unsustainable way. It was financed mostly by publicly-owned banks, which were financing themselves through short-term debt in the Wall Street market. So, there was an intermediation between short-term money from abroad coming to public banks, and given to domestic entrepreneurs.

This created a system of (inaudible) banking, because you have a very cheap money. And (inaudible) bank according to criteria which were not (inaudible) business criteria.

In addition, from 2002 until 2007, Slovenia implemented some privatizations, which were done in some cases not for (inaudible) groups that (inaudible) economy, tycoons, basically, leveraged (inaudible) very disproportionally in order to buy companies, and they didn’t have the money nor the ability to run these companies. That created a major problem.

Finally, at the time of, before the global financial crisis, Slovenia had also a construction boom. This was done mostly by domestic companies. And in 2008, these companies didn’t find new jobs to do. So this meant major construction companies basically went bankrupt. Also, there, the problem was in part that these companies were directly linked to the state, which created a problem.”

Tiskovna konferenca IMF, na kateri Phil Gerson pohvali uspehe Slovenije pri reševanju bančne krize:

http://www.imf.org/external/np/tr/2014/tr041114b.htm

Transcript of an IMF Press Conference on Europe

Washington, D.C.

April 11, 2014

Phil Gerson, Deputy Director, European Department

QUESTIONER: Last year there was plenty of speculation that Slovenia might be forced to ask for a bailout. Luckily, we avoided that. What measures taken by the government last year would you single out as positive, what would you consider as negative, and what should we focus on now? Should the privatization process proceed faster?

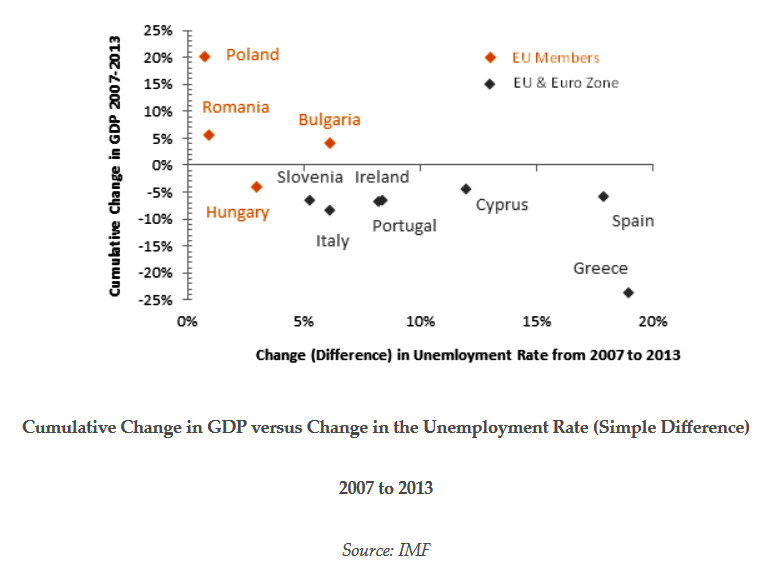

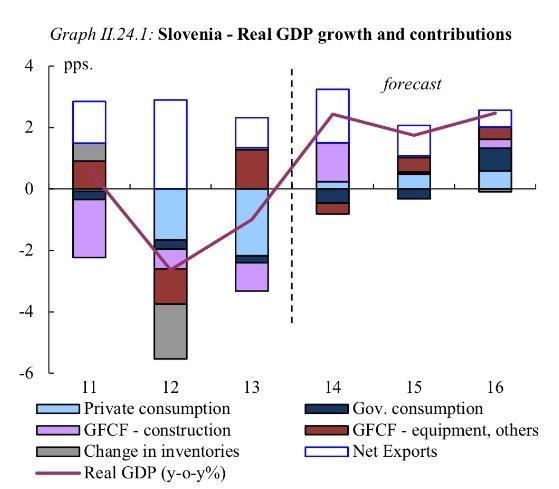

MR GERSON: You are right that the situation in Slovenia has improved significantly over the last year. In fact, we are now beginning to see signs of growth reemerging in the economy after what was a very difficult period, a very sharp downturn in Slovenia. I believe it had the second-largest downturn in the euro area at the height of the crisis.

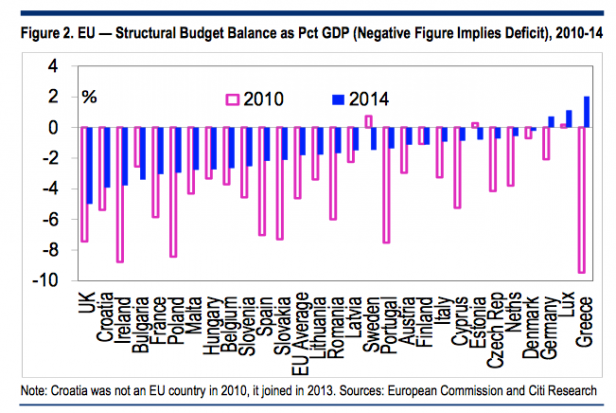

There are a number of things that the Slovenians have done over the last year to make that possible. The stress-testing of the banks and the recapitalization has been implemented. The authorities have identified a number of industries for privatization. Fiscal policy has been tightened. So there is a lot that the government has done or has started to do, and we think that that is reflected in the pickup in growth, in the much better financing conditions, and in general, an improvement of confidence in Slovenia.

The challenge for the authorities going forward is to keep going with those reforms. Although the banks have been recapitalized, nonperforming loans remain a big problem. Many of the large banks still have very high levels of nonperforming loans.

The authorities have set up an asset management company, but the process of moving those nonperforming loans to the asset management company has not moved as quickly as we would have hoped. So one thing they need to do is speed up that process. The privatization bill has passed, which has identified a number of companies for privatization. The authorities now need to begin making those sales go forward. That will do two things. First of all, it will increase financing for the budget, but even more importantly, it will help increase the efficiency of the economy and serve as a further spur to growth.

Finally, on fiscal, the authorities have identified an appropriate fiscal target for this year, but we still have to see the measures that they are going to take to implement that. So there is a need to specify the measures that will be taken.

But it is clear that the authorities have made a very good start. It has been reflected in much better financing conditions and even in a pickup in growth, and the challenge for them now is to keep going on this reform agenda and implement those policies that they have identified.

European Commission: Europe 2020 in Slovenia

Splošni pregled stanja, pričakovanja in zbirka dokumentov: http://go.shr.lc/Zpm4b1

~~~

Vir: Spectator Blogs - http://go.shr.lc/1uGDI87

~~~

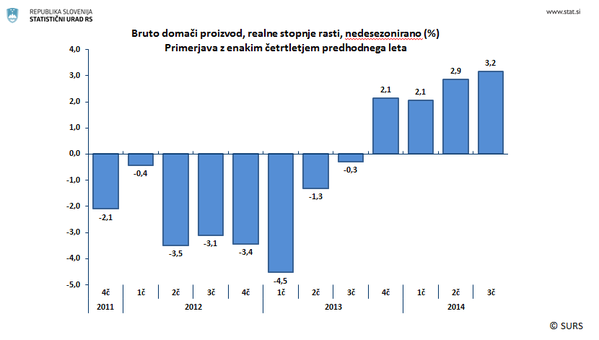

Statistični urad RS - Bruto domači proizvod, Slovenija, 3. četrtletje 2014

Pozitiven trend rasti se je nadaljeval tudi v tretjem četrtletju 2014 – BDP se je okrepil za 3,2 odstotka

~~~

S klikom na sliko pridete do celotne prezentacije.

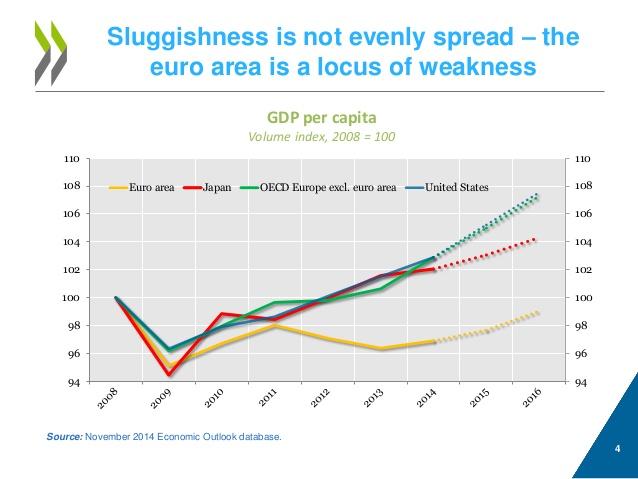

Zato je današnji nasvet OECD, ki ga skrbi globalna stabilnost in rast, zlo preprost: članice evro območja naj upočasnijo (prenehajo) s fiskalno konsolidacijo in sprejmejo ukrepe za spodbuditev rasti. Nasploh pa Italija in Francija ne bi smeli zniževati proračunskega deficita, medtem ko bi Nemčija morala povečati javne izdatke, EU kot celota pa sprejeti ukrepe za spodbuditev javnih investicij in nekatere strukturne reforme.

Več Jože P. Damjan:

Slika dneva: Evro ubija rast

~~~

DebtClocks.eu - Debt clocks of the EU Member States - comparison

http://www.debtclocks.eu/public-debt-and-budget-deficits-comparison-of-the-eu-member-states.html

Ko je bilo videti, da smo vendarle na pravi poti ...

Minister Čufer za CNBC

http://video.cnbc.com/gallery/?video=3000269562

Uros Cufer, finance minister of Slovenia, says the country has "sufficient cash" in its accounts but bond spreads will go down further.

Wed 23 Apr 2014

Pa je Janši vendarle uspelo … očrniti Alenko

Janša in Šušteršič nastavila, Bratuškova in Čufer izvedla, meni Jože P. Damijan.

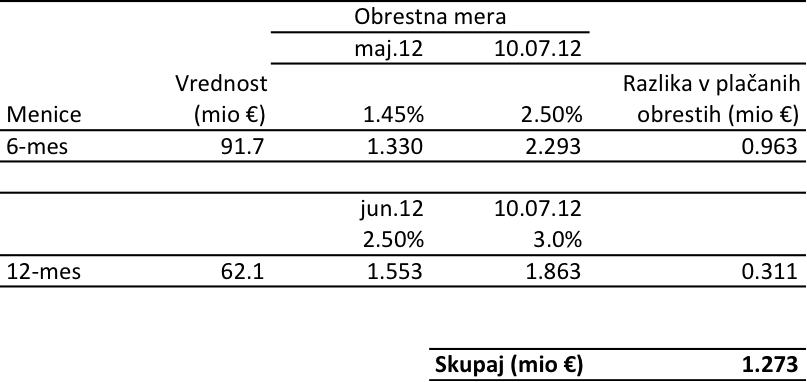

Koliko nas stanejo izjave Janeza Janše?

Jože P. Damijan.

Tabela: “Cena” izjav Janeza Janše

Razlika med gospodinjstvom in državo

Država ni gospodinjstvo, meni Jože P. Damijan.

Spending and Growth, 2009-13 - NYTimes.com

Krčenje izdatkov niža BDP pravi Paul Krugman.

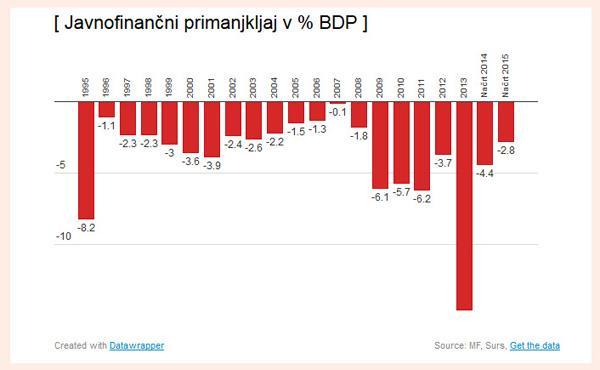

POROČILO O PRIMANJKLJAJU IN DOLGU DRŽAVE – OKTOBER 2014

Sektor država je v letu 2013 namenil največ izdatkov za socialno zaščito in ekonomske dejavnosti.

Euro Zone Membership

Princeton Energy Advisors: The Cost of Euro Zone Membership

Slovenija postaja davčni raj

http://www.dnevnik.si/posel/novice/slovenija-postaja-davcni-raj

Slovenija je s 17-odstotno davčno stopnjo davka na dohodek pravnih oseb med razvitimi državami za Irsko druga davčno najugodnejša država.