I have noticed a reflexive relationship between broker target prices and stock prices: movements in broker targets cause stock price movements; and stock price movements change broker targets. (Helene Meisler @hmeisler has a pithy summary for this: “Nothing like price to change sentiment.”) Let me illustrate with a chart, where the broker consensus target (shaded grey) is overlaid on a stock price chart, in this case S32.ax.

The increasing broker consensus appears to drag the price up. Then, it appears as if price starts dragging the broker consensus down.

Here’s another one

Looks like that price could go higher if the broker consensus keeps pulling it up.

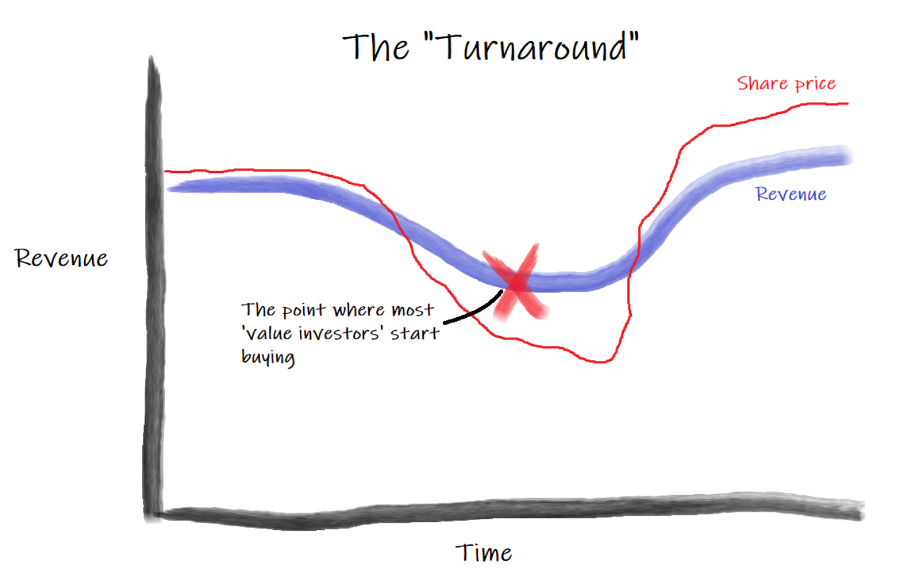

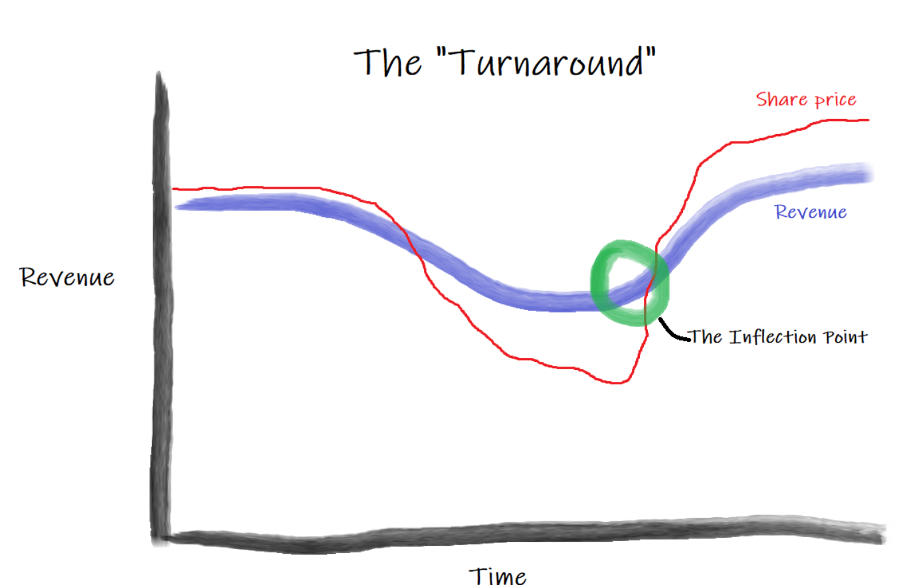

This is nice, but I have a larger point: I think this reflexive relationship can help to provide a signal for buying. But first, let me introduce you to the Matt Joass Inflection Point Theory (link HERE)

TL;DR? Here is a summary:

“Most value investors arrive for the party two hours early and make awkward chit-chat with the hosts over a bowl of dip. We arrive a half-hour late, a couple of other guests have already arrived and the conversation is flowing. Soon the party will be in full-swing. Later on, when Mr Market has gotten drunk and starts making a scene, we’ll make a polite exit.”

Here is a company I am interested in buying (Let’s not worry about the ticker, or the fundamentals, or the narrative…remember, this is just voodoo!)

I want to buy this stock, I believe it is presenting reasonable value. But, I don’t want to buy too early… the price could keep going down before it recovers. (Note how broker consensus has continuously gone down since July.)

The answer is simple: I will wait for the first broker consensus upgrade (after a run of Broker Consensus downgrades,) to signal the BUY. This is the inflection point I will wait for. (Hat-tip to Mathan Somasundaram @mathan_soma)

Update: ARB Corp, 8 Feb 2023.

Bought after upgrade signal for ARB corp. Hard to see in the image below, but Macquarie upgraded price yesterday from $30 to $33 (Neutral)

Update: Breville, 4 May 2023

First upgrade for a long time. From Shaw & Partners yesterday ($23 to $23.50) Please note, the bump up from a month ago is from CS being removed from broker coverage. Didn't buy, as I already have a small holding.

Update: ASX, 31 May 2023

Ord Minnett raises TP to $75 (from $66) Bought small parcel at $68.10

Update: ASX 2 Jan 2024

Couldn't cope with the losses, sold holding in early November.