MMT modern monetary theory

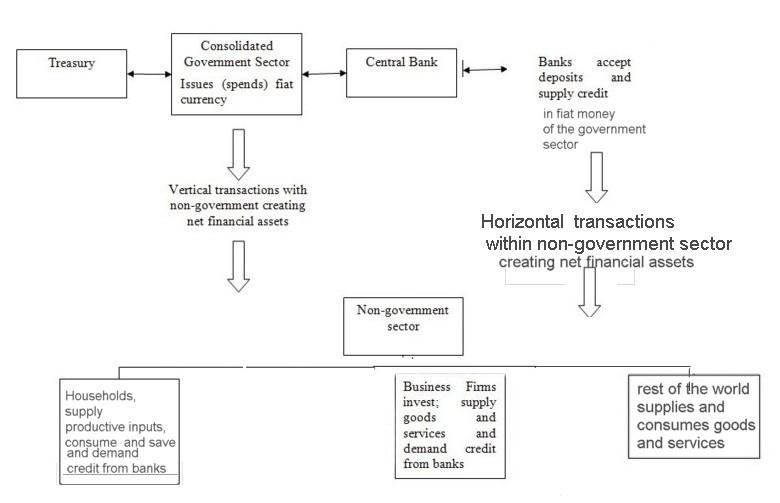

I discovered MMT several years back but I hadn't realized the strength of the theory. I am trying now to explain, within my community, the advantages of MMT and specifically the need to quit the euro for us in France. But when I attempt to explain MMT I am myself in difficulty. The diagram shown in your post comes first. It focuses only on the Government sector as issuer of sovereign fiat money, and its expenses/deficits to supplement the economy. But doesn't this omit that the private sector also produces goods and services and that the commercial (private) banks also issue fiat money as loans.

I have drawn my own diagram, and if I'm not wrong:

In France public sector expenses are 56.4% of GDP so non-goverment is 43.6%. In the first years of GFC deficits were a cushion to the effects of the crisis. See this excel sheet source in INSEE. http://pratclif.com/economy/MMT/econ-fin-pub-dep-adm-pub-secteur-euro.xls

I need to understand the transverse transactions within the non-government sector and their relation with the banks and through them to the government sector

Enregistrer